Earlier in Tuesday NY trading, U.S. equities ended slightly lower and USD marginally higher vs. most of its G10 counterparts as still ongoing Greek debt swap negotiations coupled with the IMF’s downside revision to its global growth forecast put a damper on collective risk sentiment.

After the U.S. equity market closing bell, however, a positive earnings surprise from THE U.S. tech company ignited a fruitful Wednesday for Asian equities which ended with gains on average of about +1%.

Choppy price action in FX defined Asia market hours as USD traded mostly mixed vs. G10 & EM FX ahead of the London open.

With many Asian markets still closed in observance of the start of the lunar calendar, would think a good amount of real money flows absent in Wednesday’s Asia Session:

Asia- Pacific FX - *Data & News-flows:

*Japan Dec. trade deficit worsened to multi-decade levels: -¥205.1bln vs. expected -¥170bln & negative revision to prior-¥684.7bln print to -¥687.6bln.

*JP exports to EU fell -12.7% y/y and exports to Asia fell -11.7% y/y, mostly a result of the -16.2% decline in exports to China.

* JP Chief Cabinet Secretary Fujimura says trade deficit result of March disaster and JPY strength.

*Australia 4Q Consumer Prices unchanged q/q for the first time in 3 years vs. expectations for a +0.2% q/q rise.

*RBA 4Q Trimmed Mean q/q higher at +0.6% vs. expected +0.5% with topside revision for prior +0.3% print to +0.4%.

*AU Nov. Westpac Leading Index fell -0.2% m/m vs. a +0.1% rise in Oct.

*AU DEWR Internet Skilled Vacancies: -1.1% in Dec. with Nov. figures revised down to -1.4% from -1.0%.

*New Zealand Dec. Manufacturing PMI prints 51.9, above previous readings suggesting contraction.

*NZ Dec. Credit Card Spending rises +0.9% m/m & +5.9% y/y with downside revisions for both prior prints to -4.2% & 3%, respectively.

* NZ Prime Minister John Key says optimistic for economy in 2012, important to get ‘to surpass as soon as we can’, & will detail progress towards budget surplus tomorrow.

*Singapore Dec. CPI at +5.5% m/m from 5.7% in Nov.; CPI y/y now at +5.2%

*MAS (SG central bank) preferred measure of inflation, core Dec. CPI (ex-accommodation & private transportation costs) increased +0.2% m/m & +2.2% y/y.

* MAS inflation statement noted elevated price expectations over the next few months.

Asia-Pacific FX – Techs, Levels, & Flows:

* USD/JPY offers rumored around the 78.00 figure which has so far held as resistance despite s/t momentum players’ attempts above; immediate support may be found around prior resistance & now support at the weekly kijun line around 77.80.

* AUD/USD back above the 1.0500 figure but meeting some s/t resistance around 1.0520/25 – hourly pivot & 78.6% retracement of the Oct '11 highs to Nov '11 lows – ahead of further resistance near recent highs around 1.0570. The 100-hr sma, currently around 1.0465/70, has been decent support for recent Aussie upside and looks to be the next key downside pivot.

* NZD/USD struggling ahead of 0.8020 s/t resistance & just above 0.8100 figure; the 100-hr sma around 0.8065 looks key to further downside.

* USD/SGD weakness has been met by decent demand around 1.2650 as the s/t pivot stalled numerous attempts below on hourly charts but MAS expectations for inflation to remain elevated in coming months widens the scope for an eventual breakout below the key horizontal pivot. Immediate resistance seems likely to be found near the 100-hr sma & hourly pivot around 1.2710.

AMERICAS & EMEA FX - *Data & News-flows:

* Greek PSI talks still ongoing & unresolved.

*Spain Dec Producer Prices fall -0.1% m/m, still up +5.2% y/y; Nov +6.3% y/y.

*Hungary Retail Sales unexpectedly rise +1.1% vs. expected -0.1% drop; mostly on sales of used items.

* German Jan. IFO Business Climate (consensus is 107.6), Current Assessment (consensus is 116.8), & Expectations (consensus is 99) at 0900GMT.

* GE sells €3bln 30-yr notes at 1015GMT

* GE chancellor Merkel speaks at 1630GMT.

* ECB announces allotment in 3-month tender at 1000GMT.

* UK BoE MPC Minutes at 0930GMT; focus will be on whether or not any MPC member/s stray from prior unanimous voting results.

