It’s Friday. And you ain’t got nothing to do since the market is closed.

So let’s get high on pictorial enlightenment together.

If you’re a newbie, don’t worry. It’s not illegal.

It’s just that each Friday, I try to keep my mouth shut and let some carefully selected graphics convey the important economic and investing insights for the week.

Today, I’m dishing on the (still) unbelievable rebound in residential real estate, pesky rumors about the dollar’s demise and a resurgent U.S. stock market.

So let’s get to it…

Dollar Bears Be Damned!

We’ve heard it for years. The U.S. dollar is doomed! And its demise could happen any day now.

Well… it’s time to replace the dollar as everyone’s favorite currency to malign.

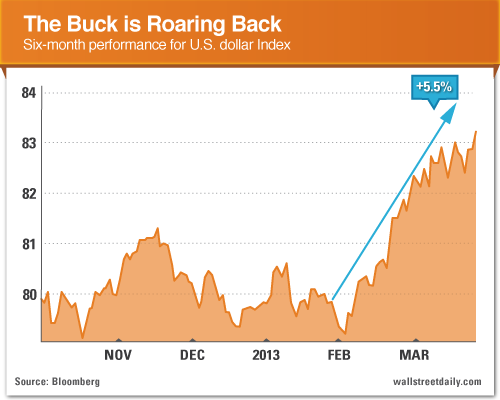

You see, lately, the dollar has been doing anything but crumbling.

Courtesy of the banking woes in Cyprus and the ensuing flight to safety, the U.S. Dollar Index is up over 5% in the last two months.

I know, I know. It’s merely a head fake before a massive collapse, right?

At least, that’s what the dollar bears want us to believe.

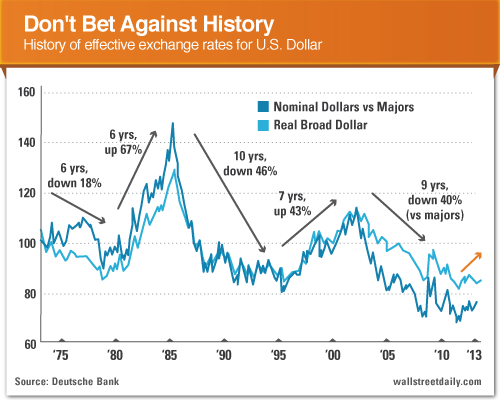

New research out of Deutsche Bank, however, suggests that we might want to think otherwise.

It turns out that dollar cycles historically last for six to 10 years. Not months – years, baby!

And guess what? Deutsche Bank is convinced that we’re on the cusp of another up cycle.

Or, as its analyst puts it, “We expect the USD has now entered a sustained multi-year uptrend.”

So don’t bet against the buck!

Go Global or Go Broke… Or Not!

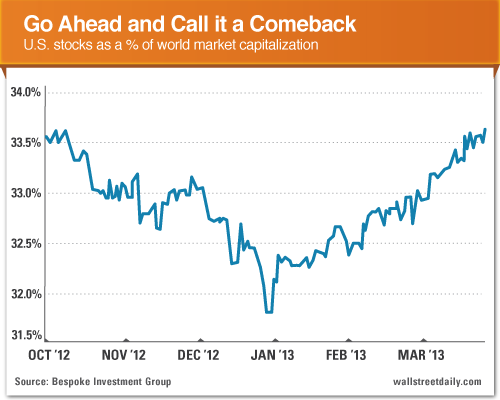

Not long ago, analyst after analyst warned that the supremacy of U.S. stocks would come to an end. And those sorry investors who didn’t rush into traditionally much more volatile international and emerging markets would regret it big time.

Now, I’m all for diversification. But not stupidity. And betting 100% against the United States always makes terrible sense. (Whether it relates to investing, politics, or – of course – the spirit and resilience of everyday Americans.)

Sure enough, U.S. stocks certainly haven’t been doomed.

In fact, they’ve been outperforming other global markets. So much so, that the United States’ share of the world’s total stock market cap keeps climbing.

Again, the current reading of 33.63% underscores the fact that 66.37% of investable opportunities remain outside our borders. So we should be allocating a portion of our portfolio to them, too.

But whatever you do, don’t sell your U.S. stocks to do so. Such neglect or disdain could come back to bite your bottom line.

How Do You Like Them Real Estate Prices?

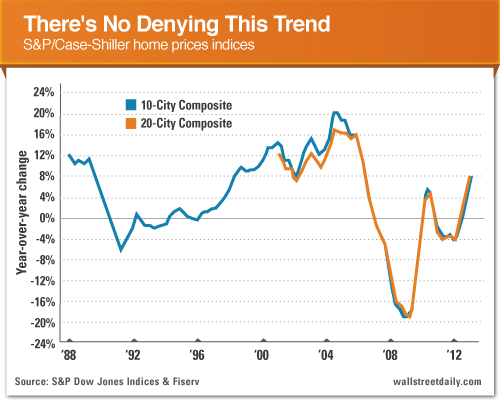

If there’s one bold prediction I’ve taken serious heat for, it’s last February’s call that the real estate market hit rock bottom.

To this day, thousands of readers refuse to believe it. Even after countless metrics and data points prove that the recovery is legit.

What are they waiting for?

Well, most say they won’t believe the hype until prices recover in earnest.

Ladies and gentleman, that moment has officially arrived.

The latest reading for the widely tracked S&P/Case-Shiller Home Price Index increased 8% in January, year-over-year.

As you can see in the chart, the trend is accelerating, too…

Bottom line: The recovery is legit. But the obvious investments are getting frothy. That means, as I’ve noted before, it’s time to trim up our stops and think about putting new money to work in the sector elsewhere.

I already shared five such investments with you here. So what are you waiting for?

That’s it for this week. Before you go, though, let us know what you think of this weekly column – or any of our recent work at Wall Street Daily – by sending an email to feedback@wallstreetdaily.com or leaving a comment on our website.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gaining Momentum: Dollar, US stocks, US Real Estate

Published 03/29/2013, 02:26 AM

Updated 05/14/2017, 06:45 AM

Gaining Momentum: Dollar, US stocks, US Real Estate

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.