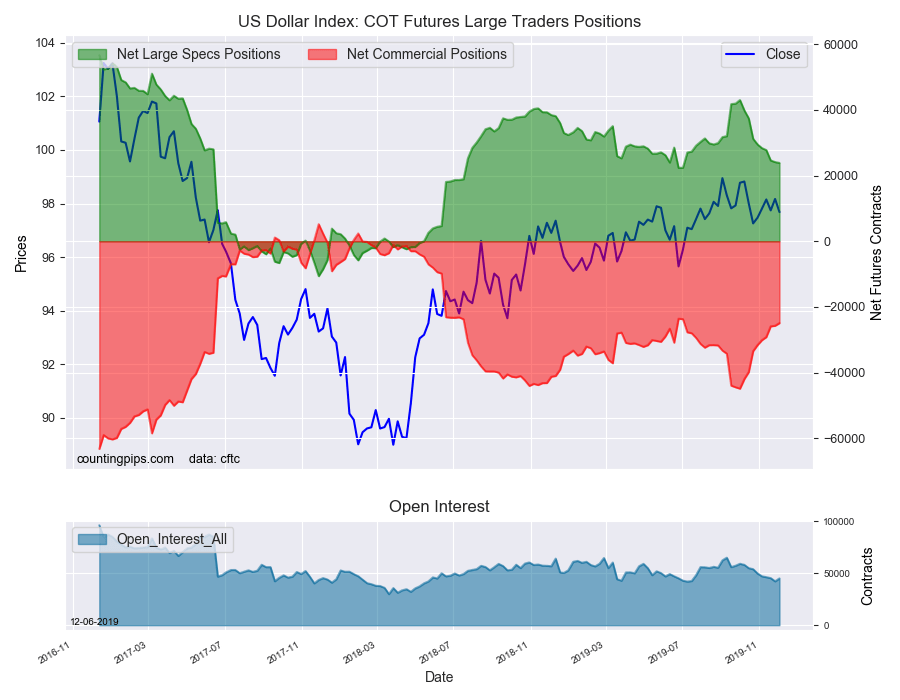

US Dollar Index Speculator Positions

Large currency speculators continued to lower their bullish net positions in the US Dollar Index futures markets once again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 23,877 contracts in the data reported through Tuesday, December 3rd. This was a weekly lowering of -261 contracts from the previous week which had a total of 24,138 net contracts.

This week’s net position was the result of the gross bullish position (longs) gaining by 1,949 contracts (to a weekly total of 31,182 contracts) compared to the gross bearish position (shorts) which saw an advance by 2,210 contracts on the week (to a total of 7,305 contracts).

US Dollar Index bets continued their downfall this week as positions have declined for nine weeks in a row and by a total of -19,151 contracts over that time. The dollar index positioning, despite the recent declines, remains bullish and has continued to stay above the +20,000 net contract level for seventy-seven consecutive weeks.

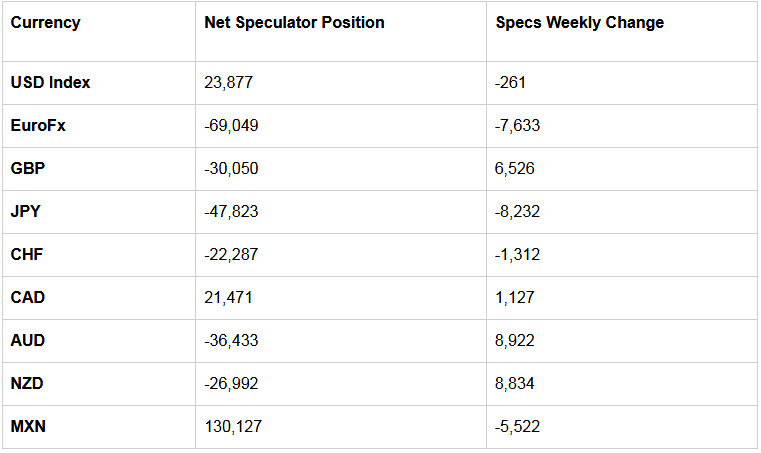

Individual Currencies Data this week:

Overall, the major currencies that saw improving speculator positions this week were the British pound sterling (6,526 contracts), Canadian dollar (1,127 contracts), Australian dollar (8,922 contracts) and the New Zealand dollar (8,834 contracts).

