This market appears reluctant to do anything with the USD, though it remains generally resilient. EUR/USD attempted another half-hearted squeeze yesterday, but once again failed to get anything going to the upside and defaulted back toward opening levels later in the day.

The action elsewhere was equally lacklustre, with only SEK providing fireworks on a couple of developments. First, the economic data has been quite good out of Sweden, and the Q4 GDP report was stellar, and second, yesterday a Riksbank governor suggested that there are signs inflation is bottoming, even amid talk from another governor of further nonconventional policy action if needed. In a context of a strong Swedish economy, any easing on the deflation worry front is a boost for SEK.

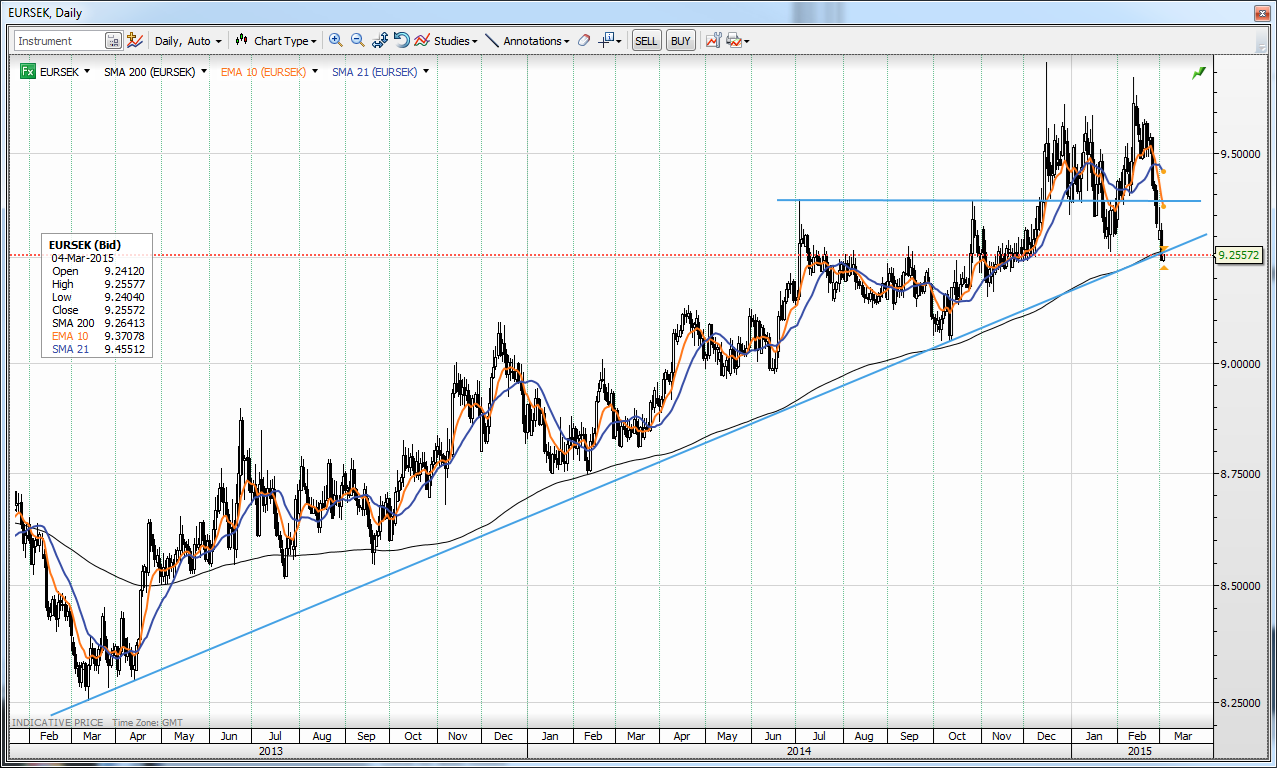

Chart: EUR/SEK

While recent price action suggested a return to the 9.2700 area, the momentum has remained impressive and the sell-off wave is now so massive that we have almost broken the long-standing uptrend since early 2013 and have challenged below the 200-day moving average. The pair could be short term oversold, but the weight of this sell-off wave shifts the outlook back toward 9.00 in the weeks/months ahead on the next follow-through lower after possible consolidation.

Hopefully today will provide enough input to get the volatility ball rolling. Watch out for the Fed’s Beige Book late today.

