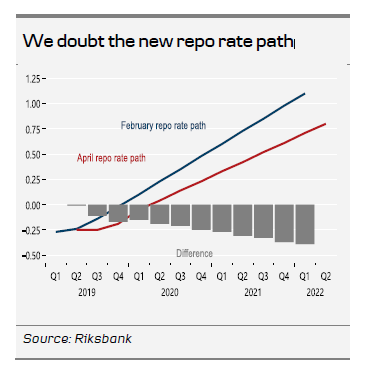

Our forecast on EUR/SEK, lower for the 1-3M horizon toward 10.20 and then higher over the 6-12M horizon toward 10.50, was based on a macro call in which the Riksbank would come across as hawkish at the April meeting while eventually realising that the hike pencilled in for 2019 was not going to materialise. Admittedly the April meeting did not really turn out as we thought. Instead of the hawkish surprise that we envisaged, where they would leave the repo rate path intact and signal an end to QE, they delivered something completely different, namely a substantial downward revision of the repo rate path now signalling a hike in either December 2019 or early next year alongside a continuation of reinvestments in the QE programme (for more details, see Reading the Markets Sweden , 26 April). The decision effectively sent EUR/SEK from 10.50 before 09:30 to a 10.66 high soon after. Since, then the cross has corrected somewhat.

The starting point now is that the money market is pricing in 8bp for 2019 (15bp before the Riksbank decision) and 17bp until July 2020 (24bp before the Riksbank). That is still too much according to us, not least given the fact that our inflation forecast clearly undershoots the Riksbank's, in particular, from the end of this year when it sees a sharp and rather peculiar rebound in inflation. Moreover, the Riksbank actually raised the growth forecast, with its 2019 estimate at 1.7% seeming too optimistic according to us unless the euro area snaps back. As a result, the Riksbank effectively lowered the bar for growth disappointments going forward. Given the policy action, Mr Ingves sounded remarkably positive on the economic outlook. Too optimistic probably. In fact, we already see a clear decline in private businesses' hiring plans, employment growth has stopped, and unemployment is slowly moving up. In the near term we are keen to see how the Board members reasoned with respect to the repo rate path when the Minutes are released on 7 May: whether all members agreed it was appropriate to delay the next hike or if some doubts were expressed. A potential market mover. In terms of data, we are back in a situation where inflation numbers will be most important for the Riksbank and thus for markets.

As a result, we think that inflation and growth alike will surprise on the downside and as such we stick to our call that there will be no hike in 2019 and probably not in 2020 either. From a foreign exchange perspective it means continued cyclical headwinds for the krona.

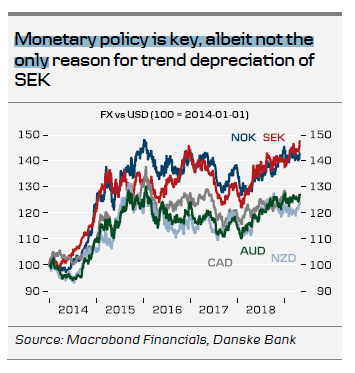

We have long argued that the fundamental, valuation-based, backdrop for the krona is not as constructive as it has been and as many observers, not least the Riksbank, seem to think. In fact we would argue that the shrinking external balances, where the trade balance in goods has turned negative and the current account as a share of nominal GDP has dropped to 1-2% (6-8% a few years ago), help to explain the real depreciation of the krona over the recent years. Our MEVA model suggests that productivity growth and terms of trade are also part of the reasons for the krona's underperformance. Hence, there are fundamental reasons to believe that the SEK is not prone for a substantial recovery any time soon.

In all, we maintain our medium-term bearish view on the SEK, but after the Riksbank we no longer see a trigger for a near-term correction lower in EUR/SEK. We therefore lift the 1-3M forecast to 10.60 (from 10.35 and 10.20 respectively), the 6M estimate to 10.70 (10.40) and 12M to 10.80 (10.50).