Investors are gearing up for a quarterly report out of GameStop Corp. (NYSE:GME), set for after the market closes tomorrow, April 2. Below we will take a look at how the video game retailer has fared on the charts, and dive into what the options market is pricing in for the stock's post-earnings move.

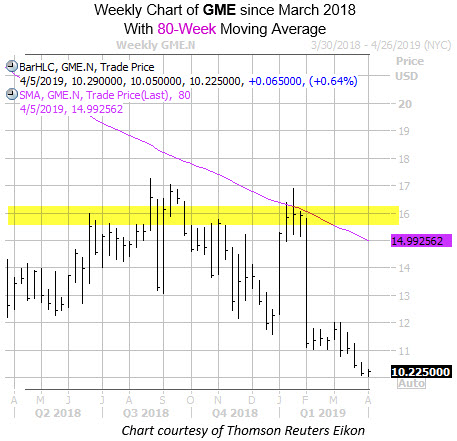

GameStop stock is down 0.6% at $10.22, and earlier touched a roughly 14-year low of $10.04. GME has been a long-term underperformer on the charts and over the past 12 months has shed 18%. The retailer did attempt a breakout in January, but despite several attempts, failed to push above resistance at the $15.50-$16 level and the falling 80-week moving average.

Moving onto GME's earnings history, the specialty retailer has closed lower the day after reporting in all but two of the past eight quarters. Over the past two years, the shares have swung an average of 7% the day after earnings, regardless of direction. This time around, the options market is pricing in a more than double 15.6% swing for Wednesday's trading.

Digging into options, data at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows GME with a 10-day put/call volume ratio of 2.04, ranking in the 74th percentile of its annual range. In other terms, puts have been bought over calls at a faster-than-usual pace during the past two weeks. Specifically, during this time frame, the May 11 put seems to be a favorite, with over 7,900 contracts having already exchanged hands. In terms of analyst attention, GameStop stock has been no stranger to bear notes.