The currencies whose speculative bets declined this week were the US dollar index (-261 weekly change in contracts), euro (-7,633 weekly change in contracts), Japanese yen (-8,232 contracts), Swiss franc (-1,312 contracts) and the Mexican peso (-5,522 contracts).

Notables:

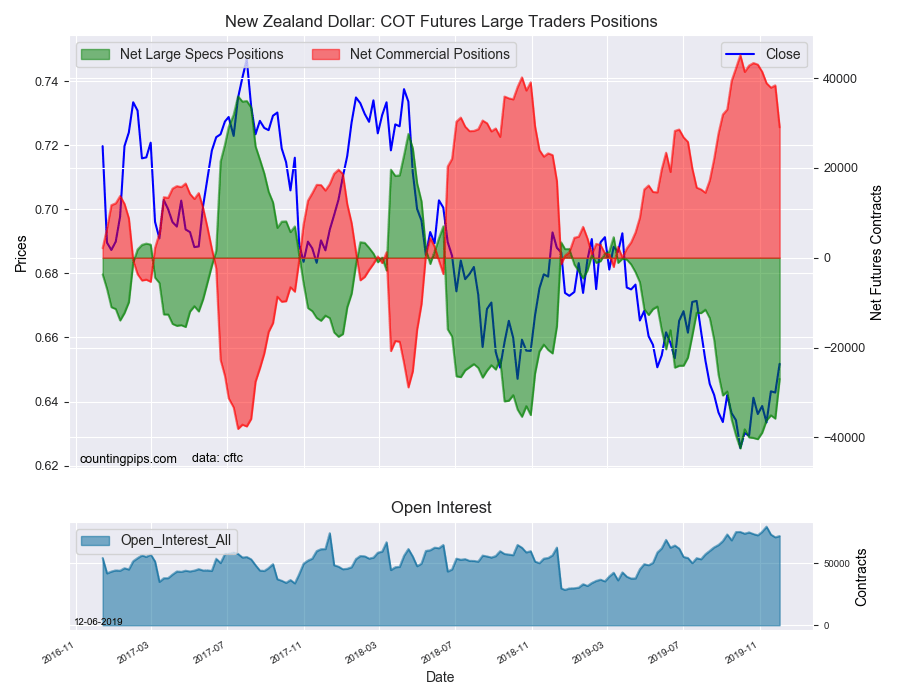

New Zealand dollar positions improved this week by over +8,000 contracts and have seen less bearish levels in four out of the past five weeks. The current level of NZD positions remains bearish at -26,992 contracts but is down from the record bearish position of -42,474 contracts that was recorded on October 1st.

