Investing.com’s stocks of the week

The G20 meeting finished last night and the joint communique published by the world’s leaders is all about the eurozone. Yesterday saw Spain pay over 5% to borrow money so it was fitting that a plan to bring about a fall in yields would be announced. The proposal stands that the EFSF and the ESM, the 2 bailout programs within the eurozone, would be used to buy the sovereign debt of peripheral nations in order to bring yields lower and try and prevent further contagion from the crisis. This is in effect the very beginning of the eurozone bond package that we have been campaigning on for the past year or so.

So what’s the problem? As with all things, someone normally gets mardy when they’re stuck with the bill and none come more intransigent than Mrs Merkel. Some are reporting that she has agreed to the deal which would be a shock given her previous battles over burden sharing. She once again spoke on Greece yesterday saying that no allowances would be made, so softness on bonds may be being used as a concession by her for discipline with Greece. We’ll leave the ins and outs to the political correspondents.

Markets wise, we saw a nice bounce in risk yesterday as participants became increasingly hopeful that the Fed would once again bring out the punchbowl and allow everyone to get merry on their cheap liquidity. The Fed meeting is their most important in a fair while and we are expecting the committee to remain on the miserly side of things and not expand their balance sheet by offering more QE. This would be a negative for risk and would see flows into the US dollar although the possibility that the board’s economic predictions err on the side of caution may only serve to see expectations shift to the next meeting. The announcement is due at 17.30.

UK inflation opened the door to further easing in the UK yesterday as it came in at a two-and-a-half-year low of 2.8%. We highlighted the falls in oil yesterday but general economic underperformance will have also seen the figure fall off. This obviously gives the Bank of England further leeway when discussing the possibility of looser monetary policy through interest rate cuts or additional quantitative easing.

We will find out how close the MPC were to raising rates last time round in today’s minutes at 09.30. Around 40% of analysts were looking for an increase in asset purchases from this month’s meeting, we’ll see whether those with their hands on the level agree. UK unemployment is also due at 09.30.

Flows will be quiet pre-FOMC although focus will remain on European equities and bond yields following the G20 announcement. We expect GBP/EUR to remain rangebound.

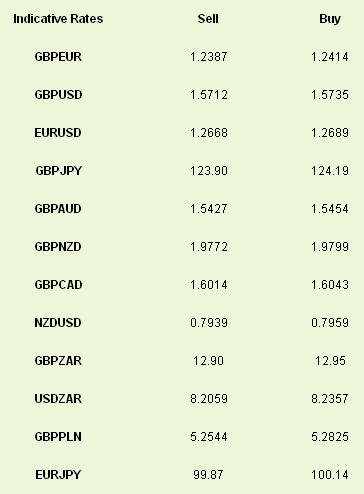

Latest exchange rates at time of writing:

So what’s the problem? As with all things, someone normally gets mardy when they’re stuck with the bill and none come more intransigent than Mrs Merkel. Some are reporting that she has agreed to the deal which would be a shock given her previous battles over burden sharing. She once again spoke on Greece yesterday saying that no allowances would be made, so softness on bonds may be being used as a concession by her for discipline with Greece. We’ll leave the ins and outs to the political correspondents.

Markets wise, we saw a nice bounce in risk yesterday as participants became increasingly hopeful that the Fed would once again bring out the punchbowl and allow everyone to get merry on their cheap liquidity. The Fed meeting is their most important in a fair while and we are expecting the committee to remain on the miserly side of things and not expand their balance sheet by offering more QE. This would be a negative for risk and would see flows into the US dollar although the possibility that the board’s economic predictions err on the side of caution may only serve to see expectations shift to the next meeting. The announcement is due at 17.30.

UK inflation opened the door to further easing in the UK yesterday as it came in at a two-and-a-half-year low of 2.8%. We highlighted the falls in oil yesterday but general economic underperformance will have also seen the figure fall off. This obviously gives the Bank of England further leeway when discussing the possibility of looser monetary policy through interest rate cuts or additional quantitative easing.

We will find out how close the MPC were to raising rates last time round in today’s minutes at 09.30. Around 40% of analysts were looking for an increase in asset purchases from this month’s meeting, we’ll see whether those with their hands on the level agree. UK unemployment is also due at 09.30.

Flows will be quiet pre-FOMC although focus will remain on European equities and bond yields following the G20 announcement. We expect GBP/EUR to remain rangebound.

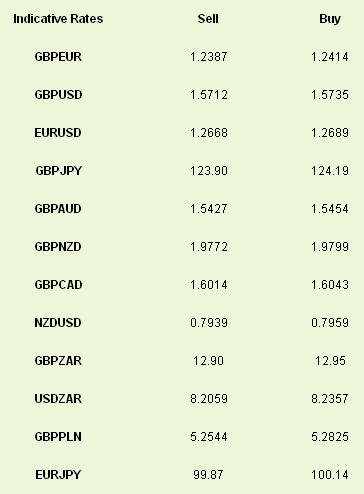

Latest exchange rates at time of writing: