Bitcoin prices had been enjoying a relatively calm week with modest gains before a selloff today that is threatening support at the 85000 handle. The recent optimism in the market has quickly disappeared as selling picks up again. Shaken by renewed market swings and economic uncertainty, many are selling their investments, which could extend the current market downturn.

Is another period of tariff induced volatility ahead?

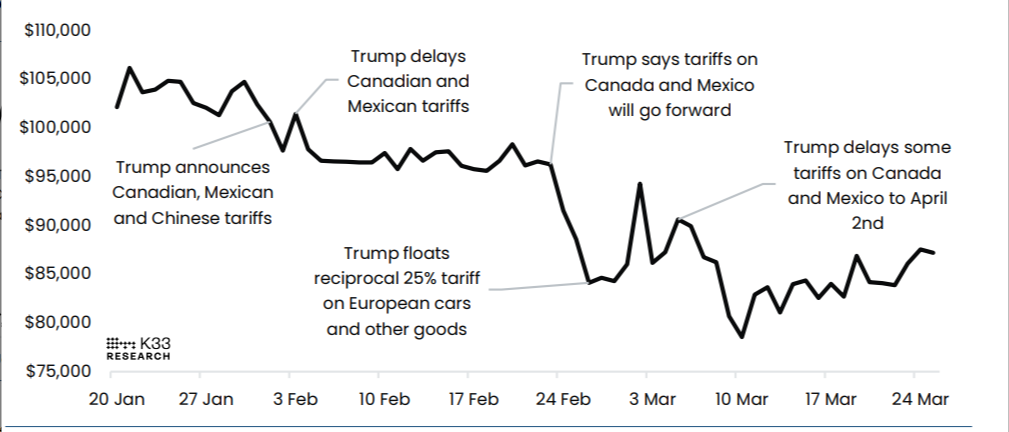

Tuesday’s K33 Research report, "Ahead of the Curve," noted that the market is currently calm but could become more volatile as it reacts to new tariff announcements.

The report says this calm might last until April 2, when the U.S. President Donald Trump is set to announce major reciprocal tariffs. This announcement could become a big market event, sparking activity in both crypto and traditional markets, similar to the big moves seen after Canadian and Mexican tariff news earlier this year.

If Trump softens his approach, markets might go up. If he stays unclear, both buyers and sellers could face volatility. If he takes a tough stance, markets could drop sharply, like they have after past tariff announcements.

BTC/USD vs Tariff Headlines

“In a back-and-forth situation, the market could look like it did in February and early March, when tariffs were the main focus. The US economy is still strong but is expected to slow down because of tariffs — a risk that most economists have already factored in,” says an analyst from K33.