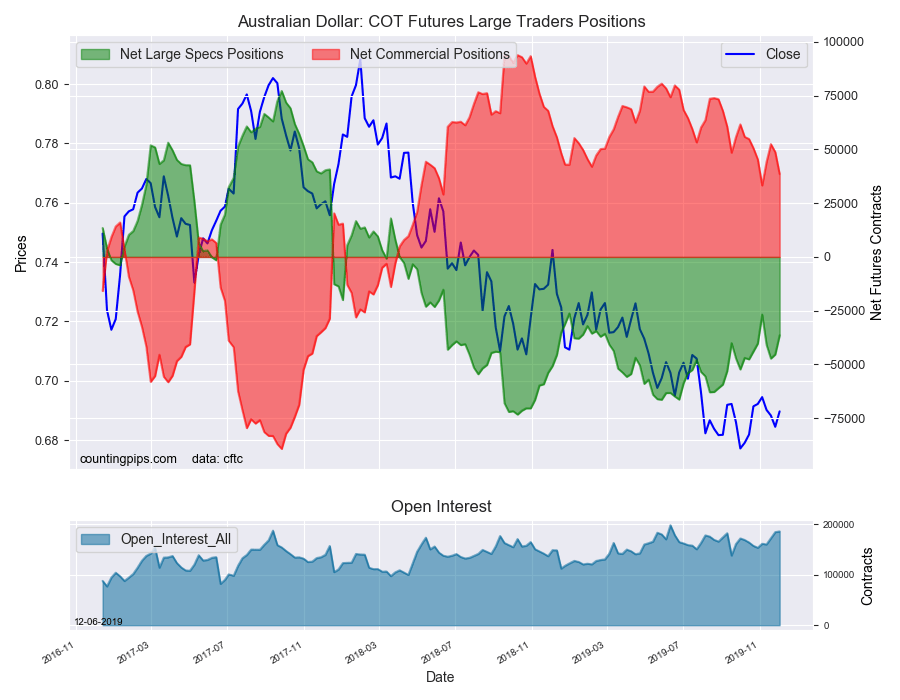

Australian dollar positions also improved this week by over +8,000 contracts and have seen better positioning in the past two weeks. AUD contracts still remain in bearish levels but bearish bets have declined to -36,433 contracts this week after spending thirty-five straight weeks above the -40,000 net contract level from March 5th to October 29th.

