This week in FX markets will be all about policymakers delivering on their threats or promises. Will Washington follow through on its threat to increase tariffs on China and will Turkish authorities deliver on their promise of rate hikes at the central bank meeting on Thursday? Backed by strong domestic data it's hard to argue against the dollar right now.

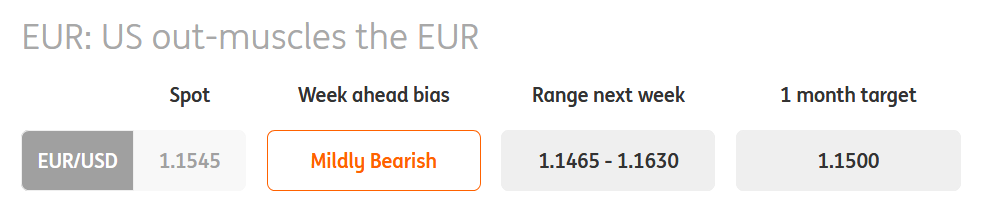

- The strong US domestic economy and Washington’s aggressive trade policies are combining to keep the dollar reasonably bid. On the former, this week should see a strong retail sales figure on (Thursday) after another high reading for core inflation (Wednesday). A 25 basis point Fed hike 26 September looks a done deal now. Expect the febrile atmosphere around protectionism to continue, where Washington is now even starting to discuss a final round of tariffs which would cover the entire range of Chinese imports. No let up here should see the pro-cyclical EUR/USD remain under pressure. On the subject of trade, US and EU trade chiefs meet on Monday in Brussels in what should be an amicable meeting.

- In the eurozone, the highlight should be Thursday’s ECB meeting. Our team is not expecting any fireworks here, where the ECB should confirm that quantitative easing is being tapered to €15 billion from €30 billion per month from next month onwards. ECB forward guidance is a much more powerful stick now and no change is expected here either – i.e. unchanged rates through summer 2019. Elsewhere, the risk market will also take note of Thursday’s CBT rate meeting in Turkey. The CBT has promised action. We expect a 325 basis point rate hike in the key one-week repo rate and a large hike would add to the new-found stability in the Turkish lira.

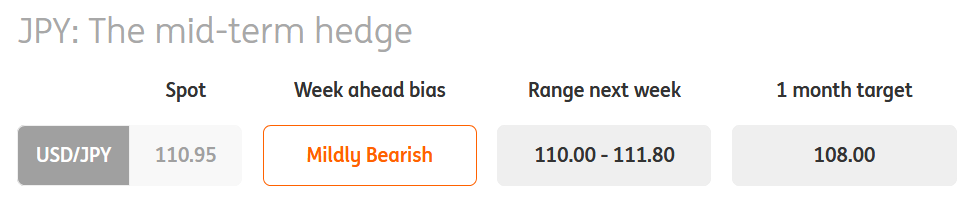

- USD/JPY continues to trade a very tight range, with few themes appearing strong enough to determine a decisive new direction. We’re certainly in the camp looking for JPY out-performance on the cross, given a tough risk environment, but USD/JPY is another story. Here, firm US rates are keeping USD/JPY well-supported above 110 and there’s yet to be a knock-out blow for the US equity story. We are concerned about contagion from emerging market equity markets back into the US, although the tax cut is providing strong insulation to US equities right now.

- Late last week President Trump’s focus turned to Japan’s trade surplus with the US – the third largest after China and Mexico. While USD/JPY initially sold off on this, one could also argue that this is a Japanese yen negative and would add to the bull trend in USD/Asia. This ambiguity is keeping USD/JPY side-lined. In Japan, we've just seen the release of the 2Q18, revised higher, and the focus this week will be on the July trade figures. However, Japanese domestic data remains a sideshow at the moment.

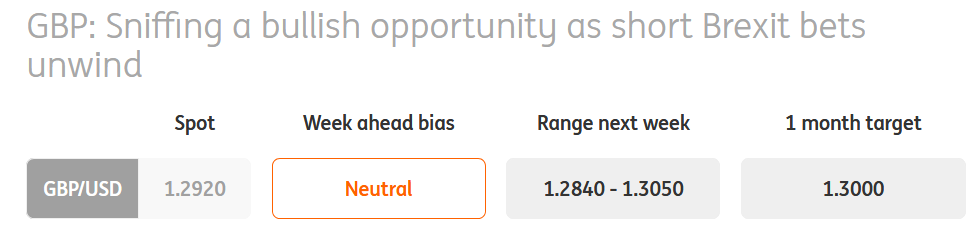

- We see two-way political risks to GBP in the near-term. On the one hand, the stream of news over the next month will be broadly GBP negative as a divisive UK parliament squabbles over what the best Brexit policy approach should be. But equally, all the noise out of Brussels seems to suggest that a Brexit Withdrawal Agreement may be within reach. While the run-in to the UK Party Conference Season later this month may keep a dampener on GBP sentiment, we think that a concrete resolution on the Irish border backstop issue could be a far greater positive catalyst for the pound. Look for a heavily sold GBP to remain more sensitive to positive Brexit headlines; we think a full short-to-neutral GBP positioning adjustment - on the back of no deal Brexit risks being priced out - would see GBP/USD trade up to 1.32-1.33 in the interim period.

