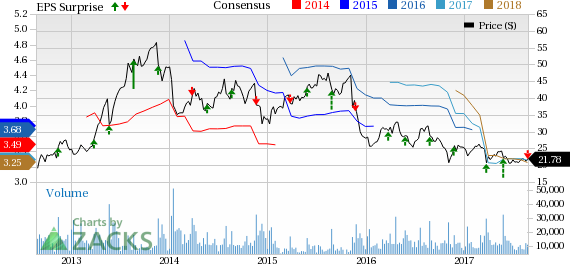

GameStop Corp. (NYSE:GME) succumbed to negative earnings surprise in second-quarter fiscal 2017 after beating the Zacks Consensus Estimate in the trailing six quarters. However, sales of this multichannel video game and consumer electronics retailer surpassed the estimate for the second straight quarter.

The company recorded adjusted earnings of 15 cents per share that missed Zacks Consensus Estimate by a penny and also declined 44.4% year over year. Net sales were up 3.4% year over year to $1,678.6 million and surpassed the Zacks Consensus Estimate of $1,620 million.

The company sales were driven by robust demand for Nintendo Switch and Collectibles. International sales were also strong during the quarter. However, investors were hurt by lower-than-expected and year-over-year decline in earnings, sending the stock down by 7.4% during the after-hour trading session on Aug 24. The challenging retail landscape, aggressive promotional strategies and waning store traffic have been weighing on performance. In the past six months, the stock has declined 17.9% compared with the industry’s increase of 32.1%.

Let’s Delve Deep

Consolidated comparable store sales (comps) increased 1.9%, reflecting a gain of 9.8% at international locations but declined 1.4% at domestic locations. By sales mix, new video game hardware sales jumped 14.8% to $248.4 million, while new video game software sales declined 3.4% to $369.3 million. Moreover, pre-owned and value video game products sales came in at $501.8 million, down 7.5% year over year. Increase in new hardware sales were primarily due to robust demand for Nintendo Switch, while new software sales and pre-owned sales were lower due to sluggish Xbox One sales.

In fiscal 2017, the company expects new hardware sales to be flat to up marginally, while new software sales are expected to be in the range of down mid to single digits. Pre-owned sales are also projected to be in the range of down mid to single digits.

Video game accessories sales were up 4.4% to $47.7 million. Non-GAAP digital receipts increased 17.4% to $241.4 million, while GAAP digital sales jumped 28.1% to $28.1 million. Surge in digital sales were primarily due to growth in downloadable content and mobile.

Technology Brands sales grew 7% to $188.3 million driven by year-over-year growth in AT&T (NYSE:T) authorized retail stores. Collectibles sales surged 36.1% to $122.5 million buoyed by robust sales of Pokémon and Marvel-related products.

Management expects sturdy performance of Technology Brands and Collectibles to continue in fiscal 2017, and the new hardware innovation in the video game category also looks promising. Technology Brands’ adjusted operating earnings came in at $15 million, up 7.9% from the prior-year quarter.

Management also anticipates Technology Brands’ operating earnings to rise over 30% to $120 million during fiscal 2017 and to be $200 million in fiscal 2019. During fourth-quarter fiscal 2016 conference call, the company stated that it expects Technology Brands sales to increase 10-16% in fiscal 2017.

GameStop expects to enhance collectibles business to approximately $650-$700 million during fiscal 2017 and anticipates becoming a $1 billion business by the end of fiscal 2019. In the third quarter, Collectibles sales are forecasted to increase by 30-40%. Earlier, management had stated that it remains optimistic about non-physical gaming businesses and expects this category to reach approximately 50% of operating earnings by the end of fiscal 2019.

During the reported quarter, gross profit increased 1% to $623.7 million, while gross margin contracted 90 basis points (bps) to37%. Adjusted operating income declined 37.7% to $36.3 million, while adjusted operating margin shriveled 140 bps to 2.2%.

Store Update

In the reported quarter, GameStop shuttered a net of 28 video game stores globally, ending the year with 3,881 video game stores in the United States and 1,991 internationally. The company opened one technology brands store and now has 1,509 stores. The company opened five collectible stores during the quarter and now has 99 stores.

Other Financial Aspects

GameStop ended the quarter with cash and cash equivalents of $262.1 million, net receivables of $185.4 million, long-term debt of $816.4 million and shareholders’ equity of $2,311.7 million. Management projects capital expenditures in the range of $110-$120 million.

Guidance

For the fiscal year, management reiterated earnings outlook of $3.10-$3.40 per share. The current Zacks Consensus Estimate for fiscal 2017 is pegged at $3.29. However, GameStop expects comps in fiscal 2017 to be at the higher end of earlier provided guidance of flat to down 5%.

GameStop currently carries a Zacks Rank #3 (Hold).

3 Retail Stocks Likely to Steal the Show

Better-ranked stocks in the retail sector include The Children's Place, Inc. (NASDAQ:PLCE) , Burlington Stores, Inc. (NYSE:BURL) and Big Lots, Inc. (NYSE:BIG) . Children's Place sports a Zacks Rank # 1 (Strong Buy), while Burlington Stores and Big Lots carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Burlington Stores delivered an average positive earnings surprise of 22.6% in the trailing four quarters and has a long-term earnings growth rate of 15.9%.

Big Lots delivered an average positive earnings surprise of 83% in the trailing four quarters and has a long-term earnings growth rate of 13.5%.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

Gamestop Corporation (GME): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research