Risk rally continues, though the momentum on equities has died out a bit this morning. The most obvious reason is Japan. Equities stalled after BOJ Governor Kuroda's speech where he plainly said they would need to see the effects of their last move to weigh other options. China eased fiscal stance and set a 6,5-7% growth rate target for 2016 and accepted slower growth is ahead. As the equity rally came to a halt, FX has held onto levels as ECB rate decision approaches.

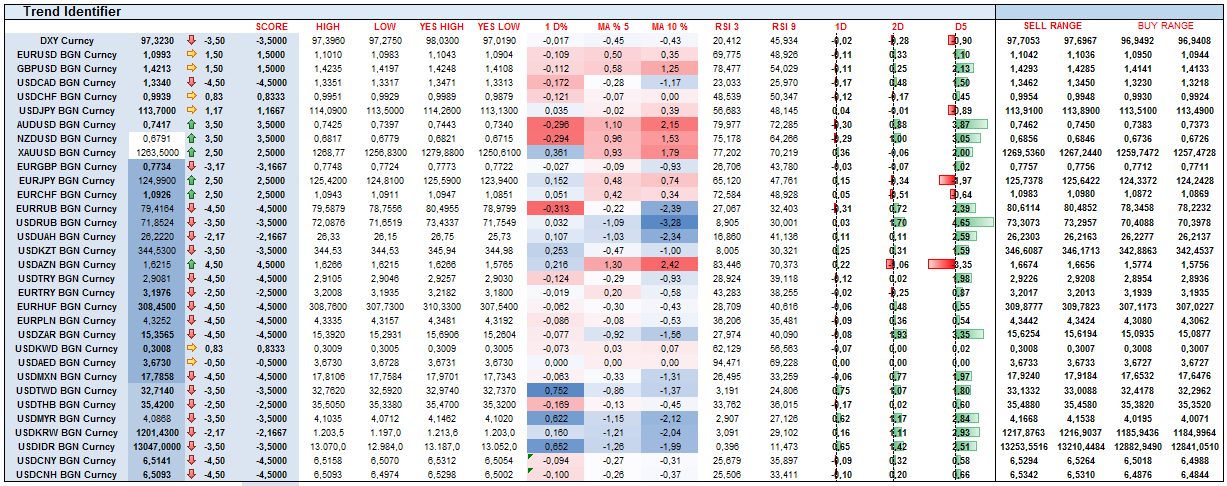

Commodities are still firm, with oil and iron ore both rallying with the Chinese fiscal easing promise. AUD, CAD and RUB have led the rally this morning. Emerging Market currencies TRY, ZAR, PLN and HUF have rallied strongly and CNY was fixed higher. Asian Emerging Market currencies KRW and IDR joined the rally as well. GBP and EUR rallies seem to have stalled here. USD/JPY remains vulnerable even with US rates rising. Gold has kept pushing higher but 1270 area has been a strong resistance and the trend seems to have stalled there as well.