THIS WEEK

After the rather disappointing Fed announcement not to the taper, several of the key currency pairs got back towards pre Fed announcement levels on Thursday and Friday. This really highlighted some of the recent over performance in a few pairs, mainly the GBP/USD and AUD/USD.

German Elections today with Merkel currently leading in polls at the time of writing, but unlikely to get a full majority. We could see some early gaps in the EUR/USD depending on the final results.

EUR/USD

Long: 1.3260

RTAS Order Book systems continued to hold longs but with the Retail Order books at extremes with the majority of Retailers short this pair, we suspect we are not far off a turn in this pair either to find space in the Order Book or to actually reverse. Resistance comes in at the 1.3560 / 13600 level with support around the 1.3430 mark. Little change on Friday with the pair chopping sideways into the German electoral risk event today.EUR/USD 1" title="EUR/USD 1" src="https://d1-invdn-com.akamaized.net/content/picab19f3e6b5bd228243a02518d16bc481.jpg" height="999" width="1112">

Pair stalled at the highs, we could see a push into the 1.3600 level, but the Retail Order Books now back at nice extremes for reversals. We could see a correctional move or a larger move lower from the pair soon.EUR/USD 2" title="EUR/USD 2" src="https://d1-invdn-com.akamaized.net/content/picb262369128486bdcdbeb36b0c665078a.jpg" height="999" width="1112">

COT report interestingly showing Non Commercials heading back towards net short positions, thus potentially providing a reversal signal soon. Key will be to watch the Net Position/Strength Indicator for a cross lower and the Index cross below 70.EUR/USD 3" title="EUR/USD 3" src="https://d1-invdn-com.akamaized.net/content/picf35aa6187f9d798d2d2c175ffdfea9ab.jpg" height="999" width="1112">

GBP/USD

Short: 1.5970

RTAS Order Book systems switched to shorts prior to the FOMC statement, although out of the money this pair significantly retraced on Thursday and Friday and now sits only slightly out of the money as we continued to find Retail Buyers. If we continue to find buyers we could easily see a further correctional move lower.GBP/USD 1" title="GBP/USD 1" src="https://d1-invdn-com.akamaized.net/content/pice142856feca650e12769d6cdb1f7bd42.jpg" height="999" width="1112">

Pair pulled back from the extreme overbought region towards the end of the week, we could see a further correction in the pair given the recent trend it has been on. And, whilst we stay above the 1.5780 mark these would still count as correctional and the pair could easily push higher again. Key for a push higher is a hold above the 1.6000 / 1.6050 mark.

GBP/USD 2" title="GBP/USD 2" src="https://d1-invdn-com.akamaized.net/content/pic0a7f4b4cefa30be045e41013dd92a7b1.jpg" height="999" width="1112">

COT report pointing towards Non Commercial longs despite a rather Bearish Weekly Candle from the pair. We would wait to see confirmation of this next week and potentially look for lower entries for longs after a correctional push lower again.GBP/USD 3" title="GBP/USD 3" src="https://d1-invdn-com.akamaized.net/content/piccc5dcb2845ec282f866277805512d901.jpg" height="999" width="1112">

