FXCM Inc (NYSE:FXCM) was deeply affected by the Swiss National Bank’s decision to abandon its cap on the Swiss franc, catapulting their clients into negative equity balances. FXCM, or Forex Capital Markets, is a foreign exchange market that operates through its own online trading platforms as well as third-party platforms. It is the largest forex broker in U.S. and Asia.

On January 15th, the Swiss National Bank deserted its franc cap that regulated the difference between the Swiss franc and the euro. This policy has been in place since the summer of 2011, when the Swiss franc was significantly stronger and more stable than the euro. The Swiss National Bank explained the move in a press release: “The euro has depreciated considerably against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar. In these circumstances, the SNB concluded that enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified.”

Since this move was unannounced, free trading between the Swiss franc and the euro caused the value of the Swiss franc to surge compared to other currencies. As a result, shares of FXCM fell an overwhelming 88% in pre-market trading on January 16th.

After the Swiss National Bank removed the cap, FXCM released a statement announcing that “due to unprecedented volatility” from the removal of the cap, FXCM “clients experienced significant losses [and] generated negative equity balances owed to FXCM of approximately $225 million.”

Many investors saw this as the end of FXCM, but the company found financing to “continue normal operations.” On January 16th, FXCM announced that Leucadia National Corporation, which owns Jefferies Group investment bank, will provide $300 million in cash to FXCM “that will permit [the company] to meet its regulatory-capital requirements and continue normal operations after [the] loss of $225 million due to the unprecedented actions of the Swiss National Bank.”

Analysts turned bearish following the Swiss National Bank’s drastic move to remove the cap.

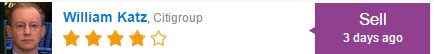

On January 16th, analyst William Katz of Citigroup downgraded FXCM from Neutral to Sell with a $5 price target. Katz alluded to the greater implications of the future of FXCM, noting, “The move by the Swiss National Bank came as a surprise to investors but the severity of the impact is likely to question the sustainability of the retail platform. Already facing investor scrutiny around account churn and recent pricing degradation, FXCM now raises solvency issues.”

William Katz has a history of rating financial institutions, such as BlackRock Inc (NYSE:BLK) and Apollo Globl Man (NYSE:APO). Katz has rated Blackrock 9 times since April 2011, earning a 100% success rate recommending the stock with a +15.5% average return per BLK recommendation. Likewise, Katz has rated Apollo Global 10 times since August 2013, earning a 67% success rate recommending the stock and a +2.9% average return per APO recommendation.

Overall, William Katz has a 63% success rate recommending stocks with a +5.2% average return per recommendation.

On average, the top analyst consensus for FXCM on TipRanks is Strong Sell.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FXCM Hit Hard by Swiss National Bank’s Surprise Move

Published 01/19/2015, 09:43 AM

Updated 07/09/2023, 06:32 AM

FXCM Hit Hard by Swiss National Bank’s Surprise Move

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.