The Federal Reserve Chair's semi-annual testimony to Congress is the headline event in an otherwise quiet week. As investors get ready for a summer of Trumpian trade and geopolitical risks, a resolute hawkish Fed remains a forcible headwind for risky assets. A status quo Powell may just see the markets love for the US dollar endure for a bit longer.

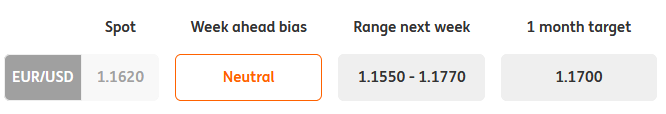

EUR: ECB forward guidance confusion unlikely to spur much upside

- The markets love for the dollar, and a hawkish Federal Reserve remains strong - and the week ahead may do little to scupper this. Chair Jerome Powell's first semi-annual testimony to Congress will be the flagship event in a quiet week. While risky assets will be hoping for some more dovish and cautious comments, it appears as though US monetary policymakers continue to focus on domestic economic dynamics while paying less attention to what's going on in the rest of the world. Unlike a Yellen or Bernanke Fed, a Powell Fed seemingly poses greater risks to global markets and in the absence of any shift in rhetoric at next week's testimony, these risks are likely to remain. However, any signs of concern from Powell over the implications for US trade policy could keep a lid on US rates and the dollar, while counterintuitively providing a bit of relief to risky assets. Note, the counterintuitive element is the fact that the catalyst for any dovish Fed U-turn - global protectionism - is outright negative for global risk sentiment). The week ahead also sees US retail sales due on Monday, industrial production due Tuesday and the Fed's Beige Book on Wednesday. All eyes will be on whether consumer or business sentiment is starting to be affected by rising trade war tensions.

- We'll be watching the final June Eurozone inflation reading on Wednesday and also keeping one eye on the May eurozone trade data out on Monday to see if there's any early fallout from the current global trade war spat. Reports that European Central Bank officials are split on the timing of the first rate hike in 2019 - with some officials potentially seeing a move as early as July has had no sustained impact on the euro. If the ECB’s Governing Council are internally confused about their forward guidance, then there’s little doubt that markets will remain equally uncertain over what the ECB means by keeping rates on hold ‘through the summer’. Until eurozone data can credibly convince us otherwise, euro investors are unlikely to chase a 2019 ECB normalisation story just yet.

JPY: More channels pointing to downside risks

- The breakout in USD/JPY over the past week has been notable and largely telling that the yen is not displaying the typical safe-haven characteristics that we’re used to seeing when the backdrop for global equity markets is this soggy. We think this disconnect is down to two factors: (1) when the source of market risk is the spectre of US auto tariffs; there is a fundamentally negative impact on Japan's economic growth outlook (note ~23% of total US car imports in 2017 were from Japan). Secondly, the JPY may be getting caught up in the Asian FX sell-off, and we note this is not that out-of-character - with USD/JPY having traded higher during the Asian crisis.

- As we alluded here: JPY: Why the yen’s at a crossroads, a flatter US yield curve also often coincides with a (lagged) move higher in USD/JPY. With the US 2s10s spread flattening by the week and likely to continue doing so, we suspect global bond market dynamics could be another source of yen weakness. The week ahead in Japanese calendar sees the release of trade figures on Thursday and national CPI data on Friday.

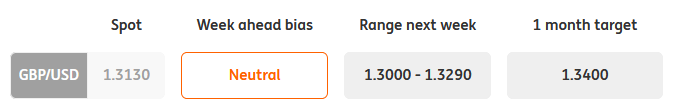

GBP: Watching a crucial round of UK-EU Brexit talks

- With Prime Minister Theresa May on the ropes - and GBP markets scrutinising every bit of Brexit news, the focus turns to a vote on the EU Withdrawal Bill early next week and a crucial round of UK-EU Brexit negotiations later. We've argued that what Brussels says about the UK government's Brexit plan - and whether there is room for negotiation - will determine the near-term directional bias for sterling. If EU officials see the current plan as 'unworkable', then we fear GBP could post a sharp move lower (GBP/USD below 1.30 and EUR/GBP to 0.90) as investors price in greater odds of a 'no deal' Brexit. However, the reality of ongoing Brexit negotiations - and a potential steer towards a 'softer' Brexit, at least relative to initial expectations is keeping GBP above water for now. No further 'bad news' on the UK political front could help ease some of GBP's short-term negative bias.

- It's a big week for UK data - although for now, the Bank of England rate hike story is a secondary factor for GBP markets. Indeed, the central bank remains wedged between a policy tightening rock and hard Brexit place. In the absence of any material shocks in next week’s UK data releases, which sees the latest labour market (Tuesday), CPI inflation due on Wednesday and retail sales reports due Thursday - we continue to look for an August rate hike under the political status quo. Markets aren’t quite convinced just yet, which lends itself to a mildly positive GBP bias in the run-up to the early August meeting should political risks subside. But the latter will be the key catalyst for unlocking GBP upside - so all eyes on Westminister and Brussels.