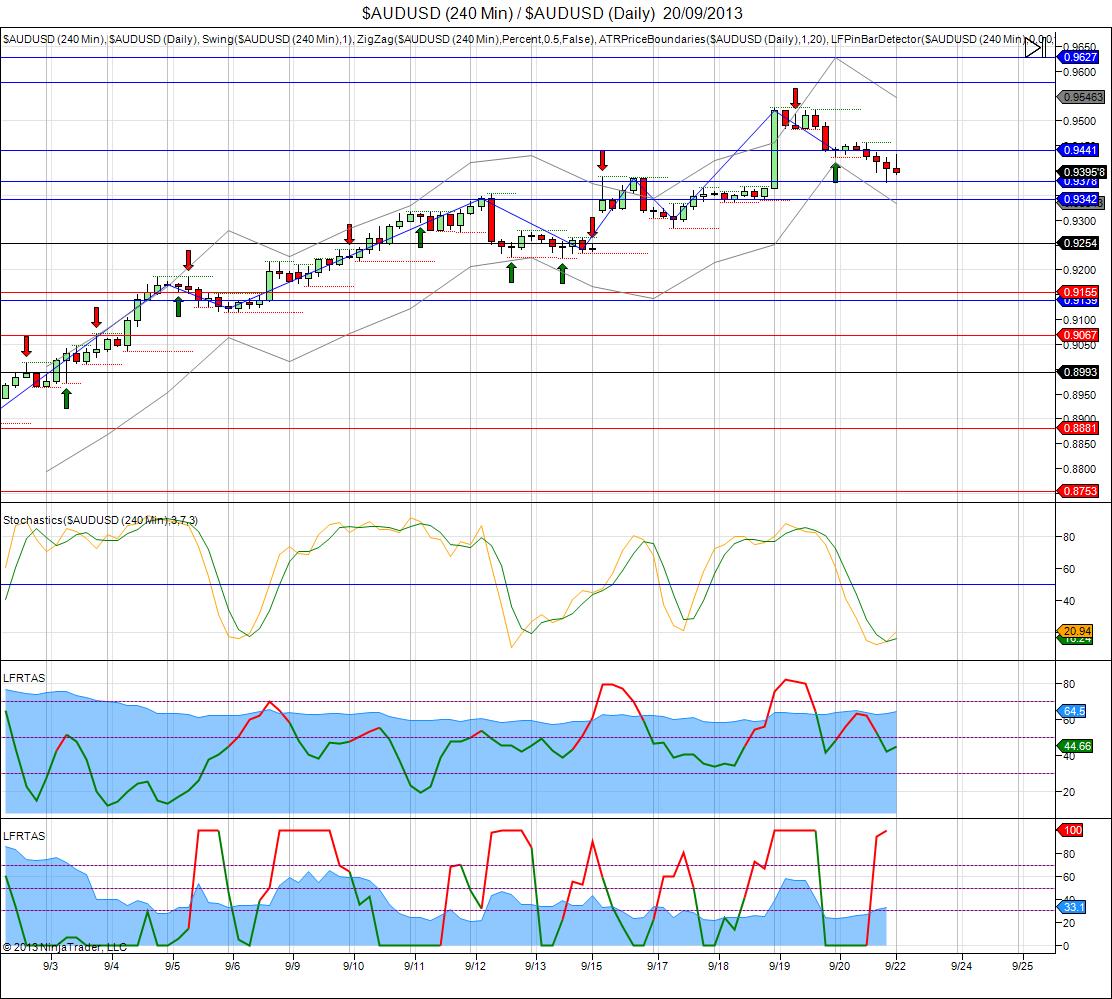

AUD/USD

Long: 0.9400

Systems switched to longs after a some minor shorts at the end of the week as we found some minor Retail Selling. That said, towards the close on Friday we found Retail Buyers again as the pair chops around. Resistance comes in at the 0.9445 mark and support just below at 0.9380. AUD/CAD 1" border="0" height="999" width="1112">

AUD/CAD 1" border="0" height="999" width="1112">

0.9700 is the key retracement level to watch for in the AUD/USD, and currently we still sit below this key level. Therefore the overall Bearish trend remains intact. Pair nearly retraced all of the US dollar weakness on Thursday and Friday in a similar situation to the GBP/USD. AUD/CAD 2" border="0" height="959" width="1112">

AUD/CAD 2" border="0" height="959" width="1112">

Rather Bearish weekly candlestick in the AUD/USD with the COT report still pointing towards shorts. Some slight buying in Non Commercials, but it has been very limited so far, if we see a cross lower and selling in Non Commercials (Momentum Indicator) we could see a further push lower. AUD/CAD 3" border="0" height="999" width="1280">

AUD/CAD 3" border="0" height="999" width="1280">

EUR/AUD

Short: 1.4360

The RTAS Order Book systems booked profits on longs and went short on Friday as we continued to see some Retail Buying. Whilst we remain below the 1.4440 / 1.4500 mark we could still see a further push lower. A nice potential breakout play of the 1.4200 mark to the downside if we see it. EUR/AUD 1" border="0" height="999" width="1112">

EUR/AUD 1" border="0" height="999" width="1112">

Pair has now managed to chop sideways whilst pushing itself out of the oversold territory and has come back off extremes in the Order Book. It is now primed for its next major move higher or lower, if we see further Retail Buying we could easily see a push lower, especially if we see Retail Buying in the EUR/USD cross. EUR/AUD 2" border="0" height="959" width="1112">

