The yen is currently bulldozing the USD and as a result speculation about the reaction of the Bank of Japan has become front page news. Setting speculation about the BOJ’s chances of intervening aside, the yen’s movements against another North American currency could be worth taking a look at. Specifically, a developing chart pattern could signal the CAD/JPY is on the precipice of taking another tumble.

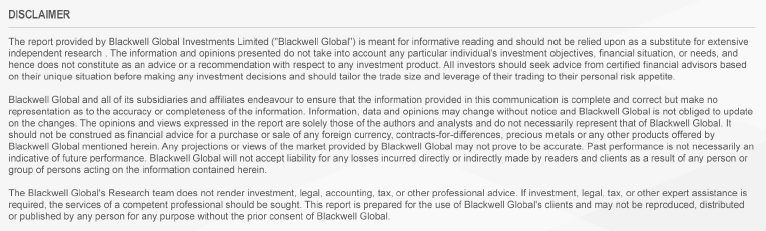

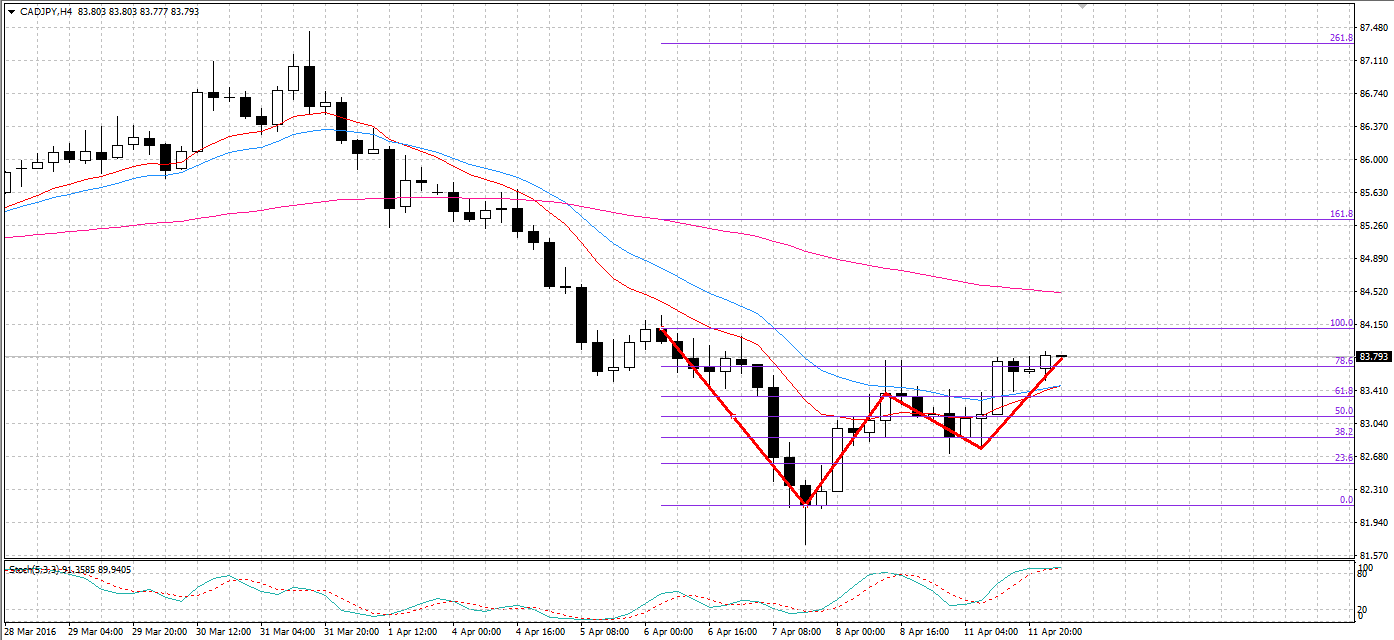

By taking a closer look at the H4 chart for the pair, it has become evident that a bearish Gartley pattern is nearing completion. As a result, this could be heralding another plunge for the CAD against the JPY. Furthermore, this specimen appears to fulfil the requirements of a classic Gartley pattern remarkably well and should therefore be identified quickly by the market.

As shown on the two charts, the pair’s recent movements mirror what we have come to expect from a textbook bearish Gartley pattern. Specifically, the retracements from 82.14 to 82.75, 83.63 to 83.76, and 84.09 to 83.78 coincide with the 38.2%, 161.8%, and 78.6% Fibonacci retracement levels respectively. As a result, the market should be fairly quick to act after identifying the strong pattern that has formed.

Additionally, the stochastic oscillator readings will be supplying downward momentum for the pair. Currently heavily overbought, the CAD/JPY is already facing heavy selling pressure and will likely begin to move when liquidity becomes less scant. Consequently, the opening of the London and New York sessions could really see the pair plummet ahead of the host of economic indicators due out of Japan and Canada in the next number of days.Furthermore, an imminent crossover of the 12 and 20 period EMA’s is highly indicative of an impending bearish reversal for the pair.

However, it is important to remember the spectre of BOJ intervention which has begun to loom as a consequence of the bullish yen. Despite previously signalling otherwise, BOJ Governor Kuroda has recently been floating the possibility of central bank intervention. As a result, there could be some apprehension to go short on the pair as the BOJ may intervene and devalue the Yen at any stage. Consequently, the market will be watching the BOJ closely in the coming week to avoid being taken off guard.

Ultimately, BOJ intervention could derail the Gartley pattern which has formed in recent days. However, given the recent bullishness of the yen it is not surprising that the pair is ready to take another tumble. In the absence of any meddling by Kuroda, the outcome of this pattern could take the CAD/JPY yen back down to the lows which were last seen at the start of February.