Strategic unique Norway case highlighted by Regional Network and inflation print.

Short-term factors have weighed on NOK; we expect these to fade.

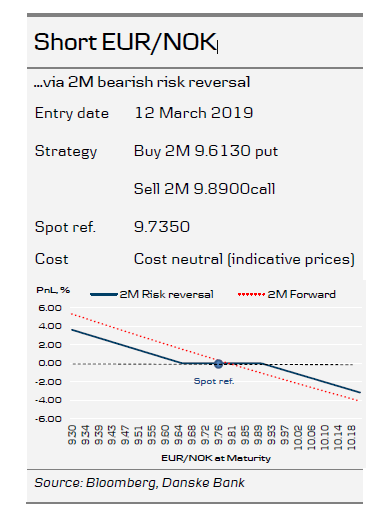

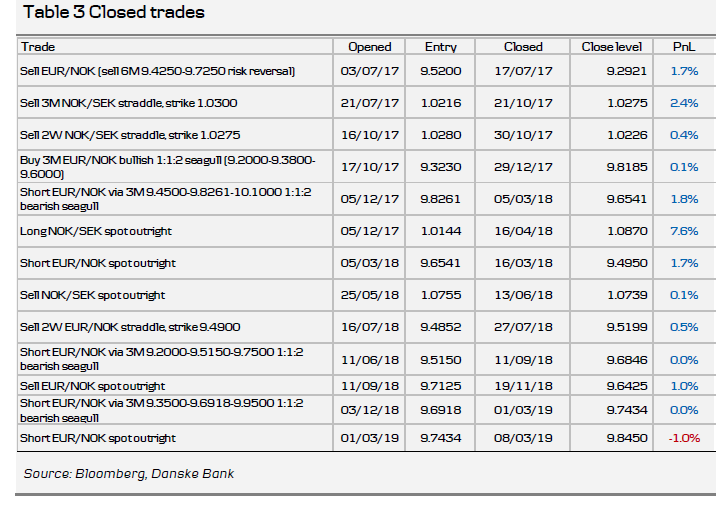

Given last week's price action, we prefer to express our bullish NOK view via options and see the 2M potential as the greatest. We remain long NOK/SEK spot outright.

On the back of this morning's Regional Network Survey and yesterday's inflation surprise, we recommend selling EUR/NOK via a 2M bearish seagull (cost neutral) as the cleanest play on a stronger trade-weighted NOK. We believe the latest NOK weakening is due to temporary factors and that large option expiries last week tied NOK more closely to SEK weakness than usual (see FX Strategy - Respect price action but look to resell EUR/NOK, stay long NOK/SEK , 8 March). The key trade arguments are as follows.

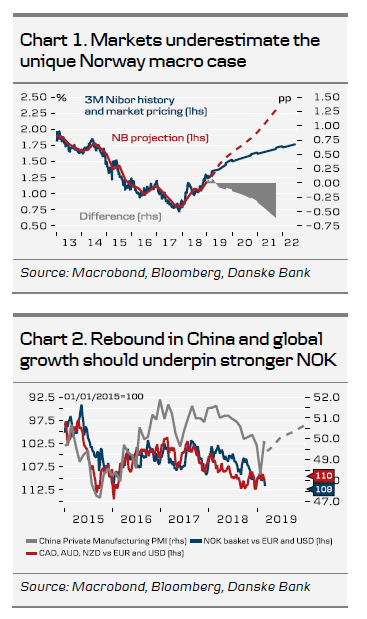

Relative growth. Norway's macro case is unique relative to peers, with lower breakeven oil prices, large infrastructure investments, petroleum industry heavy exports and a big rise in real disposable income shielding it from weaker global growth impulses. Today's Regional Network Survey confirmed mainland growth above trend potential in 2019.

Relative rates. Norges Bank is set to hike policy rates by 25bp on 21 March. Since the December inflation report, mainland growth, the labour market, housing, realised wage growth, Nibor-policy rate spreads, the oil price and the NOK have become arguments for a considerably higher rate path. In our view, markets still do not sufficiently appreciate Norway's shielded macro position (in contrast to 2014-16) relative to peers and we think investors have focused too much on externals and, recently, on a dovish ECB. Meanwhile, we think there is little reason to expect major shifts in the short-end of Norges Bank's rate path at the next meeting. It may lower the rate path somewhat in the long-end but markets already price a much softer version of this at an accumulated 40bp for end-2019, 51bp for end-2020 and c.63bp for end-2021. In comparison, in December, Norges Bank signalled five 25bp rate hikes over the next three years. Notably, as recently as last week, Norway Statistics projected two rate hikes in both 2019 and 2020, despite cutting its eurozone GDP growth forecast to 1.2% for 2019 and only 1.1% for 2020. In other words, Norway is different; Norges Bank's monetary policy is now much less sensitive to ECB shifts than before and from a carry-to-risk perspective, NOK is set to look increasingly attractive.

Structural liquidity. In Reading the Markets , we have been pointing out the connection between structural liquidity and the NOK. Over coming weeks, structural liquidity is set to tighten further (see here ). In addition, Norges Bank has stepped up its NOK purchases.

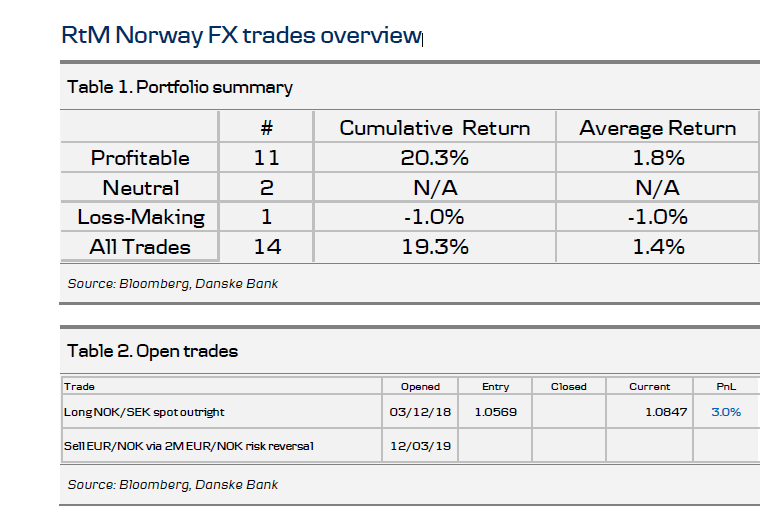

Global environment. According to our aggregate sentiment indicator, markets remain negative on risky assets (Z-score -0.8). Meanwhile, we think sentiment has become too negative and with the latest dovish shift from the Fed, substantial easing from the Chinese authorities and a likely trade deal (see here ), we expect the global environment to increasingly support commodities, oil and hence G10 commodity currencies (Chart 2).

In light of recent price action and with volatility at neutral-to-cheap levels according to our valuation models, we prefer to express this strategic view via options. The biggest risk factor for our call is if we are wrong in our constructive view on global growth, risk-off weighing on risky assets including oil and a WTO-hard Brexit (see here ).