Currencies are trading higher ahead of the Federal Reserve’s monetary policy announcement. Stronger-than-expected U.S. ADP numbers reassured investors that the central bank won’t say anything particular damaging to the U.S. dollar. In a few short hours, the Federal Reserve will deliver its monetary policy decision. Central bank meetings are traditionally one of the most market-moving event risks for the forex market and based on the recent consolidation in FX, currency traders are waiting anxiously for a big announcement. Unfortunately they will need to keep on waiting because the Federal Reserve is widely expected to leave the size and scope of its Quantitative Easing program unchanged. There’s even a good chance that the August FOMC statement will contain the same language as the June statement.

Dollar Outlook

For the U.S. dollar to weaken on the heels of the FOMC meeting the Federal Reserve would need to upgrade its level of concern for the U.S. economy or downgrade its economic assessment and neither is expected to happen. At the same time, for the dollar to rally, the Federal Reserve would need to sound less pessimistic about the domestic and global economy which is something they will refrain from doing ahead of the ECB meeting. Most of the recent stability in European bond yields, currencies and equities can be tied back to expectations for more support from the central bank. If the ECB fails to deliver, European yields could soar and the euro could sell-off once again, wrecking more havoc for the Federal Reserve.

When the Fed Chairman last spoke, he made it clear that they are ready to act if needed and that their challenge right now is figuring out whether the “loss of momentum in the economy is enduring.” Since the last monetary policy meeting in June, we have seen very little evidence of directionality in the U.S. economy and without enough improvement or deterioration in economic data, policymakers will most likely choose to pass on QE3 in August.

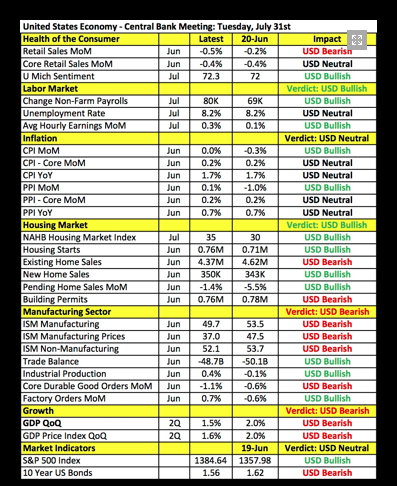

The following table shows how the U.S. economy has performed since the last monetary policy meeting. As you can see, there have been improvements and deterioration but at the end of the day, the U.S. economy is weak.

Why Wait 'Til September?

A big reason why the Fed is expected to stand pat today is because September is a much better month for a monetary policy change. By then, we will have two more non-farm payroll reports and another retail sales report. If QE3 is still needed, Bernanke could signal his plans at the annual Jackson Hole Economic Summit of central bankers in late August. Both the 2010 and 2011 Jackson Hole Summits were Bernanke’s venue of choice for signaling a major change in monetary policy – in 2010, Bernanke delivered his infamous speech that tipped off the market that QE2 was on the way and in 2011, he expanded the FOMC meeting from 1 to 2 days to outline the details for Operation Twist. The latest FOMC forecasts would have also been released by then, giving central bank officials some concrete projections to base their decisions on. Bernanke could use the Jackson Hole Summit to signal a potential change, make the adjustment in September and then answer questions at the quarterly monetary policy meeting press conference scheduled for September.

If the FOMC meeting turns out to be a nonevent like we expect, all eyes will shift to Thursday’s European Central Bank rate decision and Friday’s non-farm payrolls report.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Traders Chomping At FOMC Bit

Published 08/01/2012, 11:31 AM

Updated 05/14/2017, 06:45 AM

FX Traders Chomping At FOMC Bit

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.