In our view, the Swedish dividend season tends to spark SEK bashing on dubious grounds.

We think reinvesting of dividends is default for most investors.

April weakness in the SEK has primarily related to macro data and the Riksbank.

The Swedish dividend season is approaching and with it recurrent SEK bashing (as if it has not already been bashed enough). The reasons are that the payouts are very large and concentrated in time around April (late March-early May), foreigners hold a large stake in the big companies and there seems to be a compelling seasonal pattern where EUR/SEK has often risen in this period.

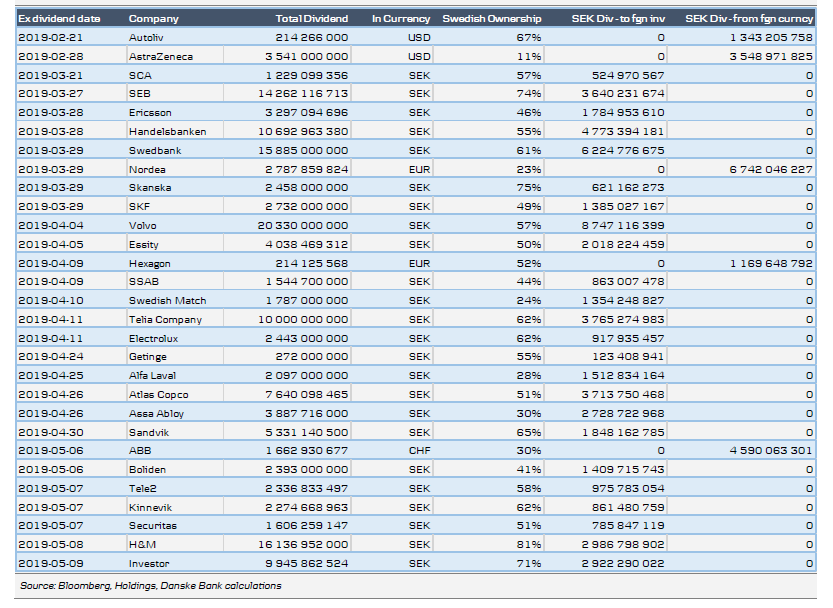

Total dividends on the Large Cap List is SEK285bn in 2019. The total amount paid in SEK is SEK183bn, while the rest is paid out primarily in USD, EUR or CHF. Foreign ownership is 38.2% (2018), which suggests a maximum outflow of SEK70bn. However, the SEK-negative flow story rests on the rather strong assumption that dividends are repatriated to the owners' home currency. If the foreign owner reinvests the money in the company, no flows will occur. We think reinvesting is default for most investors, so argue that the dividend flow story tends to be exaggerated in terms of SEK impact.

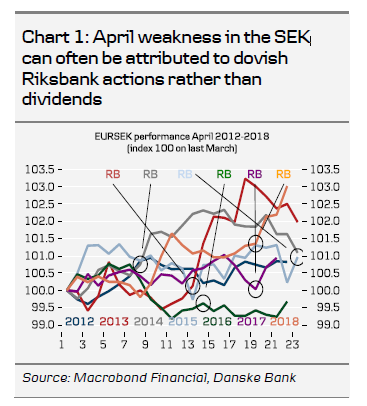

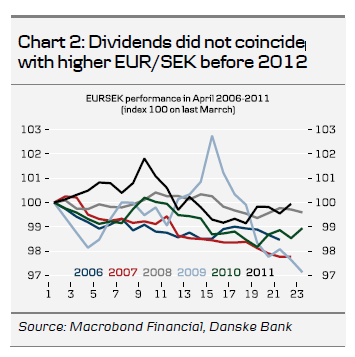

How has the SEK performed over past dividend seasons? Of the seven Aprils since 2012, EUR/SEK has risen in six and fallen in only one (Chart 1). However, for the six years before that EUR/SEK fell every year in the period (Chart 2). This begs the question of whether seasonality really relates to dividends or whether there is something else. The usual suspect behind SEK weakness in recent years is the Riksbank. When we go through the April policy releases from the Riksbank in this period, we find that in most years they have prompted a negative reaction in the SEK. Controlling for the Riksbank events, there has been no evident April weakness in the SEK. On this note, we would not be surprised if the April meeting in 2019 is on the dovish side.

This said, EUR/SEK has often made non-negligible, though transitory, moves on big dividend days and, therefore, we highlight two dividend-heavy periods. Nordic banks are concentrated at the end of March, with foreigners set to receive SEK11.6bn (Swedbank, SEB, Svenska Handelsbanken) and Swedish owners SEK6.7bn (Nordea). Here, we cannot rule out the recent problems surrounding Nordic banks affecting decisions to reinvest or repatriate and thus net SEK flows. On 4 April, there is a big amount when Volvo pays out SEK8.7bn. Finally, there is a big chunk in the last week of April, with foreigners set to receive around SEK9.8bn. Here, the decision whether to reinvest may be affected by the substantial depreciation of the SEK, which in our view should weaken the incentive to repatriate.

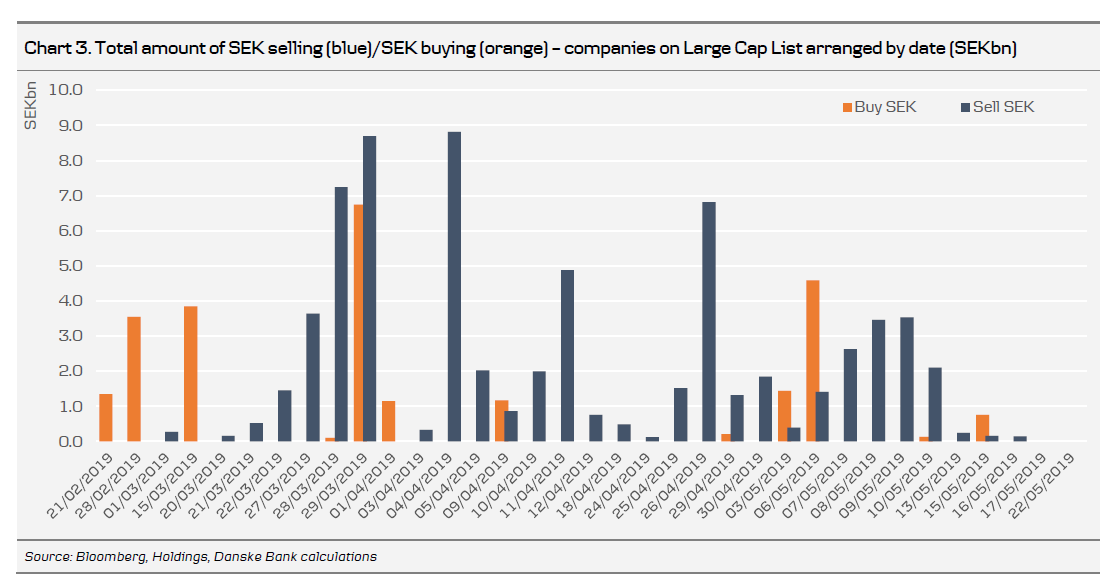

Chart 3 overleaf displays the total amount of SEK selling (blue)/SEK buying (yellow) stemming from large caps arranged by date under the technical, though unrealistic, assumption that the owners would repatriate the whole amount (SEKbn). Table 1 lists the individual companies in OMX 30 with their respective total dividends, the Swedish ownership share and the computed amount of SEK selling/buying.