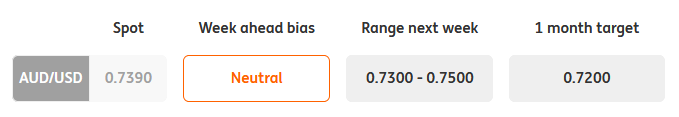

AUD: Riding the roller coaster in industrial metals

- In addition to sentiment over the Chinese economy, one of the channels through which the US-China trade war is weighing on the AUD is via the weaker terms of trade story. As our commodities team note, the industrial metals complex had a rough ride this week after the latest escalation in the global trade war which saw the USTR releasing tariff details on $200bn worth of Chinese imports. We acknowledge there may be a risk of a short-squeeze in metal prices - that could also lift the AUD in the near-term. However, the general trajectory is for further terms of trade weakness to fundamentally weigh on the Aussie (and keep AUD/USD in the low 70s area).

- There are two key events to note next week - the July Reserve Bank of Australia meeting minutes are due on Tuesday, and the June jobs report on Thursday. Recall that the July statement had a whiff of dovishness to it - and this could be further alluded to in the subsequent meeting minutes. A solid jobs report could help support the AUD, though we'll need to see convincing signs that the unemployment rate is heading towards the 5% level (current 5.4%). AUD to remain sensitive to headline trade war and hawkish Fed risks.

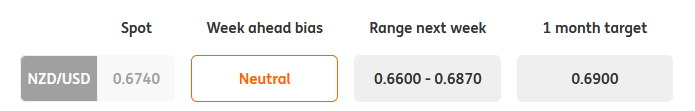

NZD: 2Q inflation to set kiwi's tone for the summer

- Over the past few months, NZD/USD price action has been pretty much driven by what's been happening with the US dollar and external risk environment. Yet, the upcoming second-quarter inflation report on Monday will set the tone for how investors view domestic NZD dynamics over the coming months. Markets are looking for another 0.5% QoQ print - which translates into a 1.6% annualised inflation reading. This is still somewhat below the 2% mid-point of the RBNZ's 1-3% target inflation range - although we'll be watching to see whether underlying inflation (the RBNZ's sectoral factor model) could get closer to the 2% level (the 1Q18 reading here was 1.5% YoY).

- In the absence of any positive NZ inflation surprises, the kiwi looks pretty vulnerable in the near-term, especially as FX investors remain fixated with a strong dollar and hawkish Fed narrative in a fairly thin summer market. Risks are that NZD/USD could test fresh lows below 0.6680 over the coming months - opening up a potential move towards 0.65.

CAD: Trading one BoC policy move at a time

- The Bank of Canada rate hike this week gave FX markets an example of how short-lived chasing a central bank tightening story could be in an ever-changing investment environment. It seemed not everyone in the market was convinced the central bank would deliver, but officials not only raised rates by 25bps, but they also noted higher rates would be warranted in the future. While the CAD saw a knee-jerk move higher, the move quickly faded as it became clear the central bank's policy outlook was conditional on a benign trade and geopolitical backdrop - something which FX investors may not agree with given uncertainty over NAFTA and the overall stance of US trade policy.

- Moreover, the uptick in 2-year Canadian bond yields was trivial, and expectations for an additional 25bp rate hike by year-end were broadly unchanged (around 45%). Economic data will drive the BoC's hand. The week ahead sees the release of June CPI inflation and May retail sales data, both due on Friday. Any uptick in inflation - as well as a bounce back in retail sales (following a dismal April reading) - could see CAD markets re-connecting with the hawkish BoC story. However, we do think we'll need to see a further de-escalation in US trade policy risks for USD/CAD to move towards our 1.29-1.30 short-term fair value estimate. Watch the 1.3060 support level as a sign of directional sentiment.

CHF: Investors given up on the Swiss haven play

- EUR/CHF broke higher this week as investors seemingly gave up on the franc as a haven asset amid a pause in trade war tensions. The breach of the 200-dma may see a broader move towards 1.18 in the absence of any further escalation in trade risks. A move above 1.1710/15 would support this view.

- As our economists note in their latest Swiss Quarterly update, given the ECB is not expecting to hike before the end of the summer of 2019, we think the Swiss National Bank won’t raise rates before December 2019. This should limit the extent to which CHF sees any idiosyncratic appreciation - and we continue to see the franc as a relative European FX underperformer. The week ahead sees the weekly sight deposits due Monday and June trade data due Thursday.

SEK: Sensitive and soft

- Minutes from the Riksbank meeting in July indicated a largely unchanged take on the current landscape. The rather soft CPI data - with core printing lower at 1.4% YoY - will in our view almost certainly encourage the Riksbank to postpone their rate hike into 2019.

- Recent trade war tensions have delivered captivating waves of uncertainty that certainly makes the near future even more inexplicable. Sweden’s open economy makes it vulnerable to ongoing trade war headlines, and one cannot rule out more Trump rhetoric in the coming week. Look for SEK to remain under pressure from both negative domestic and external factors. We look for EUR/SEK to move above 10.40 in the near-term.

NOK: A well oiled machine?

- Norway's June CPI print came in stronger than anticipated at 2.6% relative to both our forecasts (2.5%) and that of the Norges Bank. However, the upside surprise in headline inflation is entirely due to higher energy prices of both oil and electricity in Norway - and as such the follow-through in bullish NOK price action was muted. Indeed, core inflation remained subdued at 1.1%.

- The previous rally in oil prices has ended as high levels of production caught up with market prospects. OPEC revealed Wednesday that Saudi-Arabia had raised production by 400,000 barrels a day in June; lower oil prices are likely to weigh on the oil-sensitive NOK. Conflicting hawkish Norges Bank and softer external global drivers suggest a rangebound EUR/NOK between 9.40 and 9.55 in the near-term.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.