FX markets were cornered by a triple blow of a negative oil supply shock, negative trade shock and a negative monetary policy shock in the first week of May, triggering a significant global disinflationary shock.

We take a top-down view and argue the effect on G10 currencies works through (1) the impact of a bond rally and commodity price slump and (2) the (lack of) ability by individual central banks to respond to the disinflationary shock.

We could see the carry game turned upside down and negative yielding, i.e. CHF, JPY and EUR outperform high-yielding currencies, e.g. USD, AUD and NZD.

Perfect storm hits markets in May

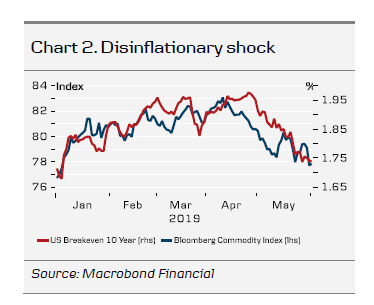

The global FX market was hit by a negative oil supply shock, a negative trade shock and a negative monetary policy shock in the first few days of May, when in the span of a week waivers on US sanctions on Iran expired, the US escalated the trade war with China and the Federal Reserve struck a surprisingly complacent tone when faced with recent economic jitters. The perfect storm led to a repricing of global asset and commodity markets and left its mark on the FX market. During May, the JPY and CHF rallied, while the GBP, AUD, NZD and NOK were losers (see Chart 1). GBP has its own domestic issues after Prime Minister Theresa May stepped down but the latter three have largely been in the hands of global sentiment.

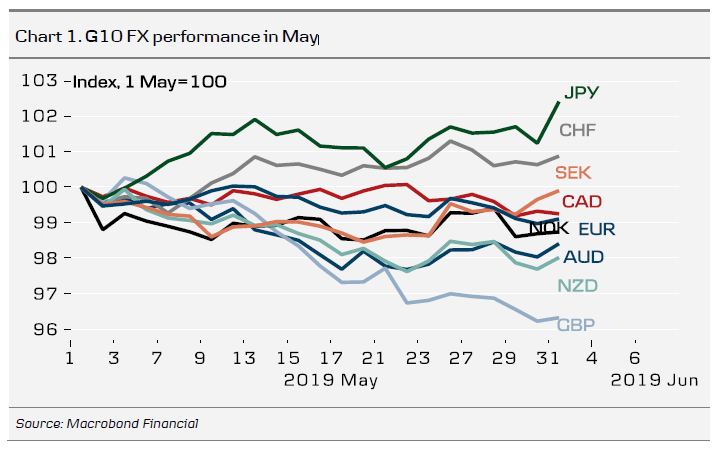

Looking at financial markets from the helicopter, it seems evident to us that a disinflationary shock has hit the global economy, resulting in a sharp bond market rally and a slump in commodity prices. It is likely this is the result of multiple shocks hitting at exactly the same time. Rather than engaging in partial analysis of the impact of the separate shocks, below we apply a top-down analysis of G10 currencies, with the focus on the effect of the sharp bond rally, fall in commodity prices and likely monetary policy response to the disinflationary shock.

JPY and CHF winners of the bond rally

The bond rally in May saw among other things the 10Y German government bond yield fall to a new all-time low. In FX markets, the winners and losers of such a significant rally in bond prices depends on who owns the bonds to begin with. In Chart 3 on the right, we map the change in major currencies vis-à-vis the USD in May and the respective country’s net international investment position in portfolio debt securities (GBP is not included). Switzerland and Japan are the only two economies in the G10 who are net creditors in bonds – the euro area has started to move in that direction (Norway is a net creditor if the petroleum fund is included). Not surprisingly, JPY and CHF were the two big winners in May. At the other end of the scale, we find just about everyone else. What stands out in this perspective is the relatively strong performance of SEK in May.

NZD, AUD, NOK losers on the commodity sell-off

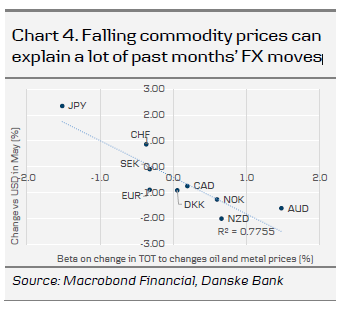

The price of crude oil and other major commodities such as copper plunged 10% in May. The sell-off could easily have been more severe if the US had not stepped up sanctions against Iran, while OPEC+ is still adhering to the output cut deal from November 2018 – these factors kept a tight grip on crude oil supply and acted as a mitigating factor. The repricing of commodity markets hit FX markets through a shock to terms of trade (TOT) – exporters become worse off and importers better off. We illustrate this effect in Chart 4 on the right. This maps the correlation between the beta of changes in TOT to changes in oil and metal prices and the change in currencies vis-à-vis the USD in May. Japan is the only country in the G10 that experience a significant terms of trade gain when commodity prices fall, which in turn coincides with JPY outperformance over the past month. The three biggest losers (disregarding GBP for the before-mentioned reasons), NZD, AUD and NOK are also where we see the highest positive beta to commodity prices.

Carry game turned upside down

If for some reason markets reverse in June, the beta coefficients highlighted above still apply and we would expect the currency moves of May to reverse. However, we doubt this will be the case, which means that markets should soon start to focus on how central banks will combat the disinflationary forces currently at play.

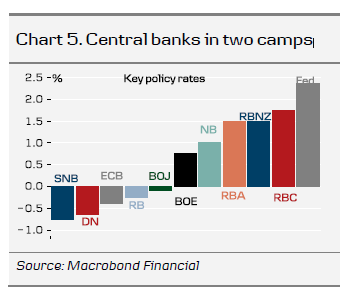

Last time the world economy was hit by a significant disinflationary shock, from 2014 to 2016, central banks met the shock head first – SNB set world-record low policy rates, the ECB went all in on QE and negative rates and the BoJ became the fifth central bank in the G10 to test the uncharted waters of negative rates. However, these three central banks never got around to tighten monetary policy after the 2014-16 shock and will thus face a test of their willingness to move further into the unknown. In contrast, the Fed, RBC, RBNZ, RBA, NB and BoE all have policy rates above zero and thus room to reflate (see Chart 5 on the right for a ranking of G10 policy rates).

From an FX market perspective, we think the potential for currency appreciation right now lies with currencies of central banks with sub-zero policy rates – they are more likely to be reluctant to ease monetary policy and will thus face an appreciation of their respective currencies, i.e. in particular CHF, JPY and EUR. In contrast, the USD may offer attractive carry at present but the Fed also has the most room to ease and weaken its currency. Next in line are the CAD, NZD and AUD, while we are a bit cautious about interpreting the NOK in this context due to the strong domestic backdrop. Right now, we have a strong conviction to sell USD when the Fed blinks as we touched on in FX Strategy – Policy inaction keeping a lid on EUR/USD, 21 May, and FX Edge – Sell USD when you see the Fed put, 27 May.