- Any positive UK data releases in the coming week would only add to the positive GBP re-pricing in recent weeks. Following the recent switch to monthly UK GDP data releases, we'll get the July growth reading (Monday); any positive surprise to the +0.1% month-on-month reading would mean that 3Q activity has been pretty solid. More importantly, the Bank of England will be focused on the UK jobs report (Wednesday) - both from a wage growth perspective and to see if 'no deal' Brexit uncertainties have started to weigh on employment activity. Talking of the BoE, the September meeting this week (Thursday) is likely to be a non-event; we look for a broadly unchanged statement - with no real mention of UK politics or Brexit. With the consensus within markets that the BoE will not hike before Brexit (March 2019) - we think there are limited GBP downside risks from softer UK data or a neutral BoE statement. Risk-reward continues to favour positioning for GBP upside in the event of a soft Brexit outcome.

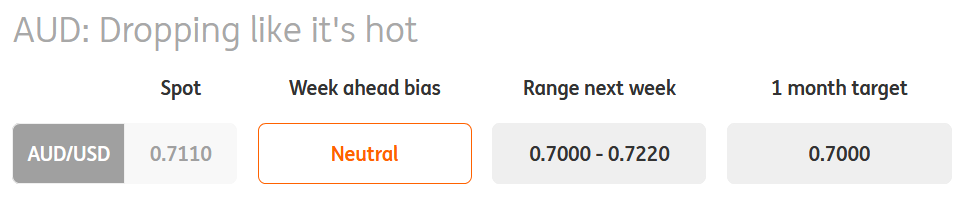

- It's difficult to envisage an end to the Australian dollar's sharp slide. US and China trade tensions are likely to keep a lid on risky assets in the near-term, while the domestic story of major Australian banks raising mortgage lending rates has dented Reserve Bank of Australia tightening expectations. While the RBA had little to say on this topic in its latest policy statement, investors broadly see limited scope for any RBA rate hikes over the next 6-12 months - not least with the economy still stuck in 'lowflation' mode.

- The week ahead sees the August jobs report(Thursday) - which is expected to show employment gains of +18k (albeit with unemployment staying at 5.3%). In addition, we also have the August business confidence (Monday) and September consumer inflation expectations (Thursday). Unless we get a string of positive Australian data surprises, investors will continue to price in a dovish RBA.

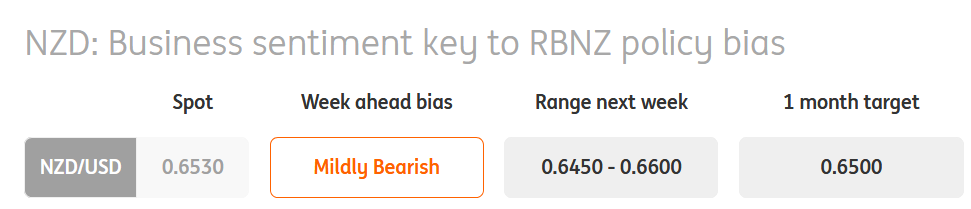

- While we wouldn't normally cite New Zealand manufacturing PMI as the headline risk to the kiwi, the release in the week ahead (Thursday) may be different. The PMI has been on a sharp slide since April (the six-month moving average is at its lowest since October 2015) - a further decline could move closer to the neutral 50.0 level and would reinforce the Reserve Bank of New Zealand's dovish sentiment. Indeed, Governor Adrian Orr explicitly cited low business confidence as a reason for the central bank's dovish shift. We feel that the market pricing in a ~27% probability of an RBNZ rate cut in Feb 2019 is a bit aggressive, although the NZD OIS curve could remain downward sloping in the absence of a rebound in domestic business sentiment. We also have 2Q manufacturing activity data in the week ahead (Monday).

- The broader global backdrop will remain tricky following Trump comments on additional China tariffs. Markets may be pleasantly surprised if US tariffs on China do not come through over the coming week. Equally, we may see investors starting to differentiate between reality and Trump bluster. Difficult to truly gauge how that plays out - and risks are that we could see 0.65 taken out.

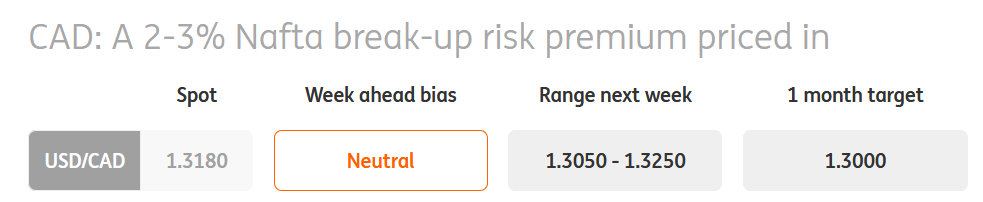

- While the US and Mexico reached a bilateral trade deal in August, the risk of a Nafta break-up has counterintuitively increased as the US and Canada remain at loggerheads over key trade issues – with President Trump actively threatening to tear up Nafta. We estimate a 2-3% Nafta break-up risk premium is priced into the Canadian dollar. Although ongoing Nafta uncertainty may weigh on CAD in the near-term, the risks of a calamitous break-up are very low. With the Canadian economy resilient and the Bank of Canada teeing us up for an October rate hike, we think the risks to USD/CAD lie to the downside.

