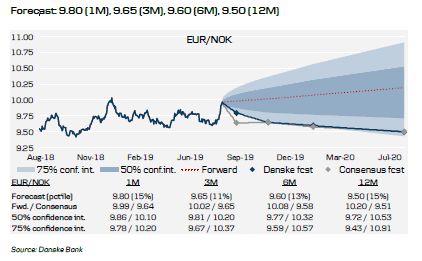

NOK. The outlook for a stronger NOK suffered a clear blow last week, as the less committed easing message from the Fed's Jerome Powell has paved the way for more persistent USD strength. In our view, a strong USD and weak global cycle are likely to keep industrial metals and oil prices under pressure longer than we previously expected. This in turn constitutes an extended headwind for commodity FX and high beta currencies in general, including NOK. On the back of this, we lift our front-end forecasts to 9.80 in 1M (from 9.60) and 9.65 in 3M (9.50). We still expect Norges Bank to add further carry attractiveness to the NOK by hiking rates in September. Indeed as long as growth remains above trend, the NOK is simply too weak for the central bank to reach its inflation target (see FX Strategy - Why is the NOK so weak? , 28 May ). However, global drivers remain the primary determinants and with the latest developments, we acknowledge reduced NOK potential in the medium to long term too. We forecast EUR/NOK at 9.60 in 6M (9.50) and 9.50 in 12M (9.30).

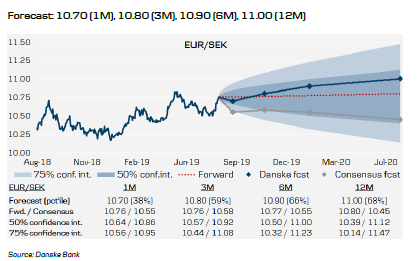

EUR/SEK. We stick to our bearish medium-term view on the SEK based on a cyclical economic slowdown, domestically and abroad, and a subdued inflation outlook that we believe will re-challenge the Riksbank (the upcoming wage round will, in our view, not make it any easier to achieve its target). Global uncertainties and the sudden re-escalation of the trade war have weighed on the SEK recently and may continue to do for some time. However, next week's Swedish inflation data may prompt a small correction lower in EUR/SEK as our forecast is above that of the Riksbank. We remain comfortable with an upward-sloping medium-term trajectory for EUR/SEK and make only small adjustments to our forecast profile: we raise 1M to 10.70 (previously 10.50), 3M to 10.80 (was 10.70), 6M to 10.90 (was 10.80) and 12M to 11.00 (was 10.90).

EUR/DKK. We see a case for Danmarks Nationalbank not fully tracking an ECB rate cut in September. This would reduce the negative carry on short EUR/DKK positions and send EUR/DKK lower. We forecast EUR/DKK at 7.4630 in 1M, 7.4575 in 3M, 7.4550 in 6M and 7.4550 in 12M.

EUR/USD. The lack of a forceful response from the Fed to a weakening economy and lacklustre inflation expectations was a blow to our view of a short-term bounce in EUR/USD. In our view, a shallow rate cut cycle from the Fed would keep EUR/USD range bound in 3M, around 1.10 (revised down from 1.15). in 6-12M, we still look for a higher EUR/USD towards 1.13 in 6M (revised down from 1.17) and 1.15 in 12M (revised down from 1.17) on the erosion of USD carry, valuation, an improved outlook for the global economy and the odds of a trade deal.

EUR/GBP. In the run-up to the Brexit deadline at end-October, we expect EUR/GBP to remain volatile and maybe more so than we previously thought likely. Financial markets are taking Boris Johnson's direct approach literally and, in the run-up to October, this could mean EUR/GBP will drift higher. Ultimately, we believe EUR/GBP could go as high as 0.97 (previously, we were thinking 0.91). Our base case continues to be a much, much less dramatic outcome at the end of October. We expect EUR/GBP to settle at 0.89-0.91 on the back of an extension and/or snap election. In the case of a decent deal or cancellation of Brexit, we believe EUR/GBP will turn towards 0-83-0.86. Although the outcome is anybody's guess, we believe it will improve after October.

USD/CNY . Due to the recent escalation of the trade war, we have lifted our USD/CNY forecast to 7.05 in 1M (6.95), 7.10 in 3M (7.0) and 7.20 in 6M and 12M. We see a rising probability that the US and China will not reach a trade deal before the US election in November 2020 and that Donald Trump will raise tariffs further on imports from China worth USD300bn to 25%.

