- No big news from the G20 summit. Talks center on euro crisis response with no signs of Germany giving in to pressure. Merkel stays tough on Greece.

- Relief following the Greek election was short-lived as focus shifted to Spain where bond yields reached a 16-year high yesterday.

- US and German equities closed higher yesterday while Southern Europe took a beating. Stock markets are losing slightly in Asia.

- Focus today on G20 statement, Spanish bond markets and ZEW index.

There has been no big news from the G20 summit in Mexico. Focus is clearly on the euro debt crisis and the response from EU leaders, not least Germany that is seen as holding the key to the necessary measures – see FT. But there are no signs that Germany is giving in to pressure for eurobonds or any kind of mutualization of debt at this stage. Germany's leader Angela Merkel has said she'll defend her policies with “good arguments.” Speaking at a news conference Merkel also continued a tough stance on Greece saying “there won't be any changes to the memorandum” – see WSJ.

Brazil said BRIC’s countries will announce contributions to the IMF fund. This was expected after IMF in April said it had received pledges of an increase in the funds of a total of USD 430bn – see Bloomberg. We do not expect the G20 meeting to present any new measures or solutions but only to state intentions to ease the euro crisis and support growth worldwide.

Talks continue in Greece to form a government – see FT. The New Democracy leader Antonis Samaras' chances of forming a viable government improved yesterday when he got backing from the Pasok leader to become prime minister. Samaras has a majority with Pasok but has stated he wants a broader coalition before he continues on more painful reforms and austerity and he is likely to try and get the smaller left-wing party Dimar to join as well.

Following short-lived relief in the markets after the Greek election focus quickly shifted to Spain where data show a continued rise in the bad loans ratio from 8.37% in March to 8.72% in April. Spanish bond yields rose to a 16-year high of 7.28%.

Equity markets quickly lost ground from a strong start but both the German and the US markets managed to close in positive territory. Southern Europe, however, took a beating.Markets in Asia are slightly lower.

US bond yields have moved a couple of bp lower overnight to 1.57% on the 10-year yield. In FX markets EUR/USD has recovered a bit overnight after falling most of the

day on the Spanish tensions. Scandi crosses are broadly unchanged.

Global Daily

Focus today: Political events remain in the limelight. In Greece, New Democracy's leader Samaras has got the mandate to lead negotiations to form a new government. The process should be concluded within three days from the election - hence, the deadline is Wednesday. The two-day G20 meeting kicked off yesterday continues today. No doubt that the European debt crisis is being discussed but we do not expect any specific proposals to be presented. The eurozone countries are instead focusing on having these ready for the EU summit on 28 June.

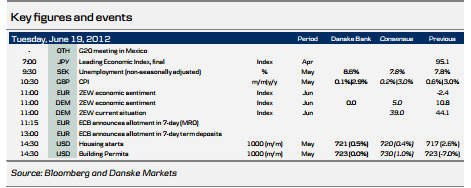

With only tier-2 releases on the agenda markets are looking ahead to the FOMC statement and press conference tomorrow. We expect the Fed to deliver more monetary easing and strike a dovish tone in the statement (see FOMC preview - Twist and shout. For today's data releases we expect the German ZEW to decline more than consensus expectations and look for only a modest increase in US housing starts for May and an unchanged level of building permits.

Fixed income markets: The situation in Spain is getting desperate and Spanish long-term yields are now at levels where Greece, Portugal and Ireland had to accept bail-out packages from EU/IMF. However, with Spanish GDP more than twice as big as these countries combined, the risk is bigger this time and the result can have larger ramifications. It is clear to us that the ECB will have to take action sooner rather than later and the question is now whether Draghi can wait until next month before announcing additional stimulus. It still makes sense to "play it safe" as the last two risk rallies have been very short-lived and have only given the bears better entry levels. Bunds, Gilts and Treasuries remain preferred targets despite expensive levels.

FX markets: The "Greek" rebound proved short-lived yesterday and EUR/USD moved lower before edging back above 1.26 again overnight. With the market already very short EUR/USD we think it will be difficult for the pair to edge much lower before tomorrow's FOMC meeting, as investors are likely to think twice about adding to short positions before a potential Fed easing announcement. We still expect to see EUR/USD lower over the coming months but it all depends on the relative monetary policy response between the Fed and the ECB. If the Fed surprises and delivers strong monetary easing this would qualify as a game changer and could trigger a trend reversal in EUR/USD - but it will likely take more than just soft language and an extension of Operation Twist.

Scandi Daily

We expect Swedish unemployment to remain steady at 7.8% (nsa) in May. Unemployment has been lower the first four months than last year, despite the weakening economy. The reason is probably that companies and the public sector are keen to retain their work force as there will be significant retirement in the coming years. Vacancies and lay-offs have both been improving over the past couple of months. There are, however, a few clouds to mention. May PMI and NIER business surveys suggest that employment in most sectors is slowing or even declining again. Hence, the outlook is still quite fragile.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst‟s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts' rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remunerationlinked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank's prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.