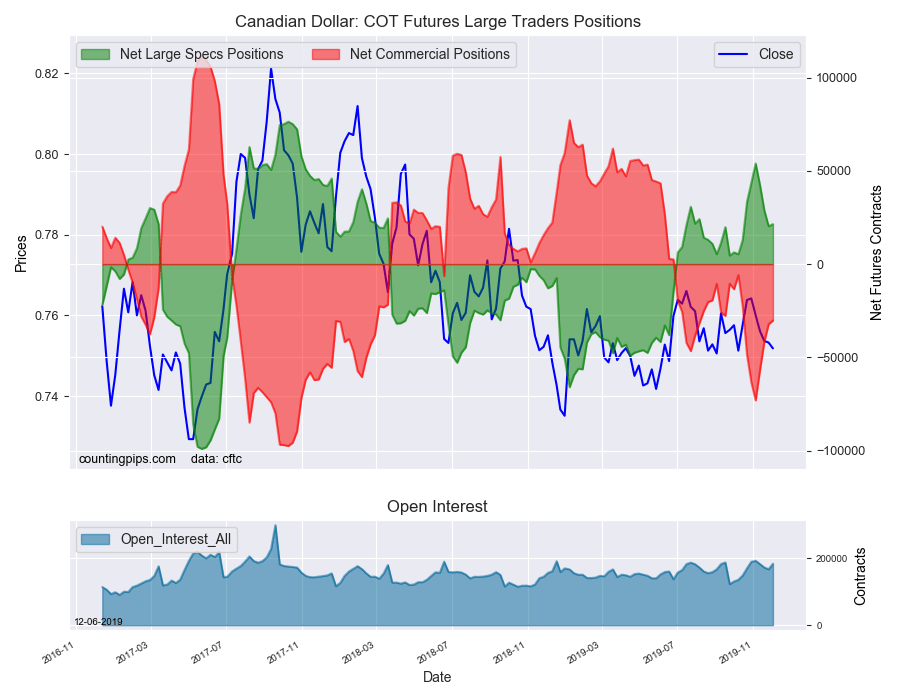

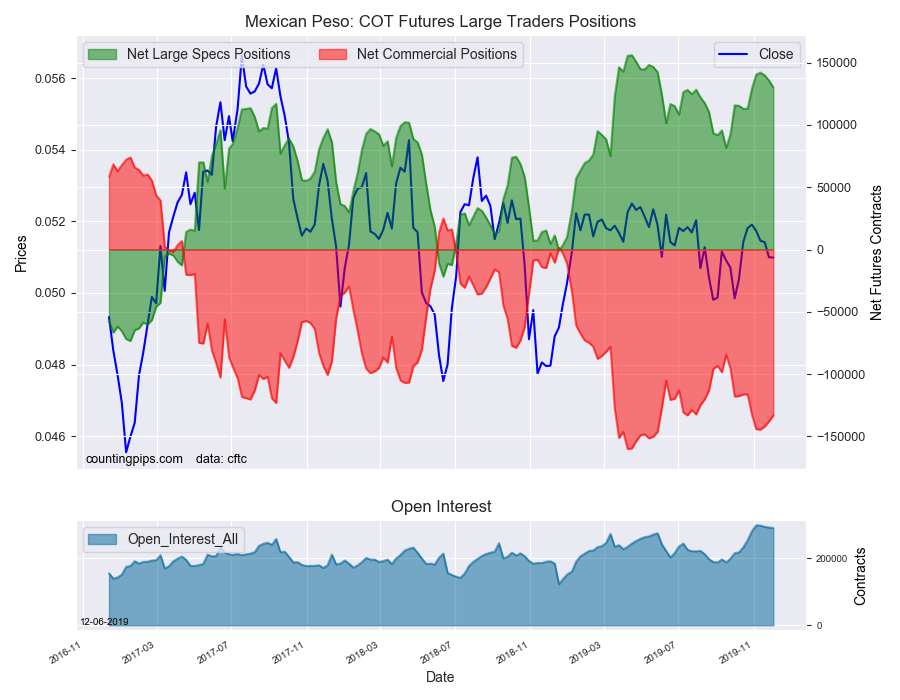

Canadian dollar positions rose slightly this week after having declined in the previous three weeks. Overall, the CAD positioning remains in bullish territory for the twenty-third straight week after turning bullish in early July. The Canadian dollar is only one of three major currencies currently with overall bullish net positions (USD Index and Mexican peso being the other ones).

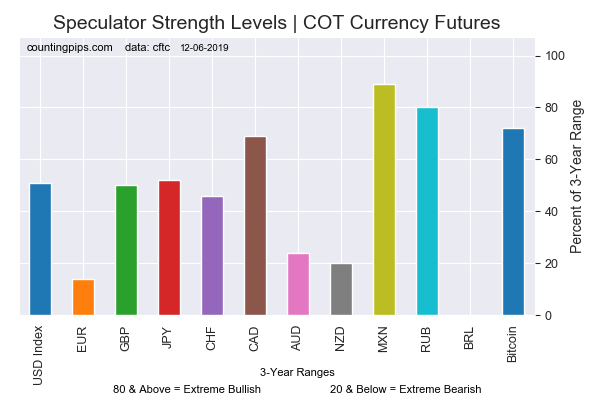

Chart: Current Strength of Each Currency compared to their 3-Year Range

See the table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

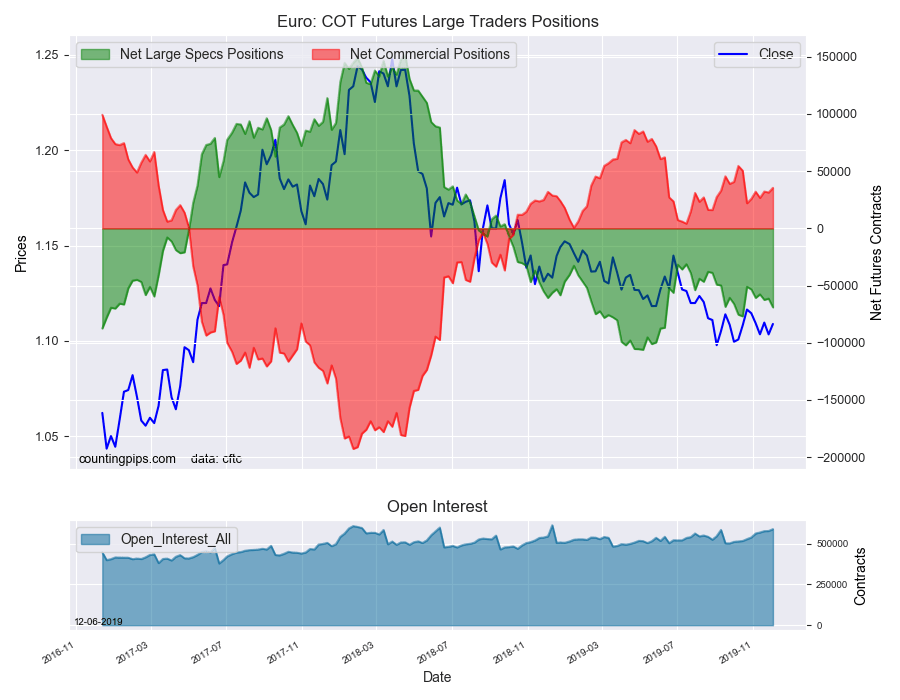

EuroFX:

