**These are my thoughts on the SPDR S&P 500 (NYSE:SPY) ETF in my Daily Trade Ideas.**

“Knowledge is power.” Francis Bacon

Markets ended the week with lots of chop, so my cash call early in the week was the right thing to do.

Overnight gaps are back for now, and I do not play that guessing game.

I took a couple days on the bike and did a tour and I may be able to do another one with the generally weak September here and markets still looking to find lows and build out there pattern for a nice end of the year run.

We will make this a great year, but I have to continue to mostly wait until the time is right, and then we should be able to grab some great gains very quickly.

Waiting is part of the game, and understanding and accepting that is key.

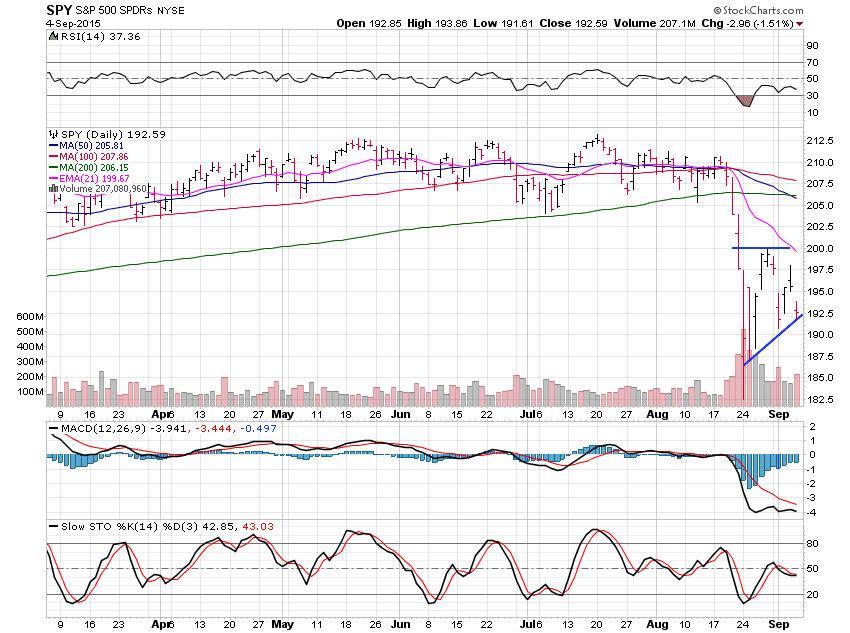

This action and pattern points to lower prices for SPY right away and the 192.50 level can be shorted.

We may need to look to 180 for a new low level now.

If the weather remains nice, I may not trade on the short-side, but time will tell.

Patience and enjoy some rest time before we really have to dive deep and focus soon enough.