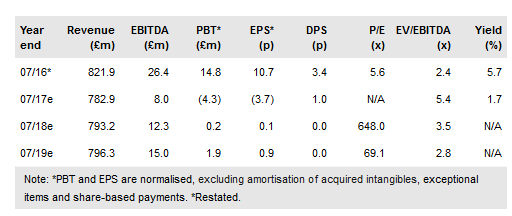

GAME Digital plc (LON:GMDG) has posted good sales growth over its first 23 weeks and even better results over the Christmas peak. While sales have been led by hardware, management is confident of covering any mix issue through cost savings, and we retain our forecast. With net cash at 35p, the market is valuing this business at 3.5x FY18e EBITDA, which looks misplaced.

Strong headline trading for 23 weeks

Group GTV for the 9.5-week peak trading period (1 November to 6 January) was up by 5.2%, and for the full 23-week period 3.8%. That is a good result in the context of the current retail landscape, and consistent with our forecast GTV growth total for FY18. It also indicates that trading was strong for the period as a whole, as the earlier period averages growth close to 3%, we estimate. Growth was driven by hardware, particularly the Nintendo Switch and the Xbox One X, where GMD has been stocked to satisfy demand throughout the year to date, unlike FY17.

To read the entire report Please click on the pdf File Below: