iShares FTSE/Xinhua China 25 Index (ARCA:FXI) put in a pretty straightforward crash from late 2007 to its late 2008 low. Then it put in a fast, steep rally in 2009, and it’s been topping for another plunge ever since.

The topping pattern is a megaphone (red on chart) in which interior megaphones have been forming across VWAP of the larger megaphone. When you see megaphones forming across the VWAP of larger megaphones, you know a triangle is forming (navy blue on chart).

FXI has just put in a 5th wave melt-up (with a rising megaphone top) with the latest of these interior VWAP megaphones (bright blue on chart). It reached the top of this interior megaphone last week. It should put in a little top up here then plunge back down to VWAP at roughly 38.50 and start a new megaphone there that will complete the navy blue triangle.

Then the entire mess should break out downwards to roughly the bottom of the red megaphone. That wave down should be a crash.

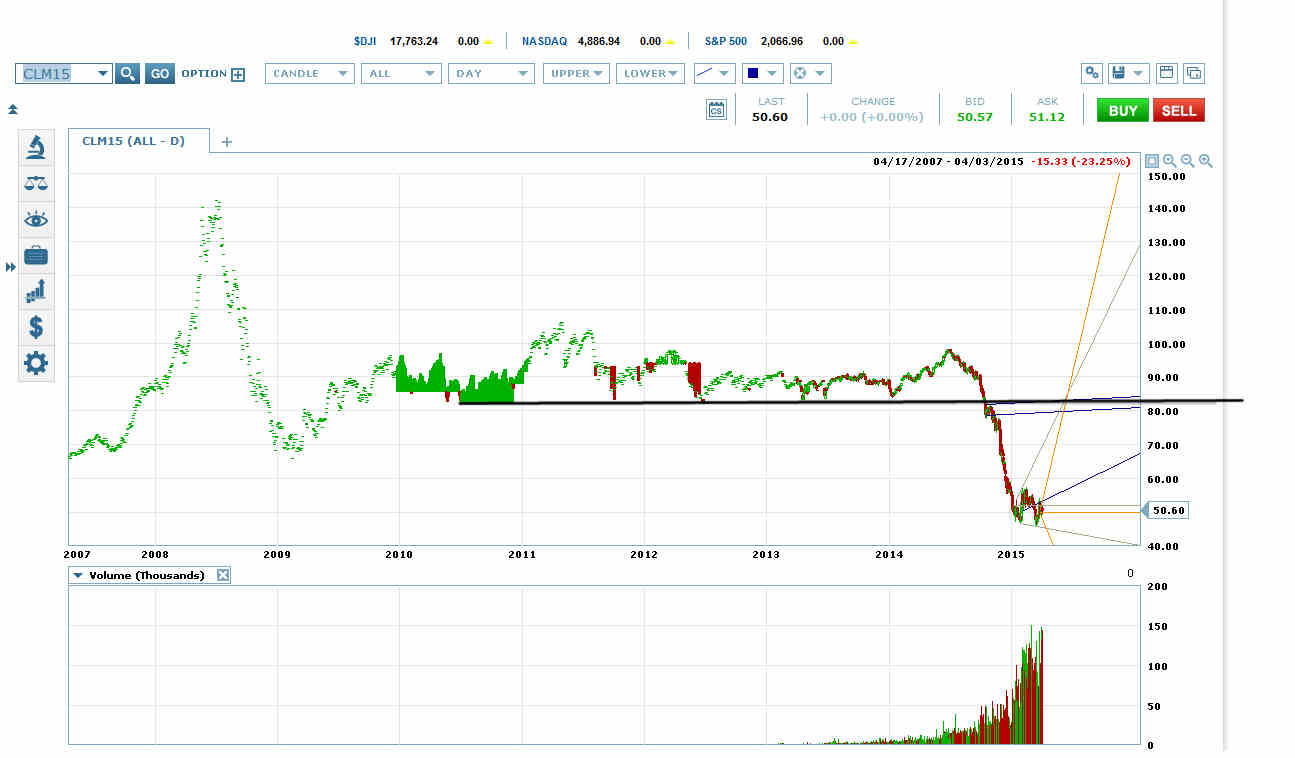

What FXI is doing on its long-term chart is a very common crash and post-crash pattern. For example, we saw the same pattern in oil, except the top of the rally wave was an extended head and shoulders pattern instead of a triangle.

And we saw this pattern in PowerShares QQQ (NASDAQ:QQQ) after the dot-com crash, although in this case the rally took longer and the megaphone top formed a lot faster.

You see this pattern on all time frames.

The QQQ chart gives you a good idea of what happens in this pattern after the retest of the crash low.