Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Thursday March 17 (St. Patrick’s Day): Five things the markets are talking about

This month was always going to be about the “battle of the Central Banks.” Two-weeks in and they have not disappointed. Some are aggressive, some passive, but they are all in agreement on one thing, they consistently express a cautious tone on the global economy.

Yesterday’s FOMC announcement provided some vindication for the market. Dealers and investors seem to have been more in tune with the underlying data than most Fed officials. Therefore, it was necessary for the Fed to back off its relatively fast rate hike anticipations.

To preserve street credibility, Ms. Yellen and company needed to deflate market expectations, and this they achieved yesterday and then some.

In a matter of three-months the Fed has gone from four to a possibility of two tightening cycles occurring this year. Naturally, the FOMC left rates unchanged and the accompanying policy statement was even more ‘dovish’ than many expected, refraining from returning to a “balanced” risk outlook.

1. Commodities and high-beta FX soar after dovish Fed

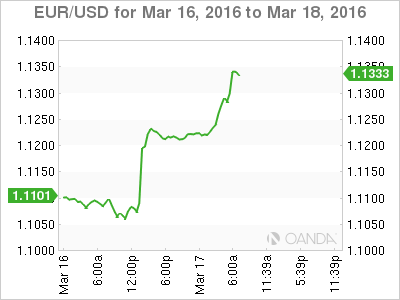

Euro and Asian equity markets are higher, tracking the strong close on Wall Street that followed a more “dovish” than anticipated FOMC statement. With staff projections for rates this year reduced by -50bps at the median to +0.875% (implying just two more hikes in 2016) has provided for some wild asset price swings. Projections for 2017-end median estimate also came in -50bps to +1.875% and the long-run rate was reduced to +3.25% from +3.50%.

FOMC forecasts also lowered their 2016 GDP estimates to +2.1-2.3% from +2.3-2.5% and PCE inflation to +1.0-1.6% from +1.2-1.7% in justifying new rate expectations.

In her statement, Fed Chair Yellen reflected on inflation persisting below +2% long run objective and noted economic conditions will evolve so as to warrant only gradual increases.

Ms. Yellen maintained that April (six-weeks away) remains a “live” meeting for another tightening. However, many now believe that the new staff projections pose a “high hurdle” to moving off the +0.25% rate any time soon.

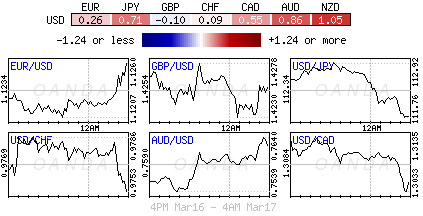

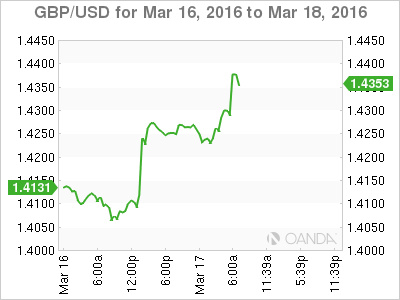

There was one dissenter – Esther George – who voted for a +25bp hike. The “mighty” dollar has crashed across the board in the wake of the decision – ¥111.17, €1.1340, £1.4364, A$0.7636, C$1.2983.

Gold has rallied +$35 to a high of $1,265, while WTI oil is close to its 2016-highs above $39, and copper is up over +1% at $2.27.

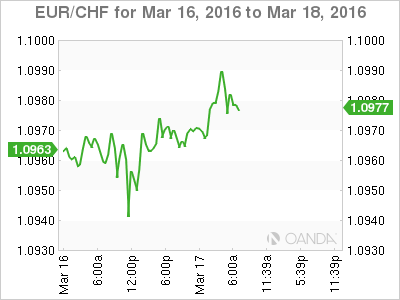

2. Swiss National Bank (SNB) holds negative rates steady

The SNB held its negative interest rates steady this morning despite the aggressive expanded stimulus package from the ECB last week.

With the possibility that the ECB’s actions could eventually put renewed upward pressure on the CHF there was a credible chance that Swiss authorities would need to be proactive.

The SNB has kept its key deposit rate at -0.75% and said it would continue to intervene in the currency markets to weaken the franc, which it says remains “significantly overvalued.”

It also held its target range for the three month London interbank offered rate, or Libor, at -1.25% to -0.25%, in line with expectations from economists.

Copying and pasting similar rhetoric from other Central Banks the Swiss authorities said that “the global economic outlook has deteriorated slightly in recent months and the situation on international financial markets remains volatile”- this certainly opens the door for a possible cut in H2!

3. The “Old Lady” yet to sing

The Bank of England (BoE) will release their monetary policy summary, the official bank rate and the MPC votes this morning at 8:00am EDT.

The benchmark rate is expected to remain unchanged at +0.50% with a unanimous vote after the lone dissenter (Ian McCafferty) rejoined the fold last month.

The ECB actions and rhetoric last week were aggressive, the Fed yesterday was downbeat in its statement and communiqué, and so what’s Governor Carney going to say?

In the BoE’s eyes, the biggest risk to the U.K. economy is the upcoming Brexit referendum in June. The Governor has gone out of the way to assure the market that they will provide liquidity in order to preserve financial stability and have drawn up contingency plans if the “Leave” vote prevails.

Sterling (£1.4286) has drifted off this months low aided mostly by a deflated ‘big’ dollar.

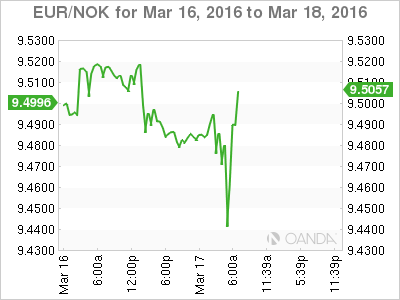

4. Norway does what’s expected

Norges Bank has cut their policy rate by -25bps to +0.50% as widely expected and lowered the rate path to a low of +0.2% in Q1 of 2017.

The central bank went as far as saying that there is a possibility for 0% rates in Norway.

Prior to this mornings somewhat more ‘hawkish’ rhetoric by policy makers, fixed income dealers had been pricing in the next cut to most likely take place in June, now it seems Norges Bank is signalling that it most likely will have to wait until September.

5. NationalBanken’s nice ‘little’ earner

Not all Central Banks lose money-defending their currency. Denmark’s Nationalbank efforts to defend its EUR/DKK peg in 2015 earned it a profit of just over +2b kroner (+$297m).

The central bank deployed a range of radical policies to keep the DKK steady amid market turbulence in Q1, 2015. Their aim is to keep EUR/DKK within +2.25% above or below €7.46038 to keep inflation low and steady.

Instead of abandoning the peg, as many investors had expected them to do similar to the SNB, Nationalbank began selling vast quantities of its own currency to weaken it.

With their firm stance, the central bank ultimately prevailed and pressured speculators to back down. When the krone started to naturally weaken, the central bank began buying it back at while locking in a currency profit.

Danish policy makers also began to charge commercial banks to hold their reserves with the aim of driving down interest rates in the economy and make holding kroner even less attractive.