Garmin, Ltd. (NASDAQ:GRMN) is an original equipment manufacturer (OEM) of navigation and communication equipment that incorporate the global positioning system (GPS)-based technology.

Garmin is currently riding high on product line expansion. Management focuses on continued innovation, diversification and market expansion to explore growth opportunities in all business segments.

Due to this, investors are eagerly awaiting Garmin’s earnings report in order to set the record straight and to give some guidance on where this company is heading and are these factors effectively contributing.

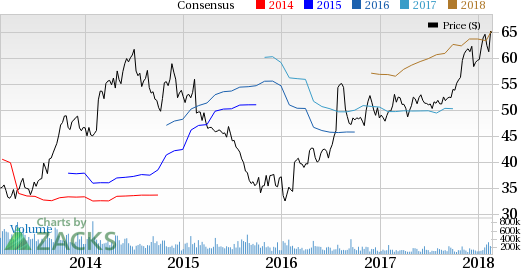

Estimate Trend & Surprise History

Estimate revision activity has been limited however, so there appears to be some uncertainty. However, Garmin has a decent history when it comes to recent earnings reports as it has surpassed estimates in all of the trailing four quarters, with an average positive surprise of 15.9%.

Currently, Garmin has a Zacks Rank #3 (Hold), but that could definitely change following the company’s earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank stocks here.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: GRMN reported earnings of 79 cents per share which exceeded the Zacks Consensus Estimate of 75 cents per share.

Revenue: Garmin beats on revenues. It posted revenues of $888 million, compared to our consensus estimate of $872.6 million.

Key Stats: The company’s top-line performance was mainly driven by its fitness, outdoor, marine and aviation products.

Check back later for our full write up on this GRMN earnings report later!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Garmin Ltd. (GRMN): Free Stock Analysis Report

Original post

Zacks Investment Research