Diversified media conglomerate, Gannett Co., Inc. (NYSE:GCI) delivered lower-than-expected second-quarter 2017 results. The company posted adjusted quarterly earnings of 18 cents a share that missed the Zacks Consensus Estimate by a penny and also declined substantially from 30 cents reported in the year-ago quarter. Higher operating expenses adversely impacted the bottom line.

Gannett reported total revenue of $774.5 million in the quarter, up 3.4% from the prior-year quarter but came below the Zacks Consensus Estimate of $790.6 million. The increase in revenue came on the back of acquired businesses such as Journal Media Group, Inc., North Jersey Media Group, ReachLocal and SweetIQ. On a same store basis, total operating revenue declined 10.6% to $669.1 million.

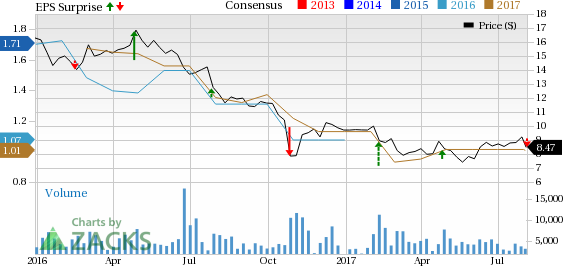

In the past six months, shares of this McLean, Virginia based company have declined 13.7% compared with the industry’s gain of 4.9%.

.jpg)

Advertising revenue increased 8.6% to $445.2 million, whereas circulation revenue fell 4.8% to $273.7 million. Other operating revenue increased 8.3% to $55.6 million.

Adjusted EBITDA declined 8.7% to $83.7 million, whereas adjusted EBITDA margin contracted 140 basis points to 10.8%.

Segment Details

Publishing segment revenue came in at $692.2 million, down 7.5% from the prior year quarter. On a same-store basis, publishing segment operating revenue fell 10.7%. Print advertising and circulation revenues declined 16.8% and 7.4%, respectively, on a same-store basis. Digital advertising revenue grew 1.3% to $99.5 million as contributions from buyouts were partly offset by foreign currency headwind. On a same store basis, the same improved 0.3%.

ReachLocal segment revenue came in at $85.9 million during the quarter, reflecting a sequential increase of 11%. Gannett has started introducing ReachLocal in several markets.

Strategic Initiatives

Gannett is realigning its cost structure and streamlining its operations to increase efficiencies and safeguard its earnings and cash flows from dwindling print advertising revenue. It also remains focused on improving its digital business with an aim to lower dependency on soft print media business and traditional advertising. The company also intends to undertake strategic acquisitions in order to strengthen its position in the industry. Gannett recently entered into a partnership deal with RealMatch that will help the former to enhance its recruitment advertising business. Other publishing companies such as New Media Investment Group Inc. (NYSE:NEWM) , The New York Times Company (NYSE:NYT) and The McClatchy Company (NYSE:MNI) are also trying to adapt to different revenue generating ways.

Other Financial Aspects

In the quarter, Gannett paid dividends of $18.2 million but did not buy back shares. During the quarter, net cash flow from operating activities was about $98.5 million and incurred capital expenditures of $14.8 million, thereby generating free cash flow of approximately $83.7 million. Management expects to incur capital expenditures of approximately $65–$70 million in 2017.

The company ended the quarter with a cash balance of $126.9 million and a revolving line of credit of $385 million.

Outlook

Gannett reiterated its revenue forecast of $3.15–$3.22 billion for 2017 but raised the lower end of its full year adjusted EBITDA projection by $5 million to a range of $360–$365 million.

Gannett currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

New York Times Company (The) (NYT): Free Stock Analysis Report

Gannett Co., Inc. (GCI): Free Stock Analysis Report

New Media Investment Group Inc. (NEWM): Free Stock Analysis Report

McClatchy Company (The) (MNI): Free Stock Analysis Report

Original post