The G-10 rundown

USD: The USD is spinning its wheels and unable to gain traction at the moment, though yesterday also showed that attempts to sell the greenback were beaten back (EUR/USD failed to regain 1.1200 yesterday, for example.) We may not have a decisive move either way until after Friday’s US payrolls numbers unless we see extreme data surprises today with ADP/ISM non-manufacturing.

EUR: Can’t seem to maintain a rally and it’s hard to decide whether we should be reactive to European data like today’s Services PMI when there is no mystery surrounding the European Central Bank policy pipeline for quite some time. Three doji days in a row in EUR/USD suggest maximum uncertainty.

JPY: Continues to look resilient and yesterday’s weak risk appetite perhaps helping it stronger. Could we be looking at end-of-year (for Japan, March 31) effects in JPY this month, with exporters looking to hedge for next year and therefore driving JPY stronger? EUR/JPY area near 133.50 looks interesting, though the pair has hardly done anything for a month now. USD/JPY remains indecisive.

GBP: GBP/USD looking vulnerable to a dip into the lower range below 1.5350 and toward 1.5200 if we see a weak services PMI from the UK today. As well, EUR/GBP progress has slowed and the pair may be in for further consolidation if it trades up through 0.7300.

CHF: Trading on the weak side as USD/CHF maintains its jagged ascent, but the market should only increase focus on CHF in the crosses if EUR/CHF is able to break above 1.0810 or below 1.0610. CHF/JPY area around 124.50 (high before the SNB stepped away from the CHF ceiling) also looks interesting.

AUD: Not getting any further traction after the Reserve Bank of Australia failure to cut rates – suggests much higher risk of weakening on this lack of follow through. If we descend back toward the tactically important 0.7750 area, it may not hold. Upside needs a 0.7900 break and broad USD weakness to generate interest.

CAD: Yesterday’s stronger than expected CAD GDP saw a one off dump in USD/CAD, but the way it pulled right back to 1.2500 since then suggests strong bids in place for a move higher as long as US data is supportive.

NZD: Waiting for resolution as the 0.7600/50 area is structurally important resistance, while a move below 0.7500/0.7450 would encourage a bearish outlook.

SEK: Additional big move yesterday after Riksbank member suggests inflation may be bottoming. As Swedish inflation data is the critical factor in the Riksbank outlook, this is highly supportive of the currency, considering otherwise strong economic data. EUR/SEK is pounding on a big trendline and through the 200-day moving average – could be shaping up for a move toward 9.00.

NOK: Biding its time on the paucity of fresh data and has oil has gone sideways. Prefer to view NOK as vulnerable as long as oil is here or lower on risks of a dovish Norges Bank .

Economic Data Highlights

- Australia Feb. AIG Performance of Services Index out at 51.7 vs. 49.9 in Jan.

- UK Feb. BRC Shop Price Index out at -1.7% YoY vs. -1.2% expected and -1.3% in Jan.

- Australia Q4 GDP out at +0.5% QoQ and +2.5% YoY vs. +0.6%/+2.5% expected, respectively and vs. +2.7% YoY in Q3

- Japan Feb. Markit Japan Services PMI out at 48.5 vs. 51.3 in Jan.

- China Feb. HSBC China Services PMI out at 52.0 vs. 51.8 in Jan.

Upcoming Economic Calendar Highlights (all times GMT)

- Italy Feb. Markit/ADACI Services PMI (0845)

- France Feb. Final Markit Services PMI (0850)

- Germany Feb. Final Markit Services PMI (0855)

- Euro Zone Feb. Final Markit Services PMI (0900)

- UK Feb. Markit/CIPS Services PMI (0930)

- Euro Zone Jan. Retail Sales (1000)

- US Feb. ADP Employment Change (1315)

- US Fed’s Evans (FOMC voter) to Speak (1400)

- US Feb. Final Markit Services PMI (1445)

- UK BoE’s Bailey to Speak (1445)

- Canada Bank of Canada Rate Decision (1500)

- US Feb. ISM Non-manufacturing Survey (1500)

- US Fed Governor George to Speak (1800)

- US Fed Releases Beige Book (1900)

- Australia Jan. Retail Sales (0030)

- Japan BoJ’s Kiuchi to Speak (0130)

- Australia RBA Deputy Governor Lowe to Speak (0130)