NZD/USD and AUD/USD are set to be low, for longer. In New Zealand, leading indicators have shifted further down and now track annual GDP growth around 1.5%, in contrast to RBNZ’s projection of 2.5-3.0%. Inflation prints have been slightly better but remain below target and the committee is likely to judge that downside risks to its inflation target remain in place given the global growth outlook. In Australia, housing market activity indicators are showing a tentative stabilisation but recent retail sales are showing consumption is weakening to a multi-year low. Both central banks are actively easing monetary policy in light of these developments.

The recent slightly hawkish comments from the Fed and re-escalation of the US-China trade war put both economies at risk and currency markets have been extremely speedy in pricing towards new multi-year lows, from what had previously been a positive outlook. Hence, since a month ago, the risk has shifted from upside to slight downside once again. We think the upcoming 1-6M outlook is worse than it appeared in June and July and we revise our expectations accordingly, while a more positive scenario in 12M puts a bottom in for the crosses. We revise AUD/USD to 0.67 in 1M (previously 0.70), 0.67 in 3M (previously 0.71), 0.70 in 6M (previously 0.715) and 0.70 in 12M (previously 0.715). Correspondingly, we set NZD/USD at 0.645 in 1M (previously 0.67), 0.645 in 3M (previously 0.675) and 0.67 (previously 0.68) in 6M and 12M. Nonetheless, these crosses are extremely sensitive to small changes in the perception of future Fed and trade policy and news on this front would materially and swiftly change spot pricing as well as the outlook. To see a rise to the highs of 2016-18, we would need to see a strong pickup in global activity; this remains very tentative though.

USD/RUB. RUB continues to follow global risk sentiment, while the recent US sanctions did not have a significant impact on the Russian currency as Russia’s local debt remains out of scope. In early August 2019, US President Trump signed an executive order imposing sanctions on Russia. It was the second round of sanctions by the US administration. The US banned loans or other assistance to Russia by international financial institutions and prohibited most loans from American banks to Russia’s government. We slightly increase our 1M forecast to 65.60 (up from 65.40) and revise our forecast down for 3M to 66.00, 6M to 67.00 and 12M to 68.00 (down from 67.00, 68.00 and 69.00 respectively).

EUR/PLN. The ECB’s softening stance and the renewed trade dispute between China and the US sent EUR/PLN higher. We believe US-China trade tensions are likely to continue into 2020, which, in our view, would send the pair higher (the PLN has been relatively immune to the risk-off periods lately). As a result, we see a slight case for EUR/PLN to edge higher on a short-term basis to 4.32 (previously 4.28) in 1M but then as the Fed delivers on the cutting side in September, we see the pair going down to 4.25 in 3M, 4.23 in 6M and 4.23 in 12M.

USD/TRY. The TRY is stabilising on a global turn to monetary easing, while quick monetary easing by the TCMB limits the TRY’s attractiveness in carry trades. However, domestic risk is still there. Because of global monetary relief, we adjust our USD/TRY outlook enhancing that the fragile domestic and geopolitical environment is still in place. Large FX debt redemptions by the Turkish private sector and more rate cuts later in 2019 are set to weigh on the TRY in 2019 and 2020. Thus, we remain bearish on the TRY in the long term, expecting the USD/TRY to reach the following levels: 5.60 in 1M, 5.70 in 3M, 5.90 in 6M and 6.00 in 12M (previously 5.70 in 1M, 5.90 in 3M, 5.90 in 6M and 6.20 in 12M).

Oil. We expect oil prices to recover over the rest of 2019. We forecast Brent will average USD70/bbl in Q3 and USD75/bbl in Q4. In our view, OPEC+ cuts, a stabilisation of the global macro economy and eventually a weaker USD will underpin oil prices.

EUR/NOK – Reduced Potential For Dtronger NOK

Growth. Back in June, the historically reliable Regional Network Survey indicated accelerating H2 mainland growth prospects of more than 3% y/y. Meanwhile, the past month’s data releases have been on the weak side of expectations. Manufacturing sector surveys now suggest somewhat weaker growth ahead, as the impact of a slowing global industrial cycle seems increasingly to counter the positive domestic impulses from petroleum industries and oil investments. In addition, the fall in unemployment has slowed but this is at least partially due to rising bottleneck problems. Overall, however, we still expect above-trend growth in the year ahead driven by oil investments and consumption.

