The euro regained some composure through the weekend as regional elections in the north of the country went the way of Mariano Rajoy’s Partido Popular with the government increasing its majority within the region. Seeing the result as an endorsement of the government’s austerity plans may be a little strong, but it will certainly reduce pressure on Rajoy and his cabinet as they prepare to ask for a bailout for the sovereign.

Elections in the Basque country, however, went the way of the separatists with Bildu, long seen as the political arm of ETA, taking 21 seats alongside the Basque nationalist party with 27. All in all, this means that the Basque country could “do a Catalonia” and vote to secede from Spain. Catalonia’s referendum takes place next month.

EUR/USD blipped higher with the news overnight with GBP/EUR remaining below the 1.23 through the entire Asian session.

The worrying economic data continued courtesy of Japan with exports falling by 10.3% in September. This was the largest fall since the tsunami last March and comes courtesy of three things. Firstly, the spat between China and Japan over a series of islands in the East China Sea has disrupted supply chains, while global demand is obviously lower due to the slips in growth.

Thirdly the yen, although it has weakened over the past week, remains at very strong levels. The government have urged the Bank of Japan to act further to help the yen. However, we doubt that they will intervene soon given current price action.

Sterling news has been quiet over the weekend with most focused on whether the Chancellor should have paid up front for his 1st class train ticket. The big news for the UK economy over the week will be the publication of UK GDP for Q3 on Thursday morning. We are looking for expansion of 0.6% as an initial estimate, ending the run of 2 consecutive quarters of negative growth, buoyed by Olympic ticket sales and a bounce back from the negativity that resulted from the Jubilee.

Unfortunately, this positivity may not be replicated in Q4 with surveys already sensing a return to flatness.

Other than that, it has been a quiet weekend and, with little on the docket today, not much is expected to move through the session. We expect prices to remain range bound until Wednesday when the calendar heats up with flash PMIs from Europe and the German IFO survey.

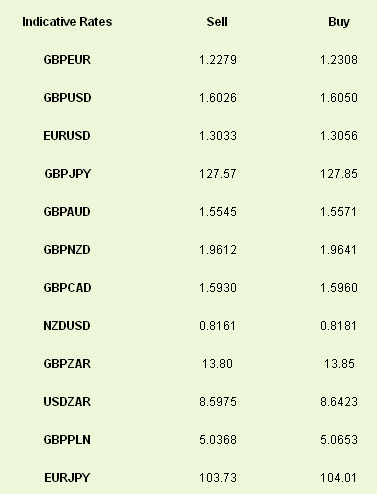

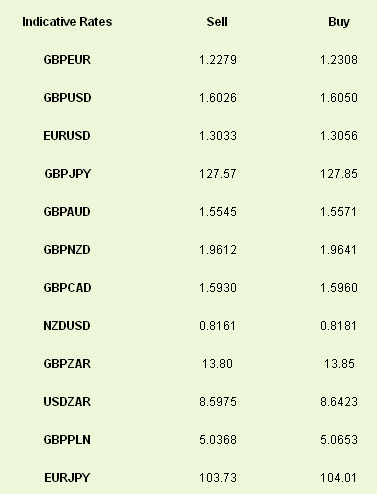

Latest exchange rates at time of writing:

Elections in the Basque country, however, went the way of the separatists with Bildu, long seen as the political arm of ETA, taking 21 seats alongside the Basque nationalist party with 27. All in all, this means that the Basque country could “do a Catalonia” and vote to secede from Spain. Catalonia’s referendum takes place next month.

EUR/USD blipped higher with the news overnight with GBP/EUR remaining below the 1.23 through the entire Asian session.

The worrying economic data continued courtesy of Japan with exports falling by 10.3% in September. This was the largest fall since the tsunami last March and comes courtesy of three things. Firstly, the spat between China and Japan over a series of islands in the East China Sea has disrupted supply chains, while global demand is obviously lower due to the slips in growth.

Thirdly the yen, although it has weakened over the past week, remains at very strong levels. The government have urged the Bank of Japan to act further to help the yen. However, we doubt that they will intervene soon given current price action.

Sterling news has been quiet over the weekend with most focused on whether the Chancellor should have paid up front for his 1st class train ticket. The big news for the UK economy over the week will be the publication of UK GDP for Q3 on Thursday morning. We are looking for expansion of 0.6% as an initial estimate, ending the run of 2 consecutive quarters of negative growth, buoyed by Olympic ticket sales and a bounce back from the negativity that resulted from the Jubilee.

Unfortunately, this positivity may not be replicated in Q4 with surveys already sensing a return to flatness.

Other than that, it has been a quiet weekend and, with little on the docket today, not much is expected to move through the session. We expect prices to remain range bound until Wednesday when the calendar heats up with flash PMIs from Europe and the German IFO survey.

Latest exchange rates at time of writing: