Garmin Ltd. (NASDAQ:GRMN) has been making some significant investments in its Marine business, which helped it to develop a solid product line.

Apart from continuously expanding product line in the business, the company recently acquired Active Corporation, a developer of leading electronic marine database to boost the segment.

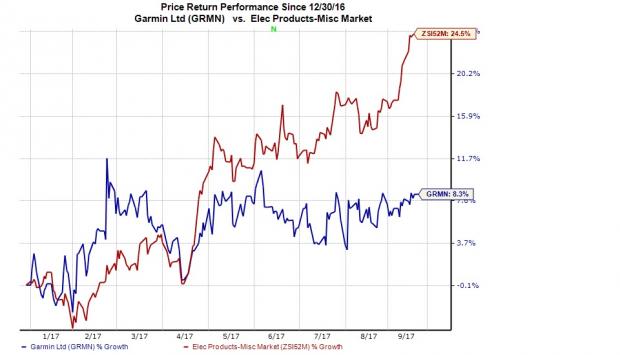

We observe that Garmin has gained 8.2% year to date, underperforming the 24.5% rally of the industry it belongs to.

Let’s take a look at how Garmin’s Marine business is performing and how it is poised for the future.

Product Line Expansion in Focus

Though the segment has been the lowest contributor to total revenue over the last five years, its performance has been stable. Gross margin from this segment have been above 45% over this period.

Overall, chartplotters, fish finders, cartography and entertainment product lines are contributing significantly to Marine segment revenues. The company is expanding the product line again this year. On Jul 10, Garmin launched the Panoptix PS22-TR transducer. Compatible with Garmin GPSMAP or echoMAP CHIRP chartplotter, Panoptix enables anglers watch fish movement and the reactions to their bait, up to 100 feet away.

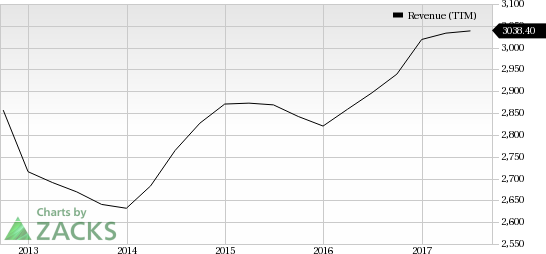

Garmin Ltd. Revenue (TTM)

On Sep 12, 2017, Garmin launched its first chartplotter and transducer bundle with Panoptix sonar technology intended precisely for ice fishing. Equipped with echoMAP CHIRP 73cv chartplotter, a Panoptix PS22-TR transducer with LiveVü Forward and LiveVü Down capabilities; the new GTH10HN-IF ice fishing transducer, Panoptix ice fishing pole mount and advanced sonar capabilities, the gadget helps to locate fish in any direction below ice by displaying real-time moving images up to 100 feet.

Garmin’s strategy has been to build a strong position for itself through product introductions and strategic partnerships. Individual and recreational purchases (retail sales) aside, Garmin also has signed on some important accounts (OEMs).

Acquisitions Supplement Expansion Efforts

Garmin has supplemented its marine product expansion efforts with acquisitions that have made significant contributions. In May 2017, the company acquired Japan-based Active Corporation a developer of leading electronic marine database. Active Corporation has developed crowdsourcing boating platform popularly known as ActiveCaptain.

It is an electronic marine database and the data pertains to real-time information about marinas, anchorages, local points of interest, and marine hazards. The information helps mariners to make their voyages hassle free. The database can be accessed using a web browser or a variety of mobile applications. The acquisition of Fusion Electronics in 2014 has also contributed meaningfully to Garmin’s marine segment.

To Conclude

Management focuses on continued innovation, diversification and market expansion to explore growth opportunities in all business segments. Product line expansion remains the top priority for Garmin. However, macroeconomic challenges remain part of the operating environment.

Zacks Rank and Stocks to Consider

Garmin carries a Zacks Rank #2 (Buy).

Other stocks worth considering in the broader technology sector include Activision Blizzard, Inc. (NASDAQ:ATVI) , Applied Materials, Inc. (NASDAQ:AMAT) and Lam Research Corporation (NASDAQ:LRCX) , each carrying the same Zacks Rank. You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Activision, Applied Materials and Lam Research is projected to be 13.6%, 17.1% and 17.2%, respectively.

New Report: An Investor’s Guide to Cybersecurity

Cyberattacks have become more frequent and destructive than ever. In fact, they’re expected to cause $6 trillion per year in damage by 2020.

The cybersecurity industry is expanding quickly in response to these threats. In fact, a projected $170 billion per year will be spent to protect consumer and corporate assets. Zacks has just released Cybersecurity: An Investor’s Guide to Locking Down Profits which reveals 4 promising investment candidates.

Garmin Ltd. (GRMN): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post