- The Canadian jobs report didn't make for the best reading – although we acknowledge that most of the headline jobs growth weakness was due to a fall in part-time jobs. The week ahead is pretty light on data; 2Q capacity utilisation data (Wednesday) is of marginal interest. External risks such as Nafta, US trade policy and oil remain the primary negative drivers for CAD.

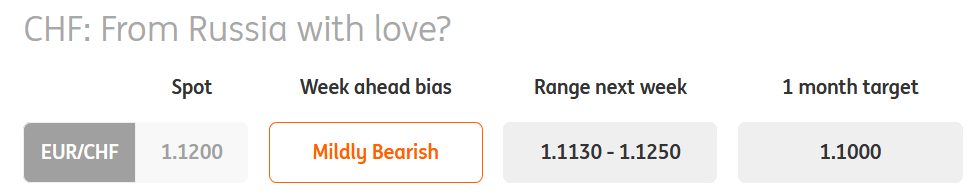

- EUR/CHF broke to a new low last week even though the BTP-Bund spread stabilised. The global equity environment remains fragile, however, and safe-haven buying of the Swiss franc continues. We also wonder whether the fear of Russian sanctions, (which has driven USD/RUB close to 70) is also triggering some CHF demand as Russian nationals try to reduce exposure to the US Treasury (and accordingly the USD).

- The Swiss National Bank has allowed EUR/CHF to break lower even though it retains its FX intervention strategy. We also wonder whether the upcoming (October) US Treasury report is discouraging SNB FX intervention. Being named a currency manipulator looks no fun in the current environment. In terms of Swiss data, it’s just August PPI data this week. July saw a new cycle high of 3.6% year-on-year and higher energy prices could see this climb further. However, we doubt the SNB is ready to make any substantive changes to its monetary policy when it meets next week.

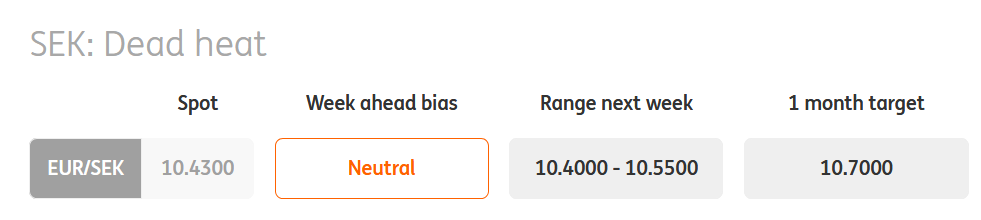

- Despite the inconclusive outcome of the elections and the likely protracted path of negotiations, we expect the Swedish krona decline to take a pause for a breath as such an outcome does not come as a surprise (a hung parliament was the most likely outcome while Swedish Democrats scored less than feared) and plenty of bad news was already been priced in beforehand (the SEK rally late Friday ahead of the election being a case in point). In fact, some short-term SEK gains are possible given the bearish positioning in krona. Nonetheless, we remain bearish on SEK into the year-end due to the seasonal fall in local interbank rates, SEK vulnerability to trade wars and the deteriorating current account surplus.

- On the domestic data front, our economists look for higher Swedish August CPIF (to 2.4% YoY) as energy prices remain elevated but still low core CPI (1.5%) way below 2%. With the Riksbank sending a very unclear message during the September meeting (the statement indicated a potential hike in December, but the interest rate forecast showed unchanged rates for the reminder of the year) the mix of higher headline CPI and lower core prices should not affect market pricing significantly (and thus have a limited impact on SEK).

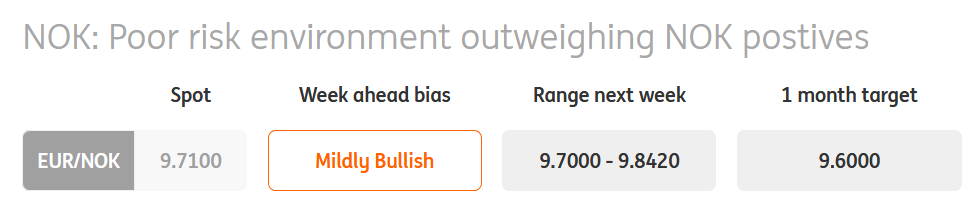

- Today’s increase in both headline and underlying Norwegian inflation is, in our view, cementing the case for the September Norges Bank hike. We have been surprised by the scale of the NOK decline and the extent to which the general challenging risk environment outweighed the NOK positives such as the hawkish NB and stable oil prices.

- With the spectre of trade wars fully in place (the US threatening further tariffs on China) and bearing in mind the NOK's vulnerability over the past weeks, the currency may not get much benefit from the hawkish NB (we expect a hike on 20 September) and EUR/NOK is at risk of breaking above the 9.80 level again this week.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”