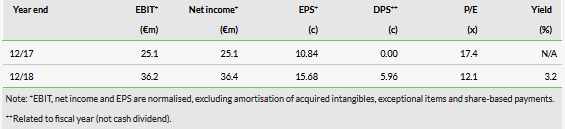

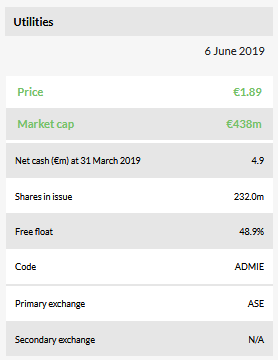

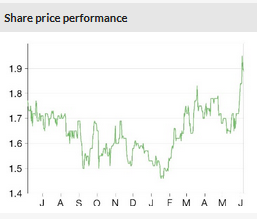

Holding Company ADMIE IPTO SA (AT:ADMr) started FY19 with a good Q1 (IPTO’s EBITDA +19% y-o-y), driven by strong revenue growth (+14%) and broadly stable costs. Despite the recent share price appreciation, the stock still trades at a large discount to both European regulated utilities and the implied equity regulated asset base (RAB).

IPTO’s Q1 adjusted EBITDA grew 19% y-o-y, well above the trend we had forecast for the full year (-3% y-o-y). The EBITDA increase was driven by revenue growth (+14% due to increased electricity demand as a result of more favourable weather conditions) and broadly stable costs. We calculate that IPTO’s net income, adjusted for a one-off provision release, grew by 75% y-o-y to €21m. Although we see no read-across for revenue in Q2–Q4, the stability in costs is supportive of future profitability. IPTO’s capex in Q1 was €19m, up 76% y-o-y but representing only 5% of the capex we previously expected for the full-year (€390m). Although capex may appear low, we note that Q118 capex also represented only 6% of the FY18 amount – investments should pick up in the coming quarters when most of the work for extending the network should be carried out. Capex is the key growth driver of IPTO, as it increases the regulated asset base on which IPTO is remunerated (RAB multiplied by the allowed rate of return = allowed EBIT).

Despite the recent share price increase, ADMIE Holding is trading at a large discount to other European regulated utilities on P/E, EV/EBITDA and dividend yield. In addition, ADMIE Holding is trading at c 35% discount to equity RAB, even though we believe the returns allowed by the regulator are broadly in line with ADMIE’s WACC.

Our forecasts and valuation are under review.

Business description

ADMIE Holding is a holding company that owns a 51% stake in IPTO, a Greek regulated utility. IPTO owns, manages and operates the Greek electricity transmission grid. The network includes 11,801km of high voltage lines. The company plans a c €4bn investment plan over 2019–27.