Forex News and Events

Kuroda again hints that further easing is likely (by Yann Quelenn)

This weekend, Bank of Japan’s Governor Kuroda declared to Sankei newspaper that rates could go deeper into negative territory at the next 21 September meeting, stating that there was room for further easing. At the same time, Fed members continue to reiterate that there is also further room for the rate hike before the end of the year. For the time being, the USD/JPY is still trading around 100.

In our view, markets have already priced in a future very large intervention from the BoJ and the continued dovish stance from the Fed. We are now entering an era where central-bank credibility is at stake and as we can see, recent verbal interventions from policymakers have barely moved markets. It is clear that the BoJ will ease, the only concern the markets’ have is “by how much?” In addition, markets are very suspicious of the Fed, which is afraid to tighten rates by 0.25%. The true reason for this being that servicing its debt would become too expensive.

We are closely scrutinizing the bond market, which finds itself in a massive bubble. Investors with free money are continuing to buy up bonds for capital appreciation and not yields. Japan 20-year government bonds are trading below 0.1% and should soon be back below zero as a result of market uncertainties and free money, but in particular as long as the Fed no-rate hike stance persists. It is important to be prepared for the BoJ to intervene on a larger scale to defend its currency.

FX volatility jumps ahead of Jackson Hole (Peter Rosenstreich)

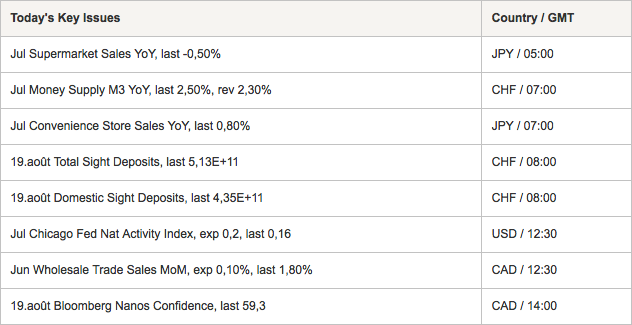

Summer always has a strange effect on financial markets and this year is no exceptions. The USD has lost value since mid-July despite steady improvement in US short-end yields. The divergence suggests a meaningfully disconnect between FX and rate markets. At a fundamental level the price actions indicates that rates (and gold) traders are pricing in a Fed hike in September while the FX trades are not convinced last week’s hawkish comment are anything but verbal manipulation. The reaction in options indicates that FX markets pricing of the Fed meeting is becoming a concern. One-month atm volatility in G10 has sky rocketed with USD/JPY climbing from 11 to 14.50 (covering Fed and BoJ risks) and EUR/USD jumpe from 7.28 to 8.20. The dislocation between fx and rates, increases the importance of Fed Chair Janet Yellen’s speech at the annual Economic Policy Symposium in Jackson Hole, Wyoming and potential for a significant move in the asset that is mispriced. This year’s conference topic is “Designing Resilient Monetary Policy Frameworks for the Future.” Considering the general breakdown of current central bank monetary policy mix, the timing of this topic relevant should not be minimized. Outside the broader goals of the conference markets are expecting Chair Yellen to use the opportunity to signal the FOMCs policy path. The Fed is clearly positive on improvements in the outlook for growth and inflation given the direction of housing and labor. However, while there are detectable improvements the data remains weak for a historical perceptive. Weak retail sales suggest the consumer is not as healthy as expected, given the strong labor market reads, while soft corporate spending will further pressure activity outlook. Finally, risk-to-GDP downside (which already slowing), from both internal and external factors remain unmistakable. Although, some Fed members have soundly vaguely hawkish, we expect Yellen will fade past data to highlight steady eroding improvements and growing headwinds, to signal no hike in September (given the current information). Should our prediction prove correct we suspect that USD is correctly priced with some further weakening of the greenback should be expected (supported by the bearish movement in short end yields). The US yield curve should steepening with a sell-off in front end yields while long term prices remain unchanged. In the current environment, selling vol, buying high-beta EM currencies remains our trade of choice.

The Risk Today

Yann Quelenn

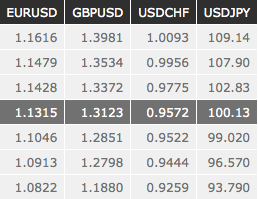

EUR/USD is consolidating its recent increase. Buying pressures still seem important. Strong resistance is given at 1.1428 (23/06/2016 high). Hourly support can be found at 1.1046 (05/08/2016 low). Expected to increase again. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD has declined inside downtrend channel showing that the medium-term bearish momentum is lively. The pair has broken hourly resistance at 1.3097 (08/08/2016 high). Expected to head towards support given at 1.2798 (06/07/2016 low). The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY is bouncing around the 100-mark. The technical structure suggests that the pair is gaining momentum to head further lower. Strong support given at 99.02 (24/06/2016 low). Hourly resistance is given at 102.83 (02/08/2016 high). Selling pressures should continue. We favour a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF has increased sharply from support given at 0.9522 (23/06/2016 low). Hourly resistance can be found at 0.9659 (09/08/2016 high). Expected to show renewed bearish pressures. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.