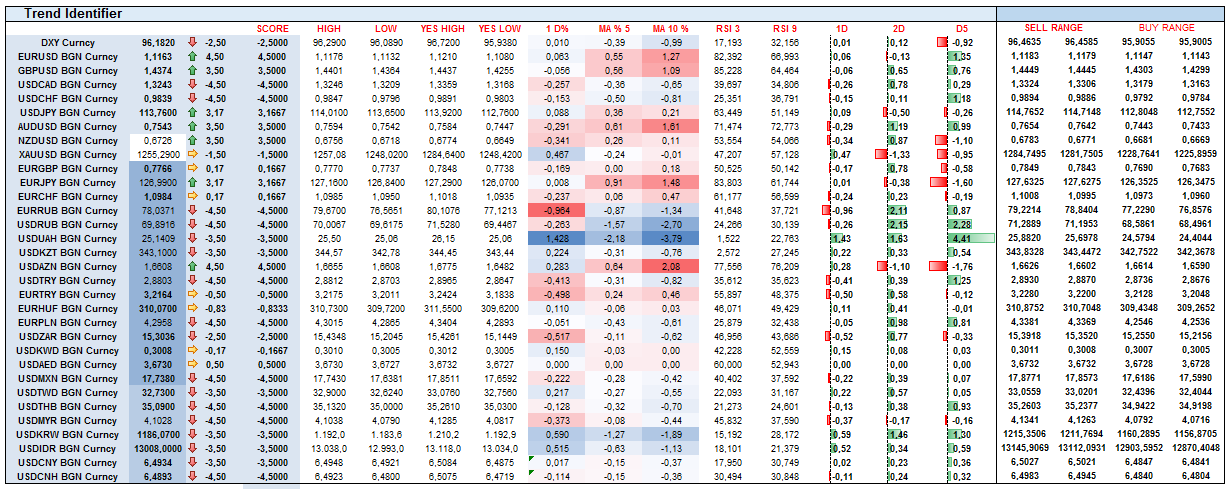

After the soft Chinese data over the weekend, AUD and commodities have started relatively stable but in a corrective mood. Equities have performed well before BOJ and the FED, however USD weakness has not been challenged so far even with higher US rates. Interest rates around the globe are higher in developed countries. Emerging countries are seeing bond market inflows driving interest rates lower.

EUR/USD still seems to be strong and in an uptrend, and for momentum to kick in 1,1250 should be breached. Commodities are still strong. Brent is stuck aorund 40 USD but metals are still pushing on. That has kept NZD and AUD relatively well bid even with the Chinese data.

Asian Emerging Markets are still seeing IDR and KRW leading the way. CNY has gained ground as well, crushing through the recent support levels. Latam FX traded well, led by MXN. European Emerging markets are weaker. The bombings in Turkey have stalled TRY appreciation momentum and Russian Ruble seems to be stuck before the Central Bank decision.

Overall, risk on trend continues at open with commodities pushing higher, but world interest rates have gapped higher on a weekly basis and we could see a correction in commodity prices.