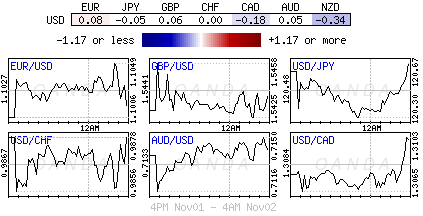

This is expected to be another action packed week, one that will be heavily scrutinized by investors, as its speckled with a number of central bank announcements (Reserve Bank of Australia this evening and the Bank of England on Thursday), and as per usual, more Fed talk.

The week concludes with Friday’s granddaddy of economic indicators, U.S non-farm payroll (NFP). With the Fed so data dependent, October’s jobs report will go along way in convincing investors whether a December rate hike is a ‘real’ possibility.

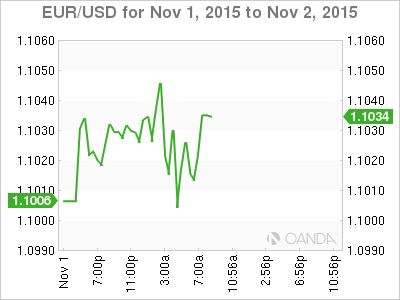

Monetary policy release by G7 central banks (BoC, ECB, BoJ and Fed) over the past few weeks have managed to keep investors on tenterhooks. Despite the market uncertainties, October was a very good month for equities. Will this carry over to this month or will China again unnerve global investors?

Investors will be looking to the manufacturing and services PMI’s for guidance. In Germany key manufacturing orders and industrial productions will be carefully read while in the U.K, output and merchandise trade will draw the markets attention.

Last July, the BoE’s Governor Carney indicated that the timing for the U.K’s first interest-rate increase would become clearer on “the turn.” Hence, the Governor is running out of opportunities to explain their policy by year-end. Already, the fixed income dealers have pushed back the timing of the first rate hike to December 2016 from August. On Thursday, Carney will be presenting the “Old Lady’s” final economic projections for 2015 at the Inflation Report press conference in London. It’s expected to be a bumper event for sterling traders.

As the markets head stateside, global equities have some pullback after further evidence of economic slowdown in China, but some of the retracement has been limited by modest growth in German factory activity.

China PMIs remain in contraction: Over the weekend, China’s manufacturing PMI print for October came in at 49.8, unchanged from the previous month, but the third consecutive month of contraction. Meanwhile, non-manufacturing PMI fell to 53.1, a new three-year low. The Stats Bureau indicated that China would continue to face challenges; imports and exports are expected to underperform due to the sluggish global economic recovery and experience further downward pressure from the domestic economy. Nevertheless, Premier Li indicated that the economy has a lot of room to grow. However, he took another step towards recalibrating investor’s expectations by purposely moving away from the engrained +7% GDP target, noting that +6.5% growth helps China accomplish its targets by 2020.

Japan final PMI slowed slightly relative to preliminary figure: But it still managed to print a one-year high at 52.4. It was noted that operating conditions at Japanese manufacturers improved substantially at the start of Q4 and that the rate of growth in production managed to accelerated at its fastest pace in nearly nine-months. Cost pressures were evident as purchasing prices rose and reason enough to support the BoJ’s no rate, no QE decision last week (¥120.53).

Not quite polar apart: Germany’s final manufacturing PMI for October came in at 52.1, beating its flash estimate (51.6) and printing its eleventh consecutive month of expansion. However, the headline was below the September release of 52.3. In contrast, U.K factories showed signs of a sharp improvement last month (55.5 vs. 51.8). With one of the steepest increases in 25-years, this would suggest that U.K manufacturing may have turned the corner after the summer’s lull. The pound (£1.5463) was boosted by the much better than expected headline print.

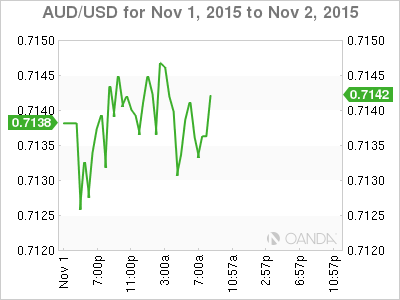

Mixed signals for the RBA: Ahead of this evening’s monetary policy decision down-under, the latest set of data released overnight might persuade a number of investors to consider shifting into the easing camp (+2%). Aussie manufacturing PMI remained in expansion, but just barely, falling to 50.2 from 52.1, while TD Securities Inflation and house prices also slowed markedly (+0.0%, an eight month low, vs. +0.3% m/m; y/y +1.8% vs. +1.9%). Despite the majority remaining in the “hold” camp, some fixed-income dealers have been leaning towards easing on the back of softer Aussie inflation data last week (A$0.7140).

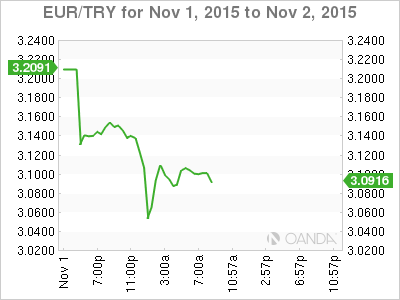

Single party rule returns to Turkey: In emerging markets, Turkey’s Sunday election results grab the headlines. Their domestic markets have surged after the Islamist-rooted AK Party (Erdogan) won a clear majority in Sunday’s parliamentary election. TRY (€3.0870) opened firmer by almost +5% after with the outright majority win. Turkey Turkey 10-Year bond yield has fallen – 50bps +9.25% as the market embraces a “strong stable government” after last June’s stalemate.