The mighty dollar closed last week on a strong note, and the opening action this morning offered a further boost to the currency as commodity weakness was underlined by the spectacular plunge in gold prices overnight. This move saw multi-year lows taken out after the weak close on Friday and after China unexpectedly indicated the exact size of its gold reserves after not providing such information since 2009.

We can only imagine where gold might trade if the market actually starts to price in another 100 basis points of Fed rate hikes as the long end of the US yield curve sees new highs for the cycle as well. The latter is likely the trigger for more focus on USDJPY, which has traded very passively of late relative to other major USD pairs.

This week, amid an extremely sparse US economic data calendar, the focus will mostly be on whether the market sentiment for the USD remains supported (with risk appetite in general likely the key gauge) ahead of next week’s Federal Open Market Committee meeting.

Elsewhere, we have a few interesting subplots of interest, including tonight’s Reserve Bank of Australia minutes and whether the AUD will join its commodity dollar brethren in the cellar of the G10. It seems the market is rather complacent on RBA dovishness relative to Reserve Bank of New Zealand and Bank of Canada dovishness and the AUD could play some catch-up to the downside. The Q2 CPI on Wednesday is the other key event risk for Australia this week.

We also have an RBNZ meeting this week on Thursday/Wednesday night. The RBNZ will be dovish and will cut rates, but will guidance justify the market’s extreme pounding of the kiwi in recent weeks?

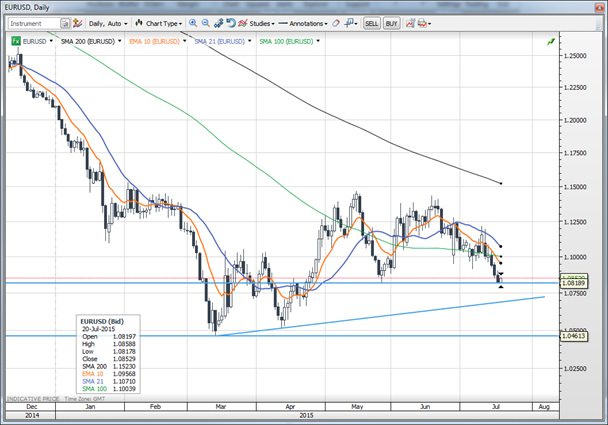

Chart: EURUSD

EURUSD has been trading up against the last local support area near 1.0820, within the larger range toward the sub 1.0500 lows. Will sentiment be enough to drive the pair through this support or are we going to have to sit on our hands until next week’s FOMC meeting or even the key US data up the week after that? There are no real support levels of note until the rising line of consolidation and then the lows for the cycle below 1.0500 if 1.0820 is taken out.

The G-10 rundown

USD: Ended last week on a strong note and this week will have to see sentiment support the USD as the economic calendar is rather barren of key data ahead of next week’s FOMC meeting.

EUR: The open questions after the Greek bailout debacle are endless and there is some risk of consolidation in the euro higher before we drive lower if risk appetite needs to consolidate some of its recent gains.

JPY: Very passive at the moment and little focus, as we wonder whether new highs for the cycle in yields in the US could trigger more focus here.

GBP: The focus this week is on the Bank of England minutes, which may have a hard time surprising to the hawkish side after a string of recent hints and rhetoric from the BoE on its hawkish shift. Still, the minutes will likely be GBP supportive and GBP will likely trade as a low beta USD or at least in correlation with risk appetite as the GBP trade is firmly a pro-cyclical one.

CHF: Little focus here if we examine the quiet EURCHF chart, but USDCHF is in breakout mode – next resistance the descending trend-line and then parity.

AUD: Wondering whether the market focuses more on AUD selling on RBA signals and possibly the CPI this week (not to mention weak commodity prices).

CAD: It looks like 1.3000 is a bit of an obstacle to further upside as it is likely a major objective/take profit level for some bulls. Still looking for higher levels still after a possible bout of consolidation.

NZD: RBNZ meeting later this week is the key event risk and likely to justify the market’s recent selling frenzy. If we are consolidating higher heading into the Thursday, meeting, it could serve as the pivot point back to NZD weakness.

SEK: What to like least – euro or SEK – tough to decide.

NOK: Interest in NOKSEK upside and EURNOK downside if 8.85 is taken out on a daily close, but oil prices are a big risk for NOK.

Upcoming Economic Calendar Highlights (all times GMT)

- Japan BoJ Minutes (2350)

- Australia RBA Meeting Minutes (0130)