- G-8 summit embraces further emphasis on measures to support growth but fails to produce concrete results.

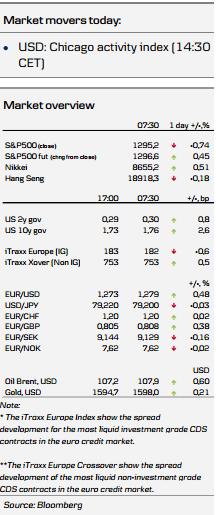

- Risk appetite continued to retreat on Friday, as US stocks posted their third weekly loss in a row.

- Sentiment remains fragile as focus turns to the EU summit on Wednesday. Market stress is likely to remain elevated ahead of the 17 June elections in Greece

Markets Overnight

The EU debt crisis was at the top of the agenda at the G-8 summit over the weekend but there were few concrete results. US President Obama joined the newly elected French President Hollande and UK Prime Minister Cameron in embracing further emphasis on measures to support economic growth, while there were no signs that Germany’s insistence on austerity measures was softening. Hence, divisions on the way forward persisted at the Camp David summit and on Greece, the concluding statement merely affirmed that the country should remain in the EU, while respecting its commitments.

Focus now turns to the EU summit on Wednesday, as the pressure on Germany to soften up its stance seems to be increasing. According to Financial Times, several controversial proposals are back on the agenda, including empowering the EUR500bn EU rescue fund to directly inject capital into the banking sector, unlimited purchases of Spanish and Italian government bonds through ECB and the mutual issuance of euro-zone bonds. Particularly the last po int has received renewed attention after French President Hollande said on Saturday that he would call for EU bonds at this week’s summit.

Risk appetite continued to retreat on Friday, as US stocks posted their third weekly loss in a row, thereby posting their longest losing streak since August. Not only did developments in Greece weigh on sentiment, but also the impact of positive drivers has faded recently with the US earnings season drawing to an end, concerns over a Chinese slowdown still lingering and some softness in US economic data recently. This morning, however, sentiment has improved in Asian trading, spurred by comments from Chinese Premier Wen Jiabao that China will focus more on supporting growth.

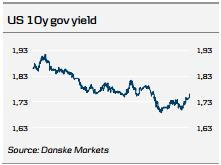

The trend lower in US bond yields slowed on Friday, after a week with big long-end gains for Treasurys. The 10-year yield rose 3bp, while front-end yields were largely unchanged.

Safe-haven currencies were the best performers on Friday, as USD and JPY posted gains versus their G10 peers. This morning ,JPY has continued to hover close to a three-month high versus USD, as USD/JPY fell to 79.00 on Friday. EUR has recovered quite a bit, after EUR/USD traded close to the 2012 low of 1.2624 on Friday.

Global Daily

Focus today: With a very light data calendar today risk sentiment will drive markets. We expect to see continued high uncertainty and stress in the markets as we await the Greek election on 17 June. Contagion to other debt-burdened euro area countries is the big issue, especially in Spain, where the financial sector is facing continuing challenges. Otherwise markets are likely to look ahead to the informal EU summit on Wednesday and the release of flash PMIs for the US, Euroland and China on Thursday. Data on the global manufacturing sector have been mixed lately and Thursday’s data should provide more clarity on the current strength of global production.

Fixed income markets: We expect to see market pressure continue to build into the EU summit on Wednesday evening, as the markets will continue to price in a higher chance of Greece leaving the euro-zone; hence we are looking for more curve flattening, new records in Bunds and Treasurys, higher yields in Spain and Italy, pressure on bank shares, increasing costs of getting USD off-shore, lower rates in Denmark and strengthening of DKK etc. We expect things to get worse and the markets will soon be looking for ECB action to stop contagion.

In the FX markets it is all about risk-off at the moment and we would certainly not recommend to go against the trend today. Hence, look out for downside for EUR/USD, EUR/GBP and the cyclical and commodity-sensitive currencies. The rush into USD and to a lesser degree JPY is expected to continue today. The so-called IMM or CFTC data showed that in the week that ended 15 May speculators added strongly to short EUR/USD positions. Bearish bets against the euro rose to 173,869 contracts up from 143,984 a week earlier; hence, even though the market is exceptionally short the euro, we believe that new shorts will be added this week and we repeat the message from the past couple of weeks: consider hedging the risk of strong moves lower in both EUR/USD and EUR/GBP.

Last week also showed that the otherwise lauded Scandies are not the place to hide when risk aversion spikes. Neither SEK nor NOK offer the liquidity demanded from a truly safe-haven currency. Hence, if risk aversion continues to dominate, look out for further upside for both EUR/SEK and EUR/NOK despite both crosses looking too high given the strong fundamentals of Sweden and Norway.

If we were to choose a Scandi pair we prefer EUR/NOK (NOK/SEK) or in fact we would choose EUR/DKK as the best hedge against the current euro turmoil. In respect of EUR/DKK we are now trading at or close to levels that earlier have triggered intervention and subsequent rate cuts from the Danish central bank. It underlines that an independent Danish rate cut could come sooner rather than later if the downward pressure on EUR/DKK continues.

Scandi Daily

Norway: Norges Bank announced last week a new issue of a government bond with 11-year maturity. The auction is due to take place today. The total issuan ce is NOK10bn, of which NOK6bn is due to be auctioned. This is standard volume for a new Norwegian issue. Fundamentally speaking, there are not many places in the world where one can buy AAA-rated government bond debt for yields at 2% or above. As such, this bond issue should offer good value and given the euro turmoil we think this is an excellent opportunity to get some true Triple A stuff. A further argument is that the auction calendar for Norwegian government bonds becomes very light over the summer. There will be two more auctions in June, none in July and then another two in August. The light supply might lead to Norwegian bonds trading higher over the summer, especially if there is a strong international demand for such papers as we expect in this period. DisclosureThis research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

DisclosureThis research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.