Could the Fed come to the rescue for global markets this week? A wonky debate about the Fed's role as the global central bank may be the highlight of the annual Jackson Hole economic symposium next week, with risky assets hoping for a Yellen-esque performance from Fed Chair Powell. However, an 'America First' monetary policy approach could heap more pain.

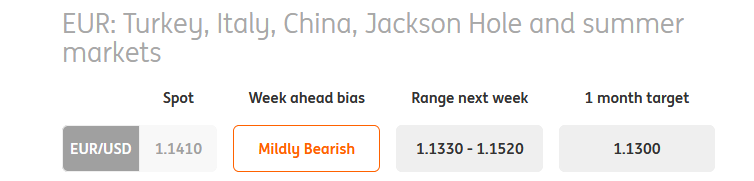

- It's summer, it's quiet, and it's been pretty wild in global FX markets. The euro is starting to reflect greater short-term domestic political angst – the link between EUR/USD and peripheral European swap spreads suggests that there may be a hefty 3-4 big figures worth of idiosyncratic European risks (Italy and Turkey) priced into the single currency. We still feel that it may be too early for any of this to be priced out. Investors are still cautious over Turkey's medium-term economic plan (and we won't get clarity here until early September), while the next month or so will also see a narrower focus on the risks around Italian budget (also unlikely to be resolved until September/October). Still, with Turkish markets on holiday from Tuesday, the former may be a reduced source of volatility for the EUR in the immediate future. A more stable CNY is also helping the cause following a couple of aggressive PBoC fixings. Eurozone data wise we get the preliminary August PMI release and consumer confidence on Thursday. The EUR bulls will want to see some signs of consumption and investment intentions returning online.

- In the US, all eyes will be on the Federal Reserve in the coming week – with both the August FOMC meeting minutes due Wednesday and the annual economic symposium at Jackson Hole on Friday. For global investors is whether the Fed acknowledges not only the recent market volatility but also the fact that its policy signals may be partly behind the deterioration in global risk sentiment. Under a Yellen Fed, we were pretty sure that these market conditions would have kept the US central bank in wait-and-see mode. However, all eyes will be on new Fed Chair Powell to see whether he formally adopts an 'America First' monetary policy approach. A Yellen-esque Powell would be the pretty positive outcome for emerging market assets in the current market environment. Elsewhere, Jackson Hole may well focus on the Fed's long-run policy framework – not least the debate over how much to shrink the central bank's balance sheet by and what the future short-term policy instrument will be. However, we doubt any of this has any noticeable short-term impact on the US yield curve which continues to be dominated by a flattening theme. It's also worth keeping one eye on some of the survey data out of the US – leading activity indicators have been coming off the boil over the past month including a sharp drop in the ISM, Philly Fed index and Michigan consumer confidence. If there wasn’t this degree of geopolitical noise in the background, one thing we'd be more confident about is our view that the cyclical USD macro dynamics have peaked in 2Q18.

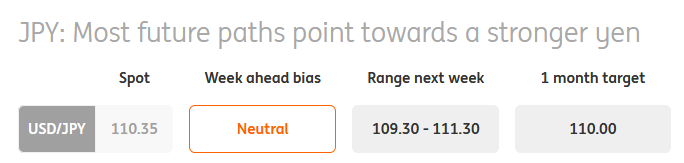

- USD/JPY remains highly sensitive to the changing geopolitical environment – and we expect the pair to remain sensitive to incoming headlines on US-China trade ties and EM geopolitics. While news of US-China trade talks has partially lifted risk sentiment, trading hopes of a better political world have proved to be unfruitful so far this year. Geopolitical reality has been a lot more damning in this new unnerving protectionist world and on balance, it's likely that more US tariffs will come in than less. Either way, with US leading activity indicators starting to soften, we see most future paths pointing towards a lower USD/JPY – and the pair crossing the 110 psychological level could be a strong confirmation of this.

- Japanese data in the week ahead sees retail sales on Tuesday, Japanese manufacturing PMI on Thursday and July CPI on Friday. The domestic story has also been marginally supportive for the yen – not least since the Bank of Japan's subtle hawkish tweak last month. The idea of 'stealth tapering' has also spread to the central bank's ETF purchases – with commentators noting the central bank has been less on hand to curb recent stock market volatility. We feel the yen has reverted back to exhibiting its usual safe-haven characteristics in a fragile environment and we expect the currency to remain the markets' preferred safe-haven vehicle.