The euro large speculator standing this week equaled a net position of -69,049 contracts in the data reported through Tuesday. This was a weekly fall of -7,633 contracts from the previous week which had a total of -61,416 net contracts.

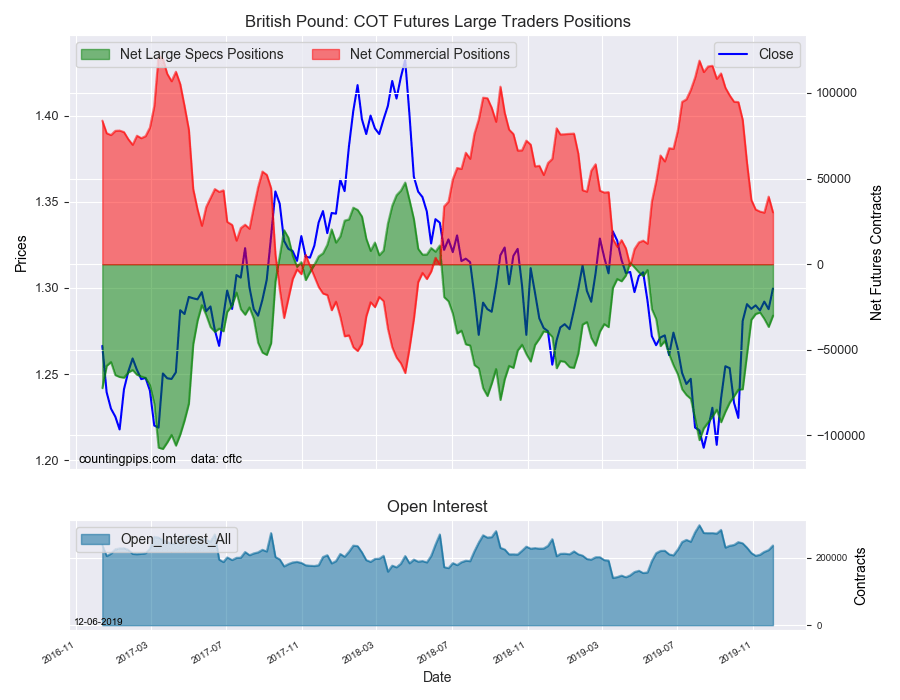

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -30,050 contracts in the data reported this week. This was a weekly gain of 6,526 contracts from the previous week which had a total of -36,576 net contracts.