Monetary policy. As expected, Norges Bank hiked the key policy rate by 25bp to 1.25% at the June monetary policy meeting. Meanwhile, as importantly, it clearly signalled that it intends to hike rates again as soon as September, with an additional high likelihood of another rate hike in 2020. While domestic releases have recently been somewhat on the soft side of expectations, we still expect Norges Bank to firm its September signal at the forthcoming interim August meeting. In addition, our base case remains two additional rate hikes in 2020.

Flows. Foreign banks (proxy for speculative flows) have been net selling NOK over the past few weeks amid resurfacing trade war concerns and global risk off. Overall, we regard NOK positioning to be neutral.

Valuation. From a long-term perspective, the NOK seems fundamentally undervalued. Our PPP model has 8.85 as ‘fair’. A model incorporating relative productivity also suggests NOK potential after the year-long period of internal devaluation and NOK weakness.

Risks. The biggest risk factors to our call are continued outperformance of the USD and a Fed not hiking rates while global growth remains weak. We could also be wrong in our above-trend call on Norwegian growth. In addition, any a breakdown in US -China trade negotiations would be NOK negative.

Conclusion. The outlook for a stronger NOK suffered a clear blow last week as the less committed easing message from the Fed’s Powell has paved the way for more persistent USD strength. In our view, a strong USD and a weak global cycle is likely to keep industrial metals and oil prices under pressure longer than we previously expected. This in turn constitutes an extended headwind for commodity FX and high beta currencies in general, including NOK. On the back of this, we lift our front-end forecasts to 9.80 in 1M (from 9.60) and 9.65 in 3M (9.50).

We still expect Norges Bank to add further carry attractiveness to the NOK by hiking rates in September. Indeed, as long as growth remains above trend the NOK is simply too weak for the central bank to reach its inflation target (see FX Strategy – Why is the NOK so weak?, 28 May). However, global drivers remain the primary determinants and with the latest developments, we acknowledge reduced NOK potential in the medium to long term. We forecast EUR/NOK at 9.60 in 6M (9.50) and 9.50 in 12M (9.30).

EUR/SEK – Still On The Increase

Growth. The second-quarter GDP figure was a blow to the Riksbank, though in line with our estimate at 1.4% y/y (-0.1% q/q). It also fell short of market consensus and as such sent EUR/SEK sharply higher. In our view, domestic demand is an increasing headwind to growth and the SEK. Unfortunately, the global economic slowdown on the back of an escalating trade war is of no help either.

Monetary policy. Despite soft messages and lingering cuts from the Fed and the ECB, the Riksbank stubbornly maintained its hiking bias in July, which in turn lent some support to the SEK. However, we think it is only a matter of time (September-October) before the Riksbank decides to postpone the next hike well into next year in an environment where both the Fed and the ECB have started to ease. Moreover, the growth outlook is likely to disappoint the Riksbank along with inflation (and wages). Hence, we expect no hike this year and probably not next year either, which would leave the policy rate in negative territory for longer. In our view, this will continue to weigh on the SEK especially versus the USD.

Flows. The significant rate gap versus the US has held back commercial and investors’ demand for the SEK and fuelled carry trades where SEK has been the funding currency. A more risk averse environment coupled with a smaller rate differential may lead to some unwinding of long USD/SEK positions. That said, the USD still stands out as the most attractive carry currency in the G10 space. Valuation. Fundamental factors can to some extent explain the recent years (real) depreciation of the SEK, although we would argue that ultra-easy monetary policy is the main culprit behind the weakening (see FX Strategy – Hardships for the SEK, 13 May).

Risks. A pronounced risk-off environment has the potential to send the SEK down the drain (beyond 11.00 versus the EUR and beyond 10.00 versus the USD), though partially balanced by the scaling back of carry positions.

Conclusion. We stick to our bearish medium-term view on the SEK based on a cyclical economic slowdown, domestically and abroad, and a subdued inflation outlook that we expect to re-challenge the Riksbank (in our view, the upcoming wage round will not make it any easier to achieve its target). Global uncertainties and the sudden re-escalation of the trade war have weighed on the krona recently and may continue to do so for some time. However, next week’s Swedish inflation data may prompt a small correction lower in EUR/SEK as our forecast is above that of the Riksbank. We remain comfortable with an upward-sloping medium-term trajectory for EUR/SEK and make only small adjustments to the forecast profile: we raise 1M to 10.70 (10.50), 3M to 10.80 (10.70), 6M to 10.90 (10.80) and 12M to 11.00 (10.90).

To read the entire report Please click on the pdf File..