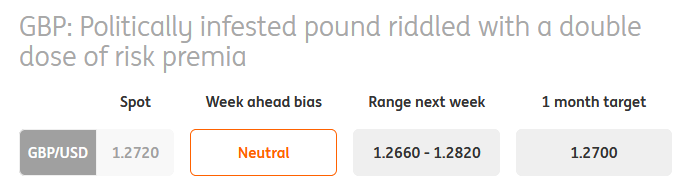

- With both retail sales and unemployment positively surprising - it wasn't the worst week for UK data releases. However, the lack of positive reaction in GBP markets is clear evidence the currency is infested with a double dose of risk premia: (1) a UK-specific risk premium capturing the obvious heightened no-deal Brexit risks and (2) a global risk premium stemming from geopolitical uncertainties and EM turmoil. While we may already be at our GBP/USD 1.27 target, the persistence of these ‘twin risk premia’ could see us undershoot this level in the near-term with risks of a move down to 1.25-1.26.

- However, we are slightly uncomfortable chasing GBP much lower now – especially in the absence of any tangible signs that we’re heading towards a no-deal Brexit. While the perceived odds of a no-deal are high – this may be partly due to political games and posturing. We still feel the odds of an actual economic regime change (UK reverting to WTO trading rules) is much lower. The prospect of a last-minute deal on the Irish backstop means that risk-reward no longer favours pricing in no-deal Brexit risks – with scope for a sharp GBP rebound in this scenario outweighing further momentum driven moves lower. Watch out for any Brexit headlines next week as UK-EU talks have now resumed, while second-tier data releases include July public finances due on Tuesday and CBI surveys (Tuesday/Thursday).

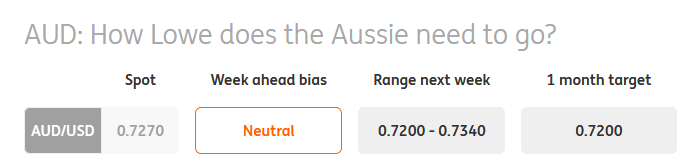

- It's been a fairly choppy week for AUD/USD – one which saw the pair make a charge towards the 0.72 level. However, a turn in the global risk environment – which coincided with some stronger People's Bank of China CNY fixings prevented any further AUD pain. The Reserve Bank of Australia's Governor Philip Lowe also kept a fairly upbeat tone when testifying to parliament as he reiterated the next likely move in the policy rate will be up - but added he thinks a lower AUD would be 'helpful'. With a lot of bad news already priced into the currency, we saw a muted reaction to this passing comment.

- The week ahead will give us slightly more insight into the RBA policy debate, with the release of the August meeting minutes due Tuesday. Also, watch out for 2Q construction work done on Thursday– which will be a precursor to the more market-moving 2Q Private Capex report due the following week. Look for AUD/USD to bounce around in the 0.72-0.73 range – with any breakout from here a function of broader sentiment over US-China trade ties.

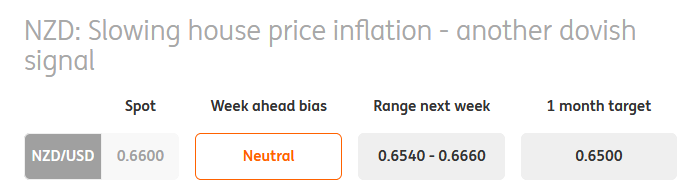

- While there wasn't a lot going on in terms of local data releases, the New Zealand government's controversial measure of banning house sales to foreigners stole domestic headlines this week. The economic implications may be muted given overseas investors will still be able to purchase apartments and rental homes. Still, one could expect house price inflation to continue to drift lower – and this further reduces the incentive for the Reserve Bank of New Zealand to press ahead with any pre-emptive tightening (not least after the 2Q PPI data showed muted underlying price pressures).