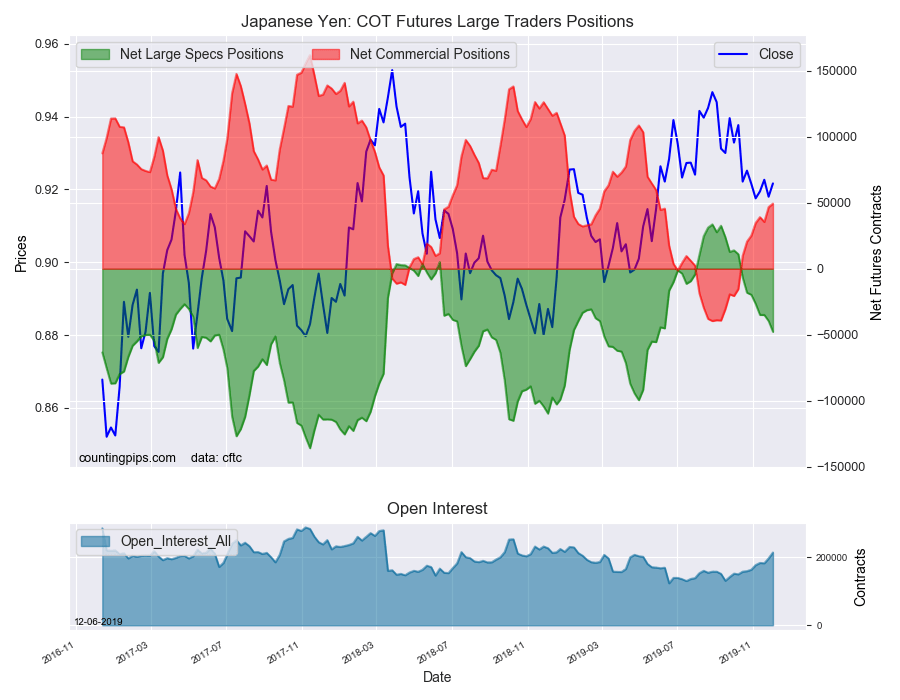

Japanese Yen:

Large Japanese yen speculators totaled a net position of -47,823 contracts in this week’s data. This was a weekly lowering of -8,232 contracts from the previous week which had a total of -39,591 net contracts.

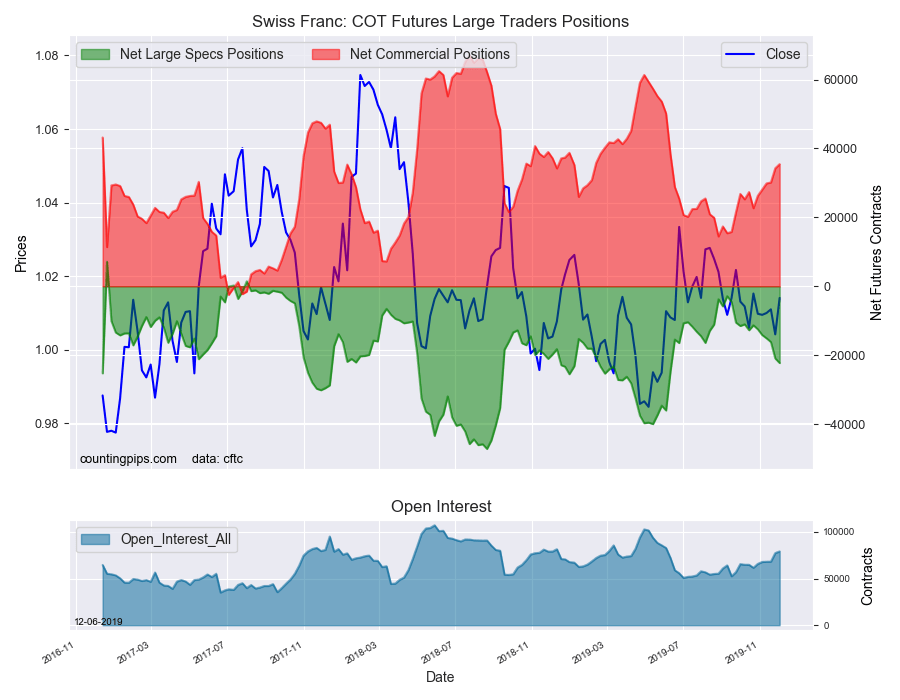

Swiss Franc:

The Swiss franc speculator standing this week equaled a net position of -22,287 contracts in the data through Tuesday. This was a weekly lowering of -1,312 contracts from the previous week which had a total of -20,975 net contracts.

Canadian Dollar:

Canadian dollar speculators was a net position of 21,471 contracts this week. This was a gain of 1,127 contracts from the previous week which had a total of 20,344 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures came in at a net position of -36,433 contracts this week in the data ending Tuesday. This was a weekly advance of 8,922 contracts from the previous week which had a total of -45,355 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing equaled a net position of -26,992 contracts this week in the latest COT data. This was a weekly increase of 8,834 contracts from the previous week which had a total of -35,826 net contracts.

Mexican Peso:

Mexican peso speculators equaled a net position of 130,127 contracts this week. This was a weekly fall of -5,522 contracts from the previous week which had a total of 135,649 net contracts.