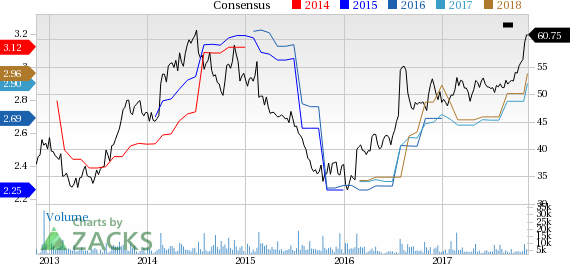

Shares of Garmin Ltd. ( (NASDAQ:GRMN) ) hit a new 52-week high of $61.28 on Nov 14, closing a shade lower at $60.75.

The share price momentum has been largely driven by the company’s impressive third-quarter results. The company’s shares have returned 2.0% following its third-quarter 2017 results reported on Nov 1.

Also, the company’s shares have gained 25.2% year to date, outperforming the industry’s 23.5% rally.

Notably, the company’s surprise history has been pretty impressive. It beat estimates in each of the trailing four quarters, the average positive surprise being 15.93%.

Key Factors

Garmin is a leading provider of navigation, communication and information devices. Accelerated adoption of Garmin’s wearable products has been a huge positive for the company.

During the third quarter, the company launched Descent dive watch, Impact bat swing sensor and TXi series of touchscreen flight displays with engine monitoring solutions. The company also unveiled new wearables including vívoactive 3, vívomove HR, vívosport and vívofit jr. Moreover, its partnership with Amazon (NASDAQ:AMZN) to launch Garmin Speak, a device that brings full range of Alexa skills inside cars, is also a key driver.

Coming to the results, the company’s earnings of 75 cents per share beat the Zacks Consensus Estimate by 9 cents.

Also, revenues of $743.1 million beat the Zacks Consensus Estimate by $25 million and were up 2.9% year over year. The year-over-year increase was backed by higher demand across outdoor, marine and aviation segments.

Moreover, the company raised its guidance for full-year 2017. Management expects revenues of $3.07 billion compared with the prior expectation of $3.04 billion. Also, it expects pro-forma earnings of $2.90 per share compared with $2.80 per share expected earlier. Currently, the Zacks Consensus Estimate for revenues and earnings for 2017 is pegged at $3.07 billion and $2.89 per share, respectively.

We believe that increasing investments in wearable gadgets such as outdoor watches and marine cameras will help Garmin to counter the decline in sales of its traditional automobile navigation devices.

Zacks Rank and Stocks to Consider

Currently, Garmin has a Zacks Rank #2 (Buy). A few other top-ranked stocks in the broader technology sector are NVIDIA Corporation (NASDAQ:NVDA) and SMART Global Holdings, Inc. (NASDAQ:SGH) , each sporting a Zacks Rank #1 (Strong Buy), while Applied Materials, Inc. (NASDAQ:AMAT) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for NVIDIA Corporation, SMART Global and Applied Materials is projected to be 11.2%, 15.0% and 17.1%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Garmin Ltd. (GRMN): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

SMART Global Holdings, Inc. (SGH): Free Stock Analysis Report

Original post

Zacks Investment Research