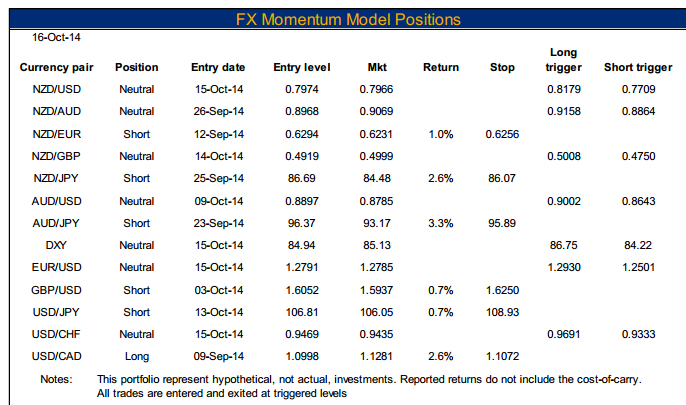

The following are the latest signals and trades generated and entered by Bank of New Zealand's (BNZ) Momentum FX Model.

BNZ's highlights on the model's positions are as follow:

Our model’s NZD short position has finally been closed out.

– Our model has finally been knocked out of its lucrative short position on NZD/USD by the recent whippy price action. The trade returned 7.9% over the course of three months (entered on 18 July).

– The picture on the crosses also looks decidedly more mixed. The NZD/GBP short position has been neutralised, and returns on the NZD/EUR short position have been pared. The NZD/JPY short position has benefited from the risk-negative market sentiment.

Market volatility has put paid to the wholesale ‘buy USD’ view our model was taking.

– In the past week, the model has been knocked out of its long USD positions against the EUR and the CHF. The US Dollar Index has also been assigned a neutral rating.

– The retracement in JPY has been particularly sharp, helped by risk-off market sentiment. From having been trenchantly short JPY, the model is now long JPY against the USD and AUD.