- Fading RBNZ rate hike sentiment has been a key additional factor for knocking NZD/USD into a lower range. We expect the pair will trade broadly within the 0.65-0.67 area – with greater risks of a downside breakout should the global risk environment continue to deteriorate. Local calendar sees 2Q retail sales on Tuesday and July trade data on Friday in the week ahead.

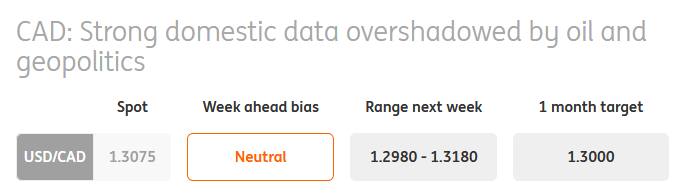

- The stunning 3% headline Canadian CPI print will likely perk up the ears of CAD bulls like ourselves – although it's worth acknowledging that much of this was driven by surging gasoline prices (CPI inflation excluding gasoline came in at 2.2% YoY). Still, with core inflation hovering around 2% and activity data also fairly upbeat, under normal circumstances, we'd certainly be talking more loudly about another Bank of Canada rate hike in 2018. The June portfolio investment data also showed solid buying on Canadian stocks and bonds – highlighting the renewed relative attractiveness of CAD assets.

- While there is a lot to like about CAD based on domestic fundamentals, we note macro data is the only bright spot. Oil prices which took a hit lower after EIA data showed a large inventory build and broader geopolitical uncertainties are keeping a lid on the loonie for now. Our short-term USD/CAD fair value model estimate is 1.28-1.30, although we'll need some of these external risks to fade before we see a move in this direction.

- Events in Italy and Turkey are likely to continue to play their role in sending the CHF higher, but the threat of further Russian sanctions might also be at play here. The US Senate is currently considering a much harsher set of measures, which would include sanctioning Russian sovereign debt for the first time. This, as well as the Italian BTP-Bund, spread moving out to the widest levels on the year are keeping the CHF in demand.

- Locally the Swiss National Bank said that their policy of negative rates and FX intervention was still in play. EUR/CHF seemed to turn near 1.1250, where it did in August 2017, which could suggest some FX intervention is underway. Away from the politics, the Swiss focus this week will be on July trade data and second quarter industrial production – unlikely to move CHF independently.

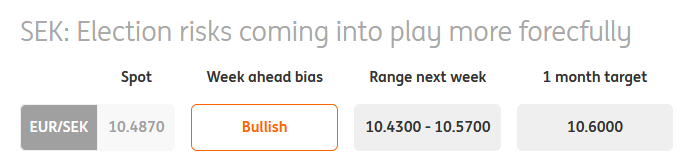

- While global markets remain cautious, we expect SEK to remain under pressure from the domestic channel. Investors will also start factoring in the upcoming general election on 9 September. Polls suggest the likely outcome is a hung parliament and record support for the far-right, anti-EU Sweden Democrats. A messy election and potentially lengthy negotiations to form a new government mean political uncertainty and could easily become another negative factor for SEK over the coming months.

- There is limited data news in the coming week. Second quarter housing starts due Monday are likely to show a continued decline in construction suggesting near-term risks to economic activity. If global sentiment remains poor, we could easily see EUR/SEK rising towards 10.55-10.60 on back of both negative domestic and geopolitical stories.

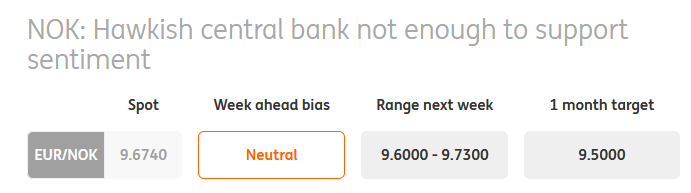

- Despite Norges Bank reiterating its intention to raise interest rates in September this week, the NOK is struggling in the prevailing risk-off environment. Weaker oil prices, in particular, are a negative factor for the krone. The combination of negative external factors has pushed EUR/NOK close to 9.70 (stops being triggered above the 9.60 level likely also played a part).

- We expect a decent second quarter Norway GDP figure on Thursday, which should further support the NB’s relatively hawkish stance. But as long as global risk sentiment remains fragile, the krone is likely to remain under pressure despite solid domestic fundamentals.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”