• Yellen to address the US Senate

• ECB meeting eagerly anticipated

• USDSEK increasingly volatile

We have seen ever constricting trading ranges in recent days in the super-majors as we await a catalyst that will break us out of the latest ranges. It’s been hard to spot one this week but a general and sudden risk-off vibe in late Europe today is seeing a considerable move that is providing an interesting volatility expansion, particularly in JPY crosses.

Tomorrow, we have the US Federal Reserve chairman Janet Yellen before a Senate panel with the same testimony she presented two weeks ago to the House (tomorrow’s testimony was meant to take place a day after the other testimony but did not due to a weather delay). We’ve seen a few economic data points rolling in since then but I think, for now,Yellen will again try very hard to provide very little in the way of surprises in her Q and A.

Otherwise, it’s all about if the fear of fear itself continues to test recent support levels in USD and JPY crosses, and then next week’s major US data for all the USD majors and especially the European Central Bank (ECB) meeting on Thursday for EURUSD.

Today, we saw an interesting correction lower in precious metals and the commodity currencies as risk appetite has come under broad pressure. This has us on the lookout for bearish trend confirmations in CAD again and whether or not AUD and NZD can move out of the local neutral setups and tilt more to the downside as well.

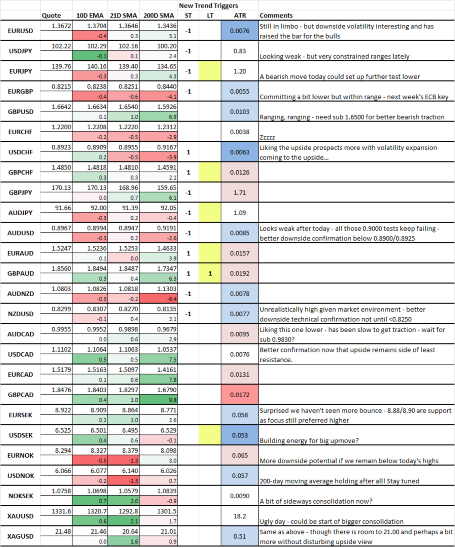

Today’s FX Board (beta) for February 26, 2014

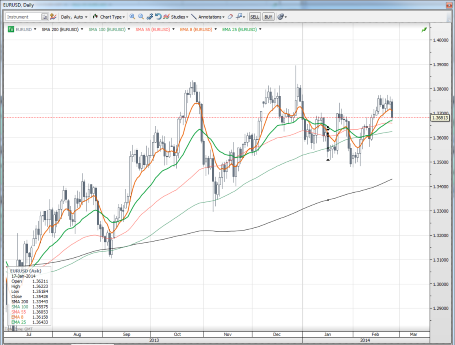

Chart: EURUSD

An interesting development late today looks bearish, and note that this is (potentially) a new nine or even 10-day low close. Resistance has dropped to 1.3700/25 on this move lower if it holds.

EUR/USD" title="EUR/USD" align="bottom" border="0" height="563" width="741">

EUR/USD" title="EUR/USD" align="bottom" border="0" height="563" width="741">

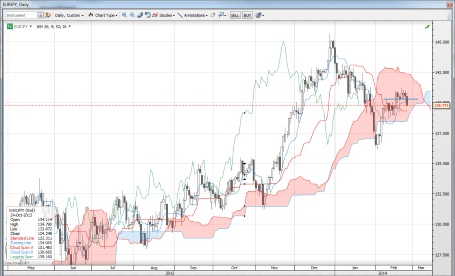

Chart: EURJPY

The most interesting of the major JPY crosses today as EUR is weak and the USD is relatively resilient. This is a big move and the break of 140.00 is technically interesting; note that the Ichimoku cloud is rising sharply in the days ahead and, if broken, could set up a test of the lows from earlier this month although that would need a dovish ECB.

EUR/JPY" title="EUR/JPY" align="bottom" border="0" height="563" width="928">

EUR/JPY" title="EUR/JPY" align="bottom" border="0" height="563" width="928">

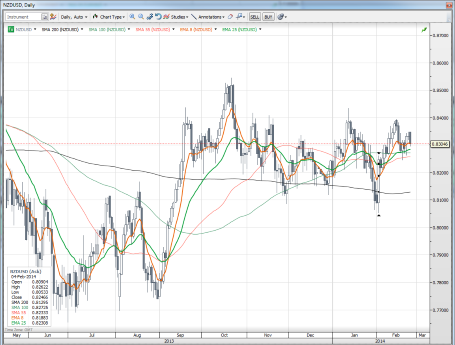

Chart: NZDUSD

Really, kiwi? Still in the upper half of the range after today’s risk mini-meltdown. If this move extends, I would expect kiwi longs to bolt for the exits.

NZD/USD" title="NZD/USD" align="bottom" border="0" height="563" width="743">

NZD/USD" title="NZD/USD" align="bottom" border="0" height="563" width="743">

Chart: USDSEK

And now for the ugliest chart in the world: USDSEK. Note the numerous false trend breaks from the exaggerated highs posted during the global financial crisis, and the generally falling volatility and lack of directional impulses. This chart is even uglier than the EURUSD chart in terms of the lack of trending and choppy behaviour.

USD/SEK" title="USD/SEK" align="bottom" border="0" height="563" width="917">

USD/SEK" title="USD/SEK" align="bottom" border="0" height="563" width="917">

Chart: USDSEK, part two

More locally, the falling trend line, or line of consolidation if you prefer — since there is no real trend — is rather interesting and could mark the beginning of something interesting to the upside in the bigger picture, perhaps 7.00 or more. After all, the Riksbank is pivoting dovish as the SEK is at historically strong levels on a broad basis. As well, the ECB is likely to finally launch some kind of easing programme at one of its coming meetings. It may be too early to anticipate this break.

USD/SEK, part two" title="USD/SEK, part two" align="bottom" border="0" height="563" width="737">

USD/SEK, part two" title="USD/SEK, part two" align="bottom" border="0" height="563" width="737">

John J Hardy is Head of FX Strategy for Saxo Bank. Read more of his insightful commentary on our social trading site here.