* UK 4Q A GDP at 0930GMT; consensus expectations are for a -0.1% q/q decline.

* UK Jan CBI Trends at 1100GMT

* U.S. President Obama in the State of the Union said would create trade-enforcement unit to allow fairer competition for U.S. exports. U.S. President Obama reiterated many prior commitments; think content of speech was more style over substance.

EVENT TO WATCH - U.S FED FOMC Rate Decision in focus due to change in communiqué which will include individual FOMC participant expectations for the timing of potential policy tightening, Fed Funds rate trajectories by year-end from 2012 to 2014, and longer run projections in the following format:

* 1230EST (1730GMT): Official Statement

* 1400EST (1900GMT): Release of above-mentioned changes in communiqué inclusive of individual rate & economic projections

* 1415EST (1915GMT): Chairman Bernanke press conference

While of the thought that conveyance of Fed rate trajectories may provide some transparency as to future rate directions, still don’t think much transparency will be given in regards to QE3. As London gets underway, markets are pricing in exceptionally low Fed Funds rates until Q1 2014 with some participants expecting at minimum some hint of QE3.

This could be setting up for potential disappointing post-FOMC price action on the premise that 1. recent positive U.S. data surprises along with the brevity of the Jan. meeting suggests QE3 isn’t likely to be implemented or even addressed and 2. Traders and economists are likely to scour over central tendencies for the above-noted rate trajectories – the focus likely to be on 2014. If the central tendency for the Fed Funds rate by year-end 2014 comes in greater than 100bp (market pricing in about 80bp by 2014 year-end), USD strength may follow suit as implies elongated timing for additional QE or possibly derails it entirely.

On charts, this may translate to a reversal of recent USD weakness and would suggest price action on relatively thin holiday volumes was more corrective in nature. Additionally, while EU debt concerns may have abated as of late on the back of ECB liquidity injections, optimism ahead of promises to deliver constructive debt crisis solutions – this time a new treaty by end of Jan. – have resulted in ‘buy the rumor, sell the fact’ price action throughout 2011.

FX STRATEGY VIEWS: Active updates

* EUR/USD potential shorts tiered at halves for a final average rate of about 1.2950 from FX VIEWS (Asia): Position squaring paving the way for EUR/USD downside?...posted 01.18.11 triggered fully on recent USD weakness but trading in red territory by about -80pips.

* GBP/USD potential short positions around 1.5750 from FX TECH LAB: GBP underperformance looks set to continue (UPDATE)...posted 09.27.11 still in the black by about +140 pips with resistance still coming in around 1.5650 ahead of the key 1.5750 m/t pivot.

* NZD/USD potential short positions around 0.7855 from FX VIEWS (ASIA/LONDON): S/t summit rallies to provide m/t value for shorts?...posted 12.08.11 in the red by about -240 pips and in close proximity to potential stop-loss levels around 0.8150 which were just averted on recent highs near 0.8142.

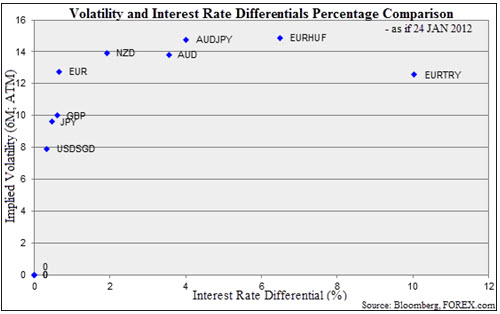

* EUR/TRY potential shorts around 2.4750 from EM FX INSIDER (Weekly Strategy)...posted 10.25.11 in the black by about +10 figures plus positive carry value on diverging ECB: CBT monetary policy paths. In its recent MPC meeting, the CBT kept all rates unchanged and maintained its current tightening bias while the ECB’s balance sheet continues to balloon with further scope for a more orthodox large scale asset purchase program if Euro-area conditions deteriorate further. Taking a look at rate differentials compared against volatility (as suggested by G10 and EM FX implied vols via 6-month at-the-money options), EUR/TRY shorts may continue to provide better relative carry value as its 6M A-T-M implied volatility is lower than most G10 & EM pairs at around 12.56% while rate differentials are much higher than most CCY pairs at above 10%.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Views (London Open): Heavy Data and Event Risk Looming

Published 01/25/2012, 05:39 AM

Updated 05/18/2020, 08:00 AM

FX Views (London Open): Heavy Data and Event Risk Looming

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.