A Fed announcement to speed up asset purchases should continue to support the dollar while the potential introduction of a third asset purchase program by the ECB may weigh on the euro. A Bank of England hold may only slightly weaken the pound, while a Norges Bank hike could bring EUR/NOK back to 10.00. Elsewhere, expect no surprises from the SNB and BoJ.

USD: Fed's tapering acceleration to support the dollar

As discussed in our December FOMC preview, we expect the Federal Reserve to announce that asset purchases will be unwound at a faster pace in January (by $30bn) and in February (by another $30bn). That puts the Fed on track to end purchases by March instead of May if the pace is kept at $15bn per month. Some acknowledgement of downside risks linked to the spread of Omicron should be broadly offset by the inflation-induced hawkish turn.

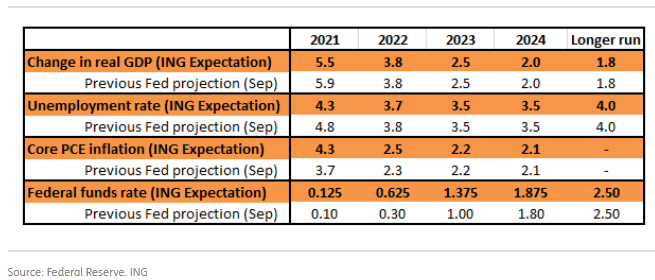

This outcome should not be particularly surprising for markets considering that recent Fedspeak signaled rising concerns about persistent inflation and seemed to downplay the Omicron-related downside risks. A lot of focus will be on the updated Dot Plots and economic projections: as shown in the table below, we expect FOMC members to forecast at least two full rate hikes in 2022, while the GDP and inflation figures may be only slightly changed.

We expect the dollar to stay supported after the FOMC announcement, as the acceleration in tapering and the upgraded Dot Plots should allow markets to cement their views around the tightening cycle starting in the first half of next year. Low-yielders should be the primary victims, although the impact may be easily mixed with worsening Omicron-related news and high-beta currencies could underperform.

EUR: More asset purchases after March means wider Fed-ECB divergence

As per our ECB December Preview, we expect the European Central Bank to stick to the "transitory" narrative when it comes to inflation, with staff projections that may see only small changes. This should delay any discussion on tightening to a much later stage, with the focus set to be on the fate of the asset purchase programs.

In line with what was signaled by President Christine Lagarde recently, we expect the ECB to confirm that the €60bn per month Pandemic Emergency Purchase Program will end in March 2022, as planned. However, we expect an announcement that it will be replaced by a third purchasing program (with an envelope of around €300bn) to smooth the transition to the much smaller Asset Purchase Program (€20bn per month).

We think this should send a rather dovish signal to the market, where the predominant view may be that we’ll see an increase to the APP rather than a new (more flexible) PEPP-style program.

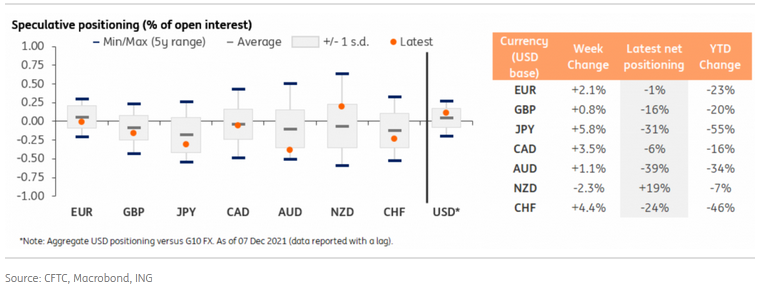

EUR/USD has struggled to stay above 1.1300 and a week where the Fed and the ECB will—in our view—take further diverging paths on tapering, should see further pressure on the pair. A break below 1.1200 should unlock further downside in EUR/USD, which, as displayed in the chart below, is currently showing no sign of being oversold, according to CFTC data.

GBP: No BoE hike, moderate downside risks for the pound

We are aligned with the consensus in expecting the Bank of England to keep rates on hold this week, as discussed here by our UK economist.

The MPC signaled in November that it is comfortable with waiting for more data and the spread of the Omicron variant offers a good reason to tread carefully.

