Wednesday March 2: Five-things the markets are talking about

Stateside, all eyes were on ‘Super Tuesday. By night's end, it produced few surprises to the U.S political landscape.

Donald Trump’s momentum gave him victories in all but three of the eleven states holding Republican primaries – Texas/Oklahoma (Cruz) and Minnesota (Rubio).

On the Democratic side, Clinton secured victories in seven states to four for Sanders, with most high-profile wins in Texas, Virginia, and Massachusetts.

The rest of capital markets continue to embrace ‘risk’ – it’s benefitting from central bank pledges on stimulus measures to prop up global growth.

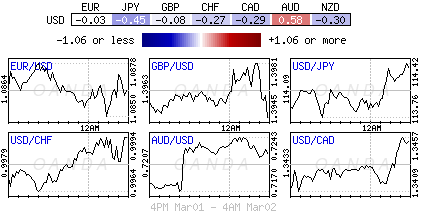

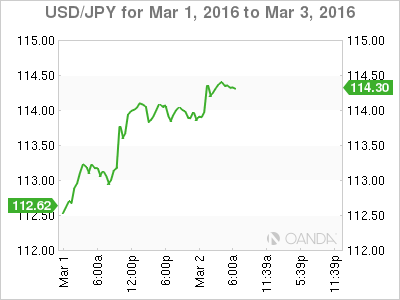

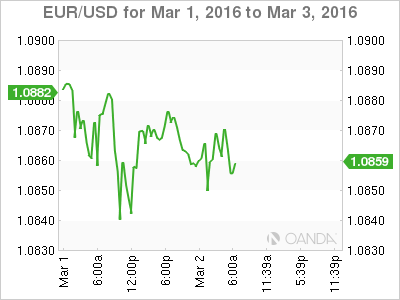

Rising risk appetite is helping to unwind recent ‘safe-haven’ flows (EUR straddles its three-week low at €1.0860, while Yen outright printed a two-week high above ¥114.45 level):

1. Stock markets in the black

Global equities have rallied hard over the past two-trading sessions, with nearly every major global index in the ‘black.’ Asian markets have benefitted from PBoC RRR cut, helping them overcome another round of dismal February data, while in Europe, expectations for more ECB easing has offset a full slate of continental manufacturing PMI declines. In the US, strong auto-sales and construction spending data has been able to drag stock indices higher.

Heading into Wednesday’s U.S open, index futures erased an earlier decline to be little changed. The benchmark index surged +2.4% yesterday, its biggest gain since January.

It’s worth noting, that in terms of equity returns, the eighth-year of a Presidency ranks last, and the first-half of an election year is often even worse.

2. Negative interest rate yields remain dominant

Japan sold 10-year debt on Tuesday with negative yield for the first time as the bond market there continues to react to the BoJ’s announcement of negative rates at the end of January (Japan MoF sold ¥2.19T in 10-yr +0.1% JGB’s – average yield: -0.024% vs. +0.078% prior; bid to cover: 3.20x vs. 3.14x prior).

In Europe, yields on German debt remain negative out to eight-years. Central Banks understand that holding negative yields for too long will eventually alter future savings and investments – relying too much on NIRP will eventually bring more problems.

Currently, futures prices indicate that investors expect the ECB to cut its deposit rate by -0.1% at its meeting next week, especially after Monday’s negative advanced January eurozone inflation reading (-0.2% v +0.3% m/m).

ECB President Draghi on Wednesday reiterated that there was ‘no limit’ on the bank’s tools for getting inflation back to target, and said next week’s policy review would have to take into account the backdrop of more downside risks to the outlook.

Stateside, a March Fed rate hike has firmed as U.S data continues a string of positive surprises (ISM – 49.5 vs. 48.2, construction spending +1.5%). It comes on top of stronger wages, retail sales and core-PCE (Fed’s favorite inflation gage).

Chances of March hike are the highest in a month, but still in doubt. Futures see odds of a next meet move at 1-in-10, June at 4-in-10. The “doves” are still betting that international and disinflation concerns to rule.

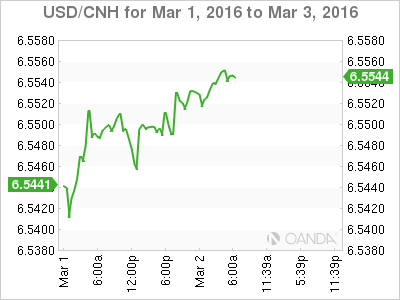

3. China’s credit rating cut

Moody’s cuts China sovereign rating outlook to negative from stable and affirms its AA3 rating, citing weakening fiscal metrics, eroding external strength and risks of a loss in policy credibility and efficiency.

The government’s financial strength “may come under pressure if it takes on liabilities from troubled state-owned companies, while capital outflows have limited policy makers’ scope to stimulate the weakest economy in a quarter century,” the ratings company said in a statement.

Global investors’ remain concerned that the ruling Communist Party will struggle to overhaul the world’s second largest economy at a time when capital is flowing out of the country and debt levels have climbed to +247% of GDP.

This weekend, Chinese leaders will begin ten-days of policy meetings to plan out how to tackle the nation’s economic challenges and meet the government’s goal of doubling per-capita income by 2020.

4. Crude supply glut weighs on prices

WTI crude prices tacked on another +1.75% gain Tuesday, but slipped late in the day after the American Petroleum Institute (API) reported a +9.9m barrel build in weekly crude inventories (much more than the +3.6m barrel increase forecasted).

Ahead of the New York open, Brent crude trades down -27c at $36.54 a barrel. On Tuesday, it reached $37.25, the highest in almost two-months. WTI is down -66c at $33.74.

Traders will be looking closely at today’s U.S. government’s weekly supply data for confirmation of the inventory build. The Energy Information Administration figures are due at 10:30a.m. EST.

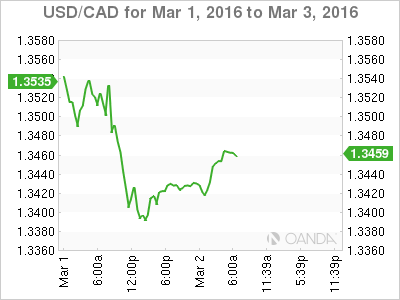

Another rise in inventories should take back some of the loonies gain outright (yesterday USD/CAD fell to a new three-month low – C$1.3391 – after the release of Canada’s GDP December figures and an uptick in commodity prices).

5. RBA cuts EUR weight

The Reserve Bank of Australia (RBA) has added the Korean won to its foreign exchange reserves (+5%). This comes at the expense of the EUR, whose weighting now stands at +20%. The EUR’s allotted weight is down from as much as +45% in 2012.

The RBA has also allocated +5% to the JPY, CAD, RMB and GBP. It’s USD weighting remains at a constant +55%. This would suggest that the Bank continues to have its own “carry trade” ideas. Too many currencies now offer no or negative returns.