“Ultimately, there has yet to be any material progress made in terms of a long term resolution for the EZ periphery debt crisis and warrants some suspicion as to the sustainability of the current EUR/USD rebound. Accordingly, we think recent EUR/USD strength should be approached with caution and believe selling EUR rallies remains a viable medium term strategy. Accordingly, the strategy is to enter one third of a short EUR/USD position just above current levels near potential bear flag tops around 1.3760, another third around 1.3900 (38.2% retracement for the most recent 1.4500/1.3500 descent), and the final third on a test of the breached primary trend-line around 1.4020 (also the 50% retracement for the aforementioned descent); for an average rate of about 1.3895. If all short entries are triggered, the stop loss level will be above the 1.4280/85 Nov. 4 ’10 highs at around 1.4310 for a total of risk of about 400 pips. The target objective will look for a move down towards 1.3050 - convergence of the 61.8% retracement for the Jun ‘10/May’11 30 big figure ascent with a key longer term pivot (see EUR/USD daily chart below) - for a potential total reward of about 850 pips and a positive reward to risk ratio slightly better than 2:1.” – posted 14 September 2011.

Approximately 6 weeks after the October 1.3150 EUR/USD lows teased limit targets around 1.3050 from the September 14th Weekly Strategy (click above link for full post), price action seems may finally be realigning with Euro-area fundamentals. For those patient enough to stick with the above-noted strategy, the painful short squeeze to highs near 1.4250 (potential stops around 1.4310) may turn out being a blessing in disguise as the third and final potential short entry at around 1.4020 was met for a total average rate just below the 1.3900 figure.

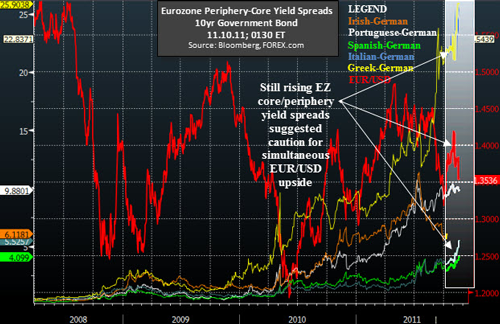

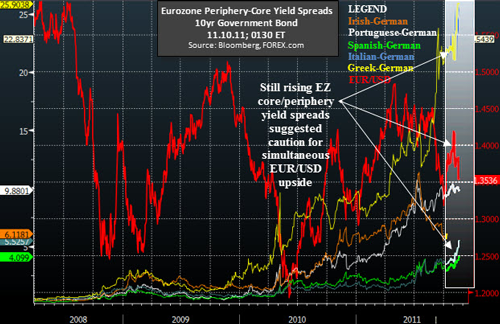

Much has transpired over the past few months but not much has changed for the source of global systemic risk, the Eurozone. Over-exuberance combined with position squeezes sent the S&P500 and EUR/USD screaming higher despite rising EZ core-periphery yield spreads (see below). Concerns of disorderly default have now spread from Greece to Italy sparking fears of Euro-zone restructuring leading to volatility spikes across the board.

Uncertainty is back on the rise as is US Dollar appeal, albeit at the expense of its G10 peers. EUR, AUD, and NZD have shattered recent range lows while completing breakouts below bearish technical patterns outlined in yesterday’s FX Views for the Asia Session – bear flag & H&S in EUR/USD, triangle in AUD/USD, H&S in NZD/USD - suggesting the ugly contest may have just begun. At the moment, EUR appears to be the standout favorite to win as likely rate cuts, foul debt breakouts, homely data, and stunted future growth prospects make USD much easier on the eyes.

Approximately 6 weeks after the October 1.3150 EUR/USD lows teased limit targets around 1.3050 from the September 14th Weekly Strategy (click above link for full post), price action seems may finally be realigning with Euro-area fundamentals. For those patient enough to stick with the above-noted strategy, the painful short squeeze to highs near 1.4250 (potential stops around 1.4310) may turn out being a blessing in disguise as the third and final potential short entry at around 1.4020 was met for a total average rate just below the 1.3900 figure.

Much has transpired over the past few months but not much has changed for the source of global systemic risk, the Eurozone. Over-exuberance combined with position squeezes sent the S&P500 and EUR/USD screaming higher despite rising EZ core-periphery yield spreads (see below). Concerns of disorderly default have now spread from Greece to Italy sparking fears of Euro-zone restructuring leading to volatility spikes across the board.

Uncertainty is back on the rise as is US Dollar appeal, albeit at the expense of its G10 peers. EUR, AUD, and NZD have shattered recent range lows while completing breakouts below bearish technical patterns outlined in yesterday’s FX Views for the Asia Session – bear flag & H&S in EUR/USD, triangle in AUD/USD, H&S in NZD/USD - suggesting the ugly contest may have just begun. At the moment, EUR appears to be the standout favorite to win as likely rate cuts, foul debt breakouts, homely data, and stunted future growth prospects make USD much easier on the eyes.