Yesterday saw a solid surge in the US dollar across the board from fresh local lows early in the European session, the best sign yet that the USD consolidation may be over with, though we’ll need next week’s important US data to support that case. Importantly, Yellen is out speaking late today in San Francisco and her appearance will include a question and answer session, so plenty of room for a reaction.

Yesterday saw two supportive US economic data points: first, another strong US jobless claims print adds to the strong jobs market drumbeat, and second, the Markit flash Services PMI survey for March, which correlates quite well with the official ISM non-manufacturing survey, surged to a fresh 6-month high.

Overnight, Japan’s inflation data once again missed the mark and it looks like we may be headed for deflationary readings once we get to the April data, which will be free of the sales-tax comparison for the year-on-year readings. If we look at the headline month-on-month data, the price level since the end of May last year, headline CPI has fallen -0.7% and the ex Food/Energy CPI is down -0.9%! In other words, not only is the BoJ missing the target, but Japan is still in outright deflation.

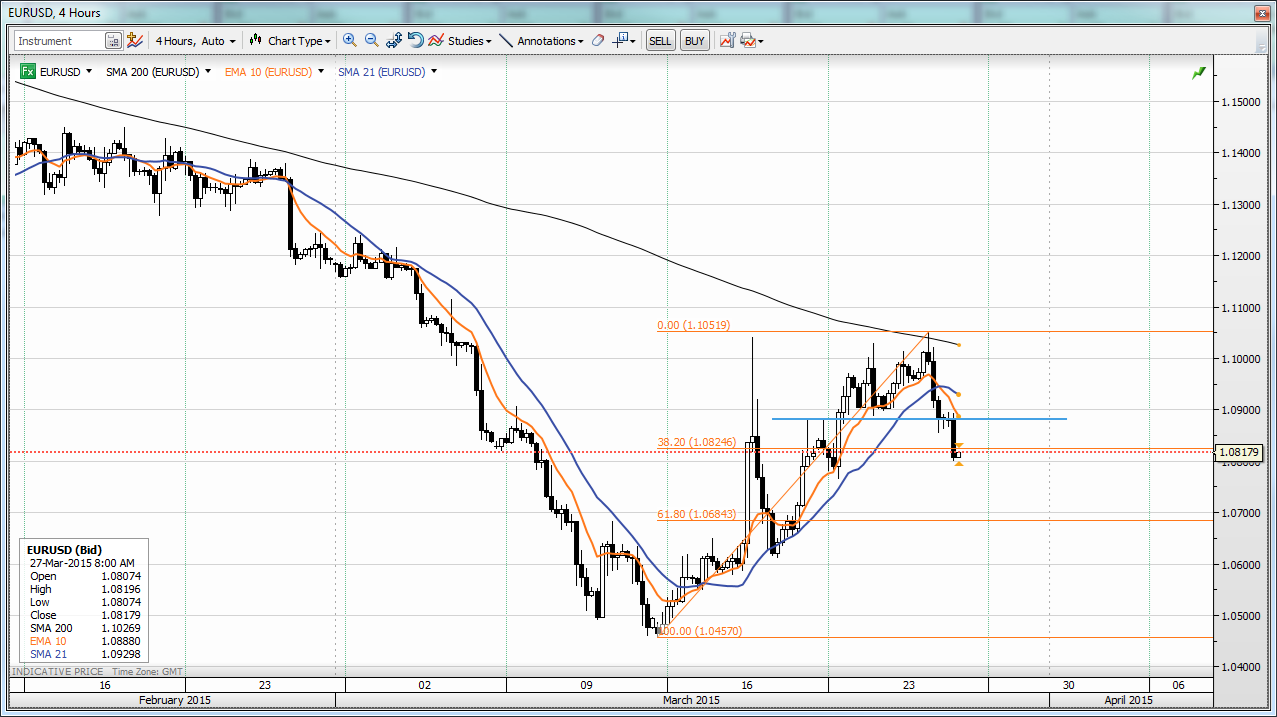

Chart: EURUSD

EURUSD getting solid confirmation today of yesterday’s reversal as we watch for a further drive back into the range as a setup to next week’s key set of US economic data.

The G-10 rundown

USD: Making a case for a recovery and next week’s data will be key in that regard. Prefer to take the rally at face value after yesterday’s strong rejection of another gambit by EURUSD to take 1.1000. Watch out for Yellen out speaking on Monetary Policy (including a question and answer session)

EUR: A broad weakening yesterday suggests the squeeze may be over as EURUSD, EURJPY and EURGBP all rolled over. Watching for a deeper cut in all three pairs today to set up a possible test of the cycle lows in the week or weeks ahead.

JPY: Still resilient, though USDJPY is slipping back up above the 119.25 resistance line this morning. Still, EURJPY and other JPY crosses remain vulnerable technically here.

GBP: Correlating with USD strength, so while GBPUSD is down from the open this morning, EURGBP is also down as we may have seen a cycle top in the latter for now just as yesterday’ action argues for a cycle top in EURUSD.

CHF: EURCHF Having a go at 1.0500 this morning and couldn’t get anything going, so the focus may be for new support levels lower if the 1.0400 area can’t corral the action. USDCHF posted a bullish hammer yesterday that is seeing some confirmation today, and the bulls will find further confirmation if the move retakes 0.9750

AUD: AUDUSD diving deeper back into the range as the bears watch for a solid plunge through 0.7750 to help cement the bearish reversal after the recent attempt to break higher.

CAD: CAD wilted a bit after yesterday’s oil rally eased, though let’s look for a powerful move higher from a 1.2500 area launchpad in USDCAD for better evidence that the range will hold here.

NZD: AUDNZD continues to tease without showing enough promise higher to tell us whether we should prefer selling AUD or NZD. The outcome there may be determined by the direction in risk appetite (as NZD is a popular carry trade long). NZDUSD cut deeper back into the range, but still needs to take out 0.7550 and even 0.7500 to build a more convincing bearish case.

SEK: Watching Retail Sales release today – with rates rising and risk still wobbly, SEK could be vulnerable here and EURSEK is banging on important resistance at 9.35 that could lead to 9.45/50 test if broken on weak data today.

NOK: NOK looking vulnerable if today’s March unemployment rate release shows an uptick after yesterday saw oil easing back lower and EURNOK surviving a test lower toward the key range lows and 200-day moving average.

Economic Data Highlights

- Japan Feb. Jobless Rate out at 3.5% as expected and vs. 3.6% in Jan.

- Japan Feb. Overall Household Spending out at -2.9% YoY vs. -3.2% expected and -5.1% in Jan.

- Japan Feb. National CPI out at +2.2% YoY vs. +2.3% expected and 2.4% in Jan.

- Japan Feb. National CPI ex Food and Energy out at +2.0% YoY vs. +2.1% expected and +2.1% YoY in Jan.

- Japan Feb. Retail Trade out at -1.8% YoY vs. -1.5% expected and -2.0% in Jan.

Upcoming Economic Calendar Highlights (all times GMT)

- Sweden Feb. Retail Sales (0830)

- UK BoE’s Carney to Speak (0845)

- Norway Mar. Unemployment Rate (0900)

- UK BoE’s Broadbent to Speak (0915)

- US Fed Vice Chairman Fischer to Speak (1030)

- US Q4 GDP Revision (1230)

- US University of Michigan Sentiment Survey (1400)

- Norway Norges Bank’s Olsen to Speak (1600)

- US Fed Chair Yellen to Speak on Monetary Policy (2145)