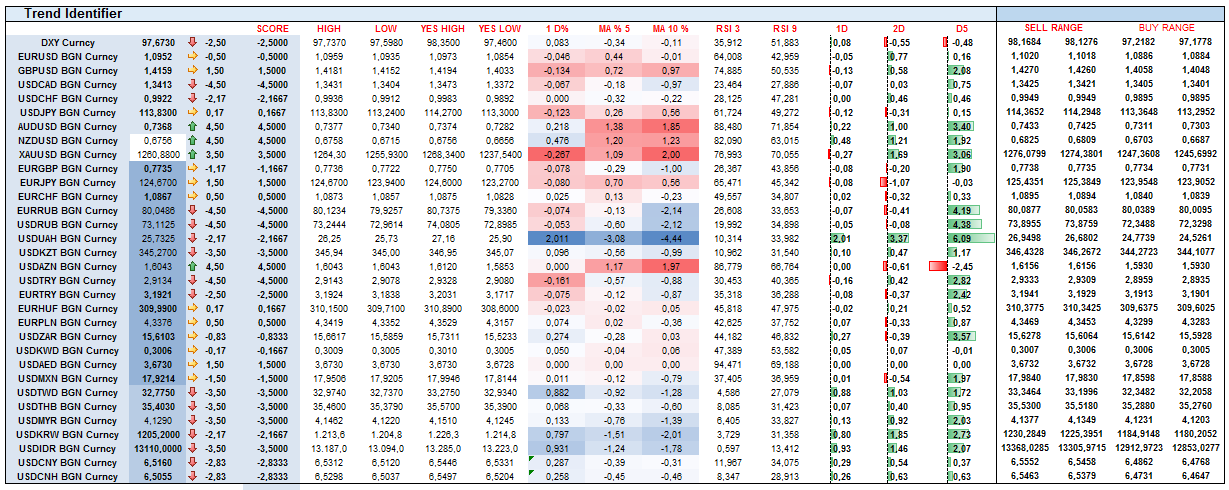

Yet another day of commodity strength yesterday evening. CAD, AUD, NZD and gold lead the way, and they are still strong in Asia.

EUR/USD was pushed higher from 1,0850s to 1,0950s during the day as the yield differential pushed the spot higher. Oil has gained some ground and metals have done well in grinding higher. USD overall has lost some ground since the ADP data, and it seems for USD to pick up real momentum we need a data well above 200K today. I would say 230K should do it.

Emerging Market currencies are stronger. Yesterday's positive close has helped Asia open in a positive mood. CNY appreciated and was fixed higher. Almost all Asian EM gained ground except for JPY. In Asia, TWD, THB and MYR are the strongest trenders. Yesterday TRY and RUB did well, but ZAR was somewhat under performing as it has done for some time now.

Central European EM currencies PLN, HUF and RON have lagged with the appreciation of EUR.