Glassnode - The week on-chain - Demand side wanes

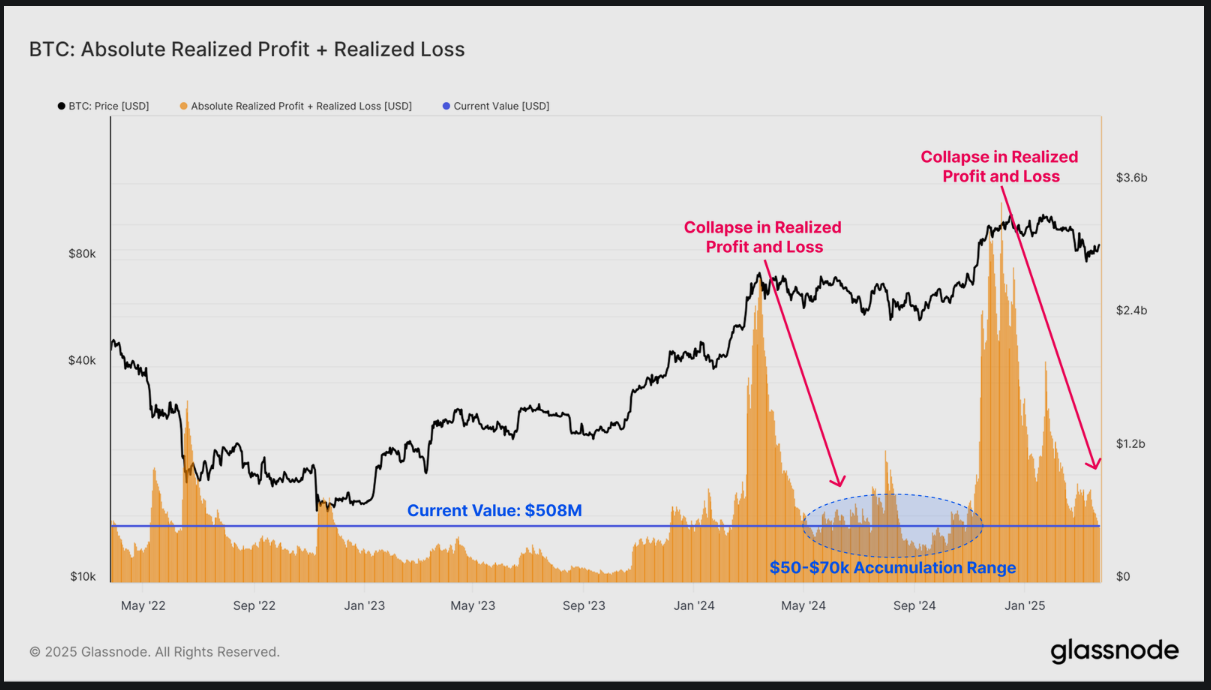

Demand is still fairly low right now, with Bitcoin’s price moving up and down within a new trading range around $85k. One way to measure demand is by looking at the amount of profit and loss investors are locking in. This helps us understand the selling activity happening in spot markets.

We can understand this through two main ideas:

Capital Inflows: This happens when new money enters the market, with a buyer paying more for a coin than what the seller originally paid (creating a realized profit).

Capital Destruction: This happens when someone sells at a loss (realized loss), and a new buyer gets the coin for less than its original price.

This metric shows the difference between the price a seller is willing to accept and the price a buyer is willing to pay.

Right now, the total realized profit and loss has dropped significantly since the $109k peak, falling from $3.4B to $508M (-85%). This is similar to levels seen during the 2024 accumulation phase when Bitcoin was between $50k and $70k (which is a good sign), indicating similar demand. Most of the losses are coming from Short-Term Holders, who are newer buyers and more likely to have bought at higher prices. The recent unpredictable and volatile market has been tough for these new investors.

On the other hand, most of the profits are being taken by Long-Term Holders, who have been in the market longer and are still in a profitable position.

Short-Term Holders are currently facing significant unrealized losses (paper losses), some of the largest in this cycle. However, these losses are still within the higher range of what’s been seen in most past bull markets.

This means that while investors are feeling noticeable financial pressure, it’s not unusual or unexpected for a bull market trend.

Gamestop follows Strategy, Saylor approves

This week, GameStop (NYSE:GME), a US video game retailer, announced on Tuesday that it has updated its investment policy to include Bitcoin as part of its treasury reserves. The following day, the company shared plans to raise $1.3 billion by offering senior convertible notes with 0% interest to private investors.

GameStop is following the lead of MicroStrategy Incorporated (NASDAQ:MSTR) or Strategy as they are now called, which recently bought 6,911 BTC for $584.1 million. Strategy now holds 506,137 BTC, purchased for $33.7 billion at an average price of $66,608 per Bitcoin, making it the largest corporate Bitcoin holder.

This move is part of a growing trend of companies adopting Bitcoin, encouraged by US President Donald Trump’s recent executive order to create a strategic cryptocurrency reserve using government-held tokens. As of February 1, GameStop has $4.7 billion in cash and cash equivalents.

ETF flows

Bitcoin ETF flows have remained steady since mid-March with spot Bitcoin ETFs having seen consistent inflows. Over the past two weeks inflows have reached nearly 1 billion dollars.

This also comes as Gold ETF (NYSE:GLD) flows have recently surpassed Bitcoin ETF flows.

Technical analysis - BTC/USD

Bitcoin (BTC/USD) from a technical standpoint on the daily timeframe remains in a bearish trend.

A daily candle close above the 90000 handle will be needed for a change in structure and this remains some distance away at present.

As things stand Bitcoin has slipped below the 200-day MA and the 85000 handle, if the daily candle closes below both it could signal further downside.

Looking at the bigger picture and the longer the price remains within the range of 78000-90000 when a breakout finally occurs it could be an aggressive one.

The fundamentals may still support further upside but the uncertainties presented by the geopolitical situation and tariff impact may continue to keep BTC/USD on the backfoot.

Bitcoin (BTC/USD) Daily Chart, March 28, 2025