The dollar, financial volatility and U.S data continues to drive Fed monetary policy, and with that, few investors believe the Fed will raise rates at the end of today’s two-day Federal Open Market Committee (FOMC) meeting.

Nevertheless, a run of robust U.S. economic numbers has put the possibility of higher borrowing costs later this year back on the table. After this morning’s U.S CPI and housing starts the odds of a June rate increase have jumped to +54%, and the odds of one by December are now +81%. It was only last month that fixed income dealers saw the chance of a rate increase at either point at zero.

The Fed would never admit defeat on rate expectations. Today’s “dot” plots are a representation of where U.S policy makers think U.S rates ‘should’ be, and not where they ‘will’ be.

For some, the Fed ‘not’ doing anything today will be considered a form of tightening, especially with the ECB going deeper into NIRP. Chair Yellen’s press conference at 14:30 EST will be well scrutinized.

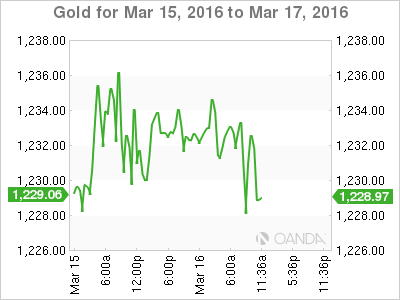

1. Gold positions pared ahead of Fed decision

The ‘yellow’ metal tends to struggle to compete with yield-bearing investments when interest rates rise. Currently, the downside for precious metals will vary depending on the Fed’s tone and outcome later today.

Gold prices have risen more than +17% this year, propelled by diminished rate-increase expectations, negative interest rates in Europe and Japan and investors concerns about the pace of global growth.

2. U.S Yields back up ahead of FOMC

U.S 2 years briefly traded over +1% for the first time in two-months yesterday while the benchmark 10 year straddled the psychological +2% handle. Higher yields over the past month reflect investors renewed expectation that the Fed’s rate normalization plan remains “on track” for 2016.

However, it’s worth noting that 10-year yields traded around +2.3% after the Fed raised rates in December. Many had expected rates to head toward +3%, however, NIRP by the ECB and BoJ have been able to keep a lid on U.S yields for the time being.

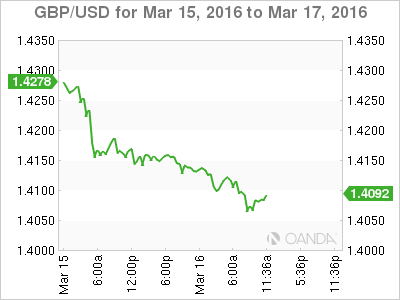

3. U.K economy faces a “cocktail of risks”

U.K. Treasury chief George Osborne announced downgraded growth forecasts for the U.K. amid a darkening global outlook but said he remains on track to close the nation’s budget deficit. He expects growth of +2% this year, compared with a previous forecast of +2.4%.

“Financial markets are turbulent. Productivity growth across the West is too low. And the outlook for the global economy is weak. It makes for a dangerous cocktail of risks,” he said.

Sterling has come under pressure and fallen to its lowest level in a fortnight outright £1.4058. The Chancellor also warned that the U.K. would face a “prolonged period of uncertainty” if it voted to leave the European Union. The referendum takes place on June 23.

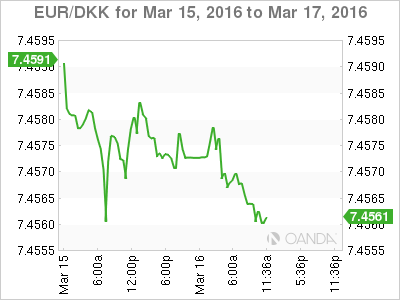

4. Not all Central Banks lose money-defending currency

Denmark’s Nationalbank efforts to defend its EUR/DKK peg in 2015 earned it a profit of just over +2b kroner (+$297m).

The central bank deployed a range of radical policies to keep the DKK steady amid market turbulence in Q1, 2015. Their aim is to keep EUR/DKK within +2.25% above or below €7.46038 to keep inflation low and steady.

Instead of abandoning the peg, as many investors had expected them to do similar to the SNB, Nationalbank began selling vast quantities of its own currency to weaken it.

With their firm stance, the central bank ultimately prevailed and pressured speculators to back down. When the krone started to naturally weaken, the central bank began buying it back at while locking in a currency profit.

Danish policy makers also began to charge commercial banks to hold their reserves with the aim of driving down interest rates in the economy and make holding kroner even less attractive.

5. Tobin tax on its way?

The news out of China that authorities are considering a Tobin Tax on currency transactions continues to make headway in capital markets. The possibility of slapping a tax on currency transactions to curb speculation against the yuan has begun a heated debate amongst analysts. The very introduction of the tax could easily undermine China’s attempts to get the Yuan fully accepted in the financial markets. Despite the tax offering some short-term stability to curb capital outflow, it will likely cripple the Yuan’s aspirations for internationalization and its SDR status.