GBP has priced in a lot of Brexit optimism in terms of negotiations between the EU and the UK. However, from here, it may not take much of a change in politics to get a large, negative repricing of GBP. We recommend considering hedging at these levels with a strong spot, thus removing high risk.

GBP has rallied on optimism, but not much more

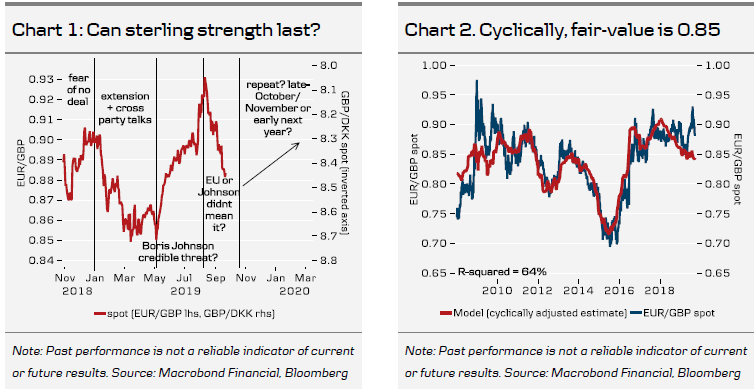

In the past month(s), EUR/GBP has moved lower from 0.93 and the key catalyst has been the notion that the EU and UK might resolve their issues. We've seen a new low at 0.88 (GBP/DKK just shy of 8.50) as EU's Juncker was quoted saying that a deal could 'maybe' be reached before the October deadline and GBP rallied accordingly. We view this re-pricing since August as fair but unstable: rising expectations of a decent Brexit solution and/or extension do indeed lower the probability of seeing an immediate increase in tariffs and a recession for the UK, see What if: no-deal Brexit scenario for EUR/GBP .

Consider getting hedges in at these levels

Following the recent GBP rally, we stress that it will take only minimal negative news to substantially reprice GBP spot (Chart 1). In terms of possible outcomes, our cyclical fair-value estimate for EUR/GBP is 0.85 (Chart 2) and a full no-deal takes sterling close to, but below, 1.0. But, even with an extension, we should not reprice all the way to cyclical fair value as an extension would be accompanied by an election and thus renewed political risk. In turn, this will put pressure on the weak economy which could move lower as uncertainty is extended. The result of an election is not clear either, but it does have the potential to add volatility back in to GBP. From an FX perspective, we observe that GBP can often be seemingly 'irrational' in the pricing of realistic political outcomes versus headline-driven news and be quite momentum driven. Thus, in October and ahead, we see scope for repricing risk in EUR/GBP, when viewed from the stance of today's optimism. Our base case remains a Brexit extension will be needed once more, with the risk of a renewed drop in GBP being omnipresent; we target EUR/GBP at 0.90 in 3M (NYSE:MMM). In light of this, we consider the risk-reward from locking in GBP income favourable at current levels.