EUR/AUD 2" border="0" height="959" width="1112">

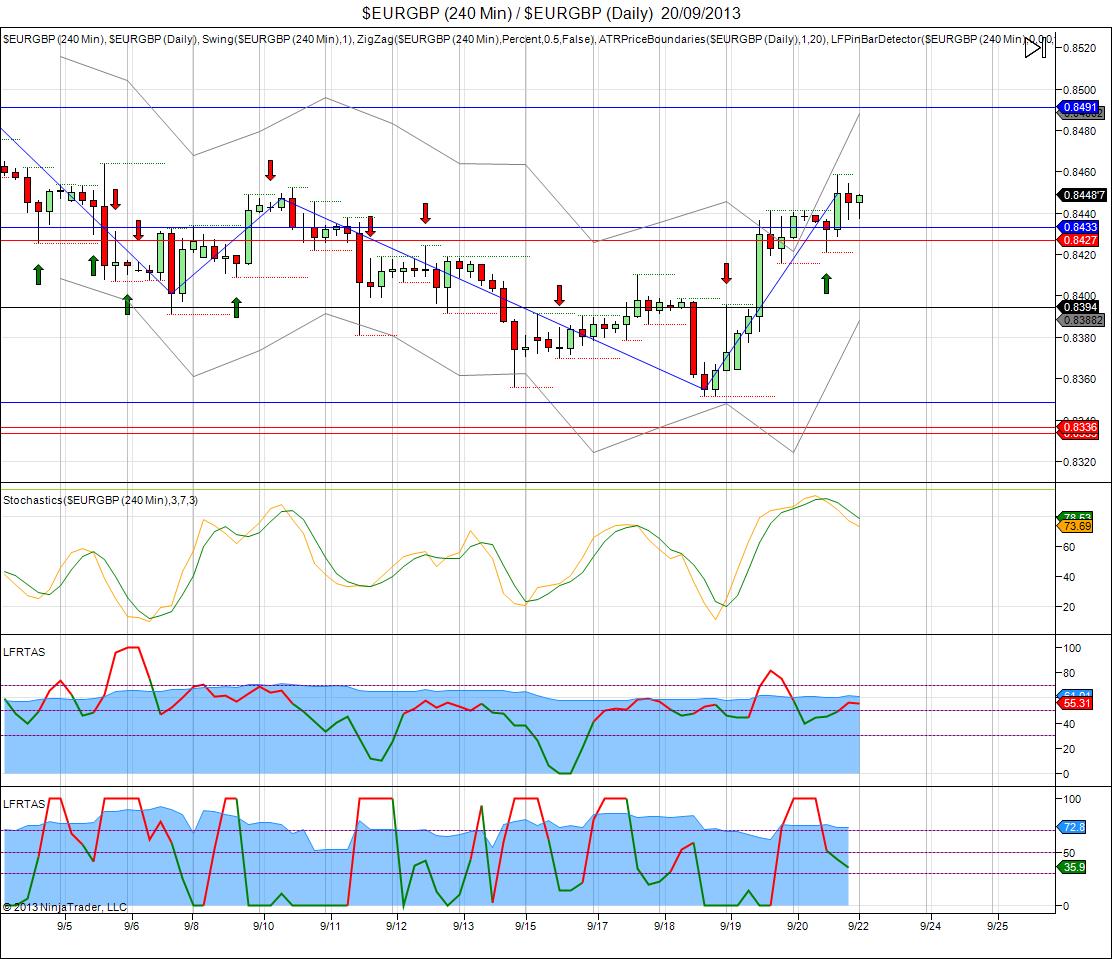

EUR/GBP

Short: 0.8445

Order Book systems have chopped around at current levels with an almost perfectly flat Retail Order Book, and therefore today the pair switched from shorts to longs back to shorts a the end of the week managing to book some minor profit. The flat Retail Order Book means the pair is likely to switch to longs again tonight on minor Retail Selling but will quickly reverse if the trend changes. EUR/GBP 1" border="0" height="959" width="1112">

EUR/GBP 1" border="0" height="959" width="1112">

The pair finally bounced higher off of lows. Support comes in at the 0.8425 level, and resistance comes in just above at the 0.8490/0.8500 level. So far support has held up well after several tests but we suspect the resistance level and 200 day SMA around 0.8500 to put up a strong resistance point for potential moves lower from the correctional bounce. Watch price action around the key resistance level for clues as well as the trend in Retail Order Book. EUR/GBP 2" border="0" height="999" width="1112">

EUR/GBP 2" border="0" height="999" width="1112">