European Central Bank (ECB) president Mario Draghi was out yesterday pouring cold water on the enthusiastic sell-off in euro as he stated: “Don’t try to infer anything from what I say, anything about the possibility of negative rates…This was discussed in the last monetary policy meeting and there’s no more news since then. Let me make this clear”. This, of course, came after the Wednesday story from Bloomberg story that ECB in-the-knows suggested that a negative deposit rate was likely. But before the Draghi speech, the strong German November flash PMI numbers already saw strong EURUSD buying from the day’s lows that came after a particularly weak French number. France is clearly the sick man of Europe now.

This is making life dicey once again for the EUR/USD bears and it will likely be up to this morning’s Germany IFO survey to sort things out one way or another. At this point, if we get a strong close in EUR/USD back through perhaps 1.3550 today, it may be a game changer to the upside. Meanwhile, a weak IFO and a renewed weakening of sentiment needs to see a convincing follow up move lower and clearance of perhaps the 1.3400 level for bears to gain confidence here. It appears we need even stronger hints that the ECB is planning a real expansion of its balance sheet to get this EUR/USD back into a more convincing stance (the ECB’s Peter Praet’s recent statements on the potential for buying debt were apparently not enough to do the trick thus far…).

December-taper?

The Fed’s James Bullard was out yesterday indicating that a strong November jobs report would increase the likelihood of a December asset purchase taper. I think that as long as we see a reasonable jobs report and strong ISM surveys and possibly more importantly, if equity markets remain strong into the December Federal Open Market Committee (FOMC) meeting, and as long as the yield curve remains as steep as it has been lately, the odds of a Fed December-taper will fatten like a Christmas turkey. The Fed really didn’t like the huge move in the 2—5 year rates at the belly of the curve over the summer. Now, we have 10-year rates back toward the highs while 2-year yields are down close to 25 basis points — meaning the market is buying the Fed message of low rates for a long time.

Looking ahead

The USD/JPY break looks rather convincing, with support coming in at 100.80/60 now. Another good extension of the move before we see more consolidation in the trading days ahead will help build the case for an attempt at perhaps 105.00 in the weeks ahead, which is increasingly likely if we see tapering odds increasing, higher yields and at least stable risk appetite.

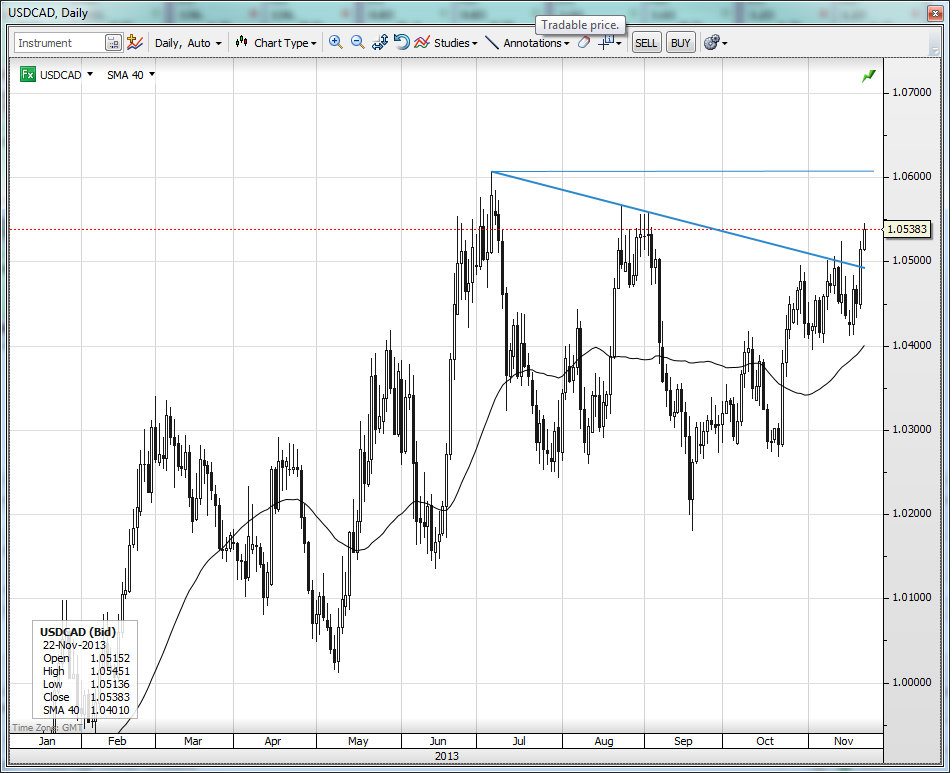

The US calendar today is quiet, with only a Canadian CPI print providing distraction. The commodity currencies are generally on the defensive here and USD/CAD has now launched its third major campaign above the 1.0500 level — this one looks promising, but the bulls have been disappointed in the 1.0600—1.0700 zone for over three years now. There could be a secular reassessment of CAD if (more likely when) 1.0700 is taken out. Stay tuned. Note that AUD/NZD is taking out fresh lows for the cycle below 1.1200. As long as risk appetite is healthy and there is nothing but strength out of the New Zealand economy, this could continue for a time, but the kiwi overvaluation, broadly speaking, is getting very stretched. The major support for AUD/NZD since the 1980s has come in the 1.05/06 area, for perspective.

Chart: USD/CAD

USD/CAD is in focus once again as we have the third major try for the year above the 1.0500 level. This will be one to watch over the next couple of weeks to see if the pair can gain momentum. A December-taper would very likely send the pair to new three-year highs and encourage trend-followers to pile on board what has been a rather dormant pair. USD/CAD" width="952" height="773">

USD/CAD" width="952" height="773">

Next week is Thanksgiving Week in the US, with many taking off Wednesday through Friday, and with US markets entirely closed on Thursday and only open for half a day on Friday. This is traditionally seen as the strongest season for equity markets, but can we continue to tack onto gains after one of the best years in equity market history?

Over the weekend, the ECB’s Jörg Asmussen will deliver a major speech on bank reform in Europe.

Upcoming Economic Calendar Highlights (all times GMT)

- Sweden Nov. Manufacturing/Consumer Confidence (0815)

- Germany Nov. IFO Survey (0900)

- Canada Oct. CPI (1330)

- US Fed’s George to Speak (1340)

- US Nov. Kansas City Fed (1600)