Investing.com’s stocks of the week

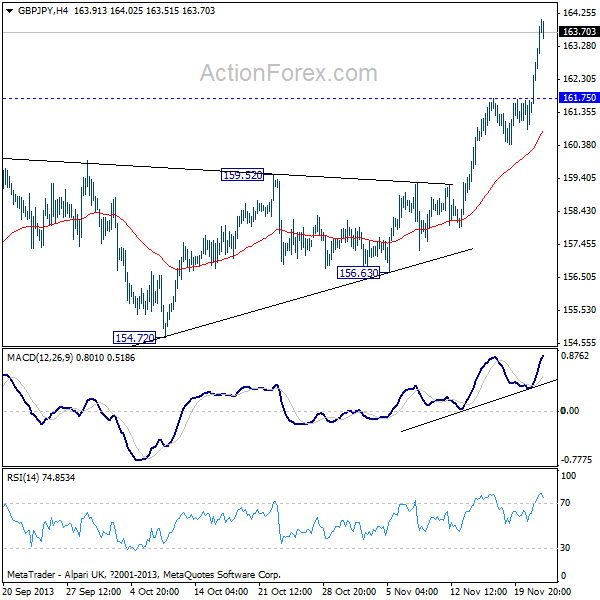

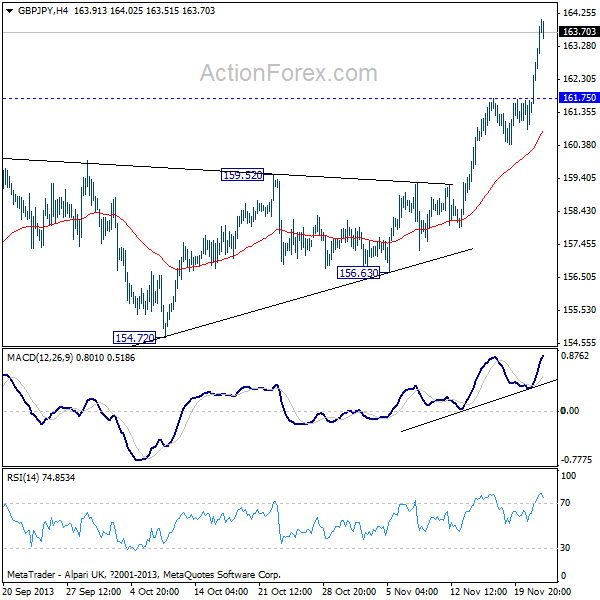

GBP/JPY Daily Outlook

Daily Pivots: (S1) 161.94; (P) 162.91; (R1) 164.81;

GBP/JPY rises to as high as 164.07 so far today and intraday bias remains on the upside for the moment. The decisive break of 163.05 indicates strong upside momentum. Current rally would now be targeting long term fibonacci level at 168.11 next. On the downside, break of 161.75 support is needed to signal topping. Otherwise, outlook will stay bullish.

In the bigger picture, considering bearish divergence condition in daily and weekly MACD, the up trend from 116.83 might be close to completion. Break of 156.77 resistance turned support should confirm medium term topping and bring correction back to 147.61 support and below. However, sustained trading above 163.05 will argue that further rally would be seen to 38.2% retracement of 251.09 to 116.83 at 168.11 before GBP/JPY sees strong resistance.

GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" width="600" height="600" />

GBP/JPY" width="600" height="600" />

GBP/JPY" width="600" height="600" />

EUR/JPY Daily Outlook

Daily Pivots: (S1) 135.01; (P) 135.71; (R1) 137.04;

EUR/JPY rose to as high as 136.54 so far and intraday bias remains on the upside. Current rally should extend towards 139.21 resistance. But at this point, we'd still expect strong resistance from there to bring reversal eventually. Meanwhile, on the downside, break of 134.10 will turn bias back to the downside for 131.21 key support level.

In the bigger picture, EUR/JPY is expected to top out in medium term soon, on lost of upside momentum as seen in daily and weekly MACD. Strong resistance is expected from 139.21 and 61.8% retracement of 169.96 to 94.11 at 140.98 to complete the rally from 94.11. Break of 131.21 would confirm and would bring correction back towards 124.95 support and below.

EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" width="600" height="600" />

EUR/JPY" width="600" height="600" />

EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 161.94; (P) 162.91; (R1) 164.81;

GBP/JPY rises to as high as 164.07 so far today and intraday bias remains on the upside for the moment. The decisive break of 163.05 indicates strong upside momentum. Current rally would now be targeting long term fibonacci level at 168.11 next. On the downside, break of 161.75 support is needed to signal topping. Otherwise, outlook will stay bullish.

In the bigger picture, considering bearish divergence condition in daily and weekly MACD, the up trend from 116.83 might be close to completion. Break of 156.77 resistance turned support should confirm medium term topping and bring correction back to 147.61 support and below. However, sustained trading above 163.05 will argue that further rally would be seen to 38.2% retracement of 251.09 to 116.83 at 168.11 before GBP/JPY sees strong resistance.

GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" width="600" height="600" /> GBP/JPY" width="600" height="600" />

GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 135.01; (P) 135.71; (R1) 137.04;

EUR/JPY rose to as high as 136.54 so far and intraday bias remains on the upside. Current rally should extend towards 139.21 resistance. But at this point, we'd still expect strong resistance from there to bring reversal eventually. Meanwhile, on the downside, break of 134.10 will turn bias back to the downside for 131.21 key support level.

In the bigger picture, EUR/JPY is expected to top out in medium term soon, on lost of upside momentum as seen in daily and weekly MACD. Strong resistance is expected from 139.21 and 61.8% retracement of 169.96 to 94.11 at 140.98 to complete the rally from 94.11. Break of 131.21 would confirm and would bring correction back towards 124.95 support and below.

EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" width="600" height="600" /> EUR/JPY" width="600" height="600" />

EUR/JPY" width="600" height="600" />