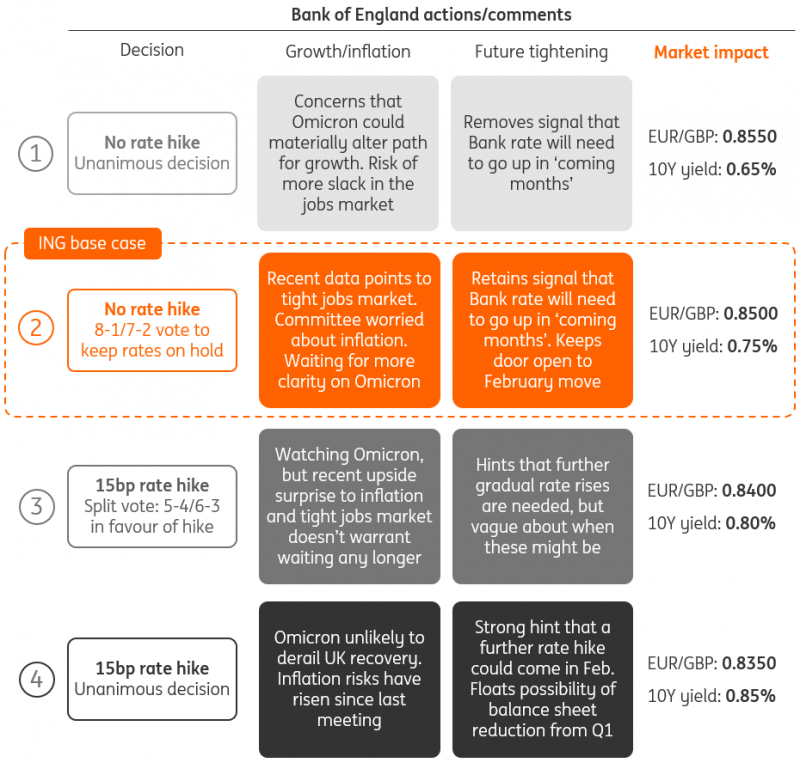

Focus will be on: a) how many members will vote to remain on hold (we expect either a 7-2 or 8-1 split); b) forward looking language. On the latter, we expect the BoE to leave the door open for a February hike, by reiterating that Bank Rate will likely need to be raised in coming months.

Markets have almost completely priced out a rate hike this week and we therefore expect only some moderate downside risks for sterling ahead of the announcement. As shown in the chart above, the pound is—unlike the euro—quite oversold, especially when compared to its 2021 average, and the openness to a February move should help limit the losses.

We explore different EUR/GBP scenarios (chart below) ahead of the BoE announcement: we think the 0.8600 resistance may hold until a dovish ECB puts pressure on the pair less than an hour later.

Our EUR/GBP forecasts are for end-Thursday and include both the BoE and ECB impact. We expect GBP/USD downside risks to be larger, and when combined with a USD-positive outcome of Wednesday’s FOMC, we could see cable trade within the 1.30-1.31 range by the end of the week.

NOK: A new leg higher as Norges Bank hikes

A "super Thursday" for central banks will also see Norges Bank announce policy. Markets have grown increasingly skeptical that the NB will be able to stick to its planned rate hike for December given the Omicron outbreak. We think that with inflation running above 5%, a very tight labor market, growth supported by recent rise in oil and gas investments, resilient crude prices despite Omicron and spiking natural gas prices, the case for a 25bp hike this week remains quite strong.

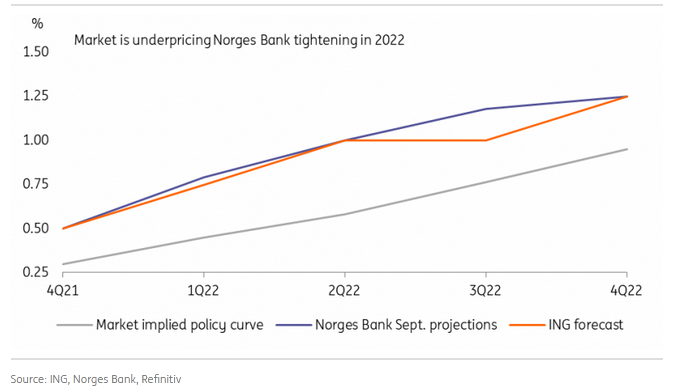

The money market appears to be pricing in only 20bp of tightening for the next three months, and we therefore expect a rate hike to be a hawkish surprise and send the krone higher.

Focus will also be on the rate projections: we think NB will stick to three more hikes in 2022 while assessing the impact of Omicron. That should also contribute to some NOK-positive hawkish re-pricing, as the market currently expects three hikes in total from now till end-2022 (chart below). When combined with a dovish ECB, we think EUR/NOK has the potential to fall back to the 10.00 level this week.

CHF: SNB to keep an eye on the franc, as usual

The Swiss National Bank kicks off this week’s “super Thursday” with an 8:30AM (GMT) rate announcement that looks unlikely to have any real surprise potential. The focus should mostly be on CHF-related comments, and we expect the SNB to stick to the narrative that the franc is “highly valued,” defying any potential speculation that policymakers may be welcoming a stronger CHF to fight inflation.

SNB sight deposit data released last week seemed to point to increasing FX intervention in December as EUR/CHF came under pressure again amid Omicron-related concerns.

With the ECB set to postpone the end of its emergency asset buying and the fast spread of Omicron likely to provide a further blow to eurozone sentiment in the near term, the SNB may well have to tolerate EUR/CHF trading below 1.0400 in the coming weeks, despite continuing to carry out FX intervention.

JPY: Little impact from BoJ extending pandemic funding

The last central bank announcement of the week, on Friday, will be by the Bank of Japan. Recent history suggests little to no impact from BoJ rate decisions on the yen and this time should be no different. All policy tools are set to remain untouched, while we think (and this seems to be the consensus) that the BoJ will extend the emergency corporate funding programs as the Omicron variant generates new risks to the outlook.

JPY should remain driven by external factors into year-end. The Omicron outbreak has allowed the yen to be the only currency to outperform the USD in the past 30 days.

Given the risks of new restrictions and the currency’s lingering oversold condition, there is likely some room for JPY to find more support in the near term, especially in the crosses. EUR/JPY may break below the recently-explored 127.60 nine-month lows by year-end. USD/JPY, instead, may stay supported as a hawkish Fed limits the downside.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more