Against all expectations, the markets barely reacted to statements released last week following meetings of the Bank of England and the European Central Bank. As expected, they left their respective key interest rates unchanged. However, there was nothing in their post-meeting statements to push the U.S. dollar out of the narrow range it has been trading in since last week. The event that finally pushed the Canadian dollar out of this range was an announcement by Jean-Claude Juncker, President of the Eurogroup, that despite the fact that Greece had agreed to the austerity measures demanded by the other members of the eurozone, the funds would still not be provided until Greece made a clearer commitment. The finance ministers want a written promise from the Greek leaders that the measures will be maintained even after the April elections. Last night, the Greek parliament approved a series of austerity measures required by the Troika (199 vs. 74). Essentially Greeks were faced with two choices: comply with the demands of the leaders of the single currency—which triggered more protests (let us remember that the unemployment rate in Greece was 20.9% in November)—or default on its sovereign debt and leave the eurozone. The second option would certainly have created turmoil in the markets, and questions would again have been raised about the solvency of European banks.

Canada

Very little economic news is expected in Canada this week. The only important figure, the Consumer Price Index for January, will be released on Friday. Analysts expect it to be 0.0%, up 0.5% from the last reading.

United States

Our neighbours to the south will have a more newsworthy week. We will have Core Retail Sales on Tuesday, FOMC Meeting Minutes from the latest meeting of the Federal Reserve on Wednesday, Building Permits for January on Thursday and a speech by Ben Bernanke in Arlington, Virginia on Thursday. As in Canada, the most important day will be Friday, with the release of the Consumer Price Index. It is expected to be 2.2%, or unchanged from last time.

International

The week’s international news begins straight out of the gate with the Bank of Japan’s decision on its key interest rate, to be released on Monday. On Tuesday, Australia will release employment data. Then on Wednesday we will know England’s Consumer Price Index and Germany’s ZEW Economic Sentiment Index. Also on Wednesday, Mervin King, the Governor of the Bank of England, will give a speech and a Eurogroup meeting will be held. On Friday, we are expecting the German Producer Price Index and Retail Sales in England. Naturally, we will continue to monitor the Greek saga closely. Have a good week!

The Loonie

“Do not think of yourself as being so important that others seem insignificant.” - Confucius

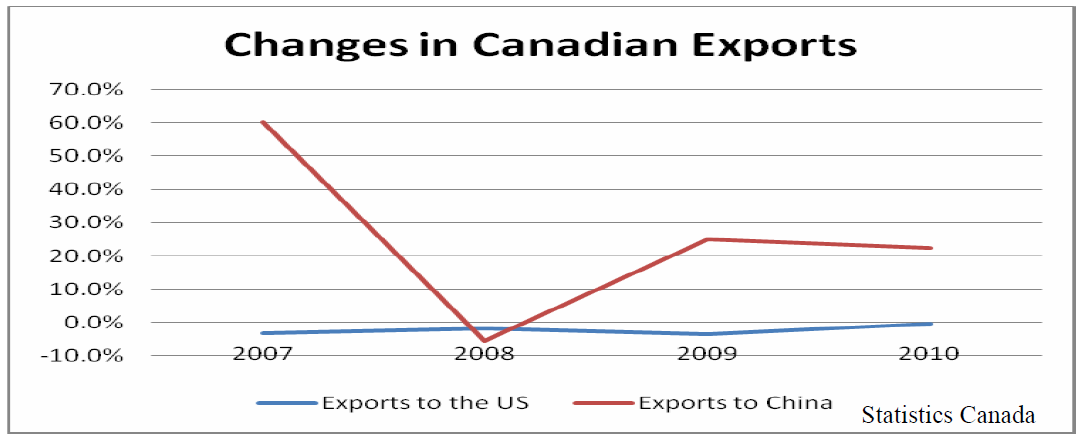

Last week Stephen Harper, the Prime Minister of Canada, began a five-day visit to China. The main objective of his visit is to leverage closer political relations for more economic cooperation between the two countries. This is laudable, since Canada is rich in natural resources and China has an immense appetite for them, due to its phenomenal economic growth. This is why business leaders from the Energy sector accompanied the Prime Minister, in order to sing the praises of the Northern Gateway project, which will deliver Alberta’s oil to Canada’s West Coast where it can be shipped to Asian consumers. Some will see this as a speedy response to the snub received from our neighbours to the south who have refused a proposed Canadian oil pipeline on U.S. soil. It should be remembered that the Keystone XL project, which would have carried Alberta’s oil to U.S. refineries on the Gulf of Mexico, was shelved due to environmental concerns in the U.S. However, Stephen Harper’s approach seems much closer to a narrative that has been gestating for some time among senior Canadian economic authorities. As the Governor of the Bank of Canada has recently pointed out, Canadian businesses must strive to develop new markets and business partnerships in order to minimize the impacts of a recession in Europe and an anemic recovery in the U.S.

As can be observed from the above graph, it seems like the efforts of the Canadian business sector have not been in vain. In fact, the level of Canadian exports to China has been steadily increasing since 2008 in stark contrast to the level of exports to the United States that have been generally diminishing over the past years. However, the Prime Minister is not the only one making an effort to encourage greater economic integration between China and Canada. The National Bank of Canada is also trying to facilitate trade with your Chinese business partners. NBC will soon allow clients to make direct trades in the Renmimbi, the currency of the Middle Kingdom. If you conduct business in China, we strongly recommend that you speak to your F/X trader about this new service. Have a good week.

Technical Analysis: (Friday, February 10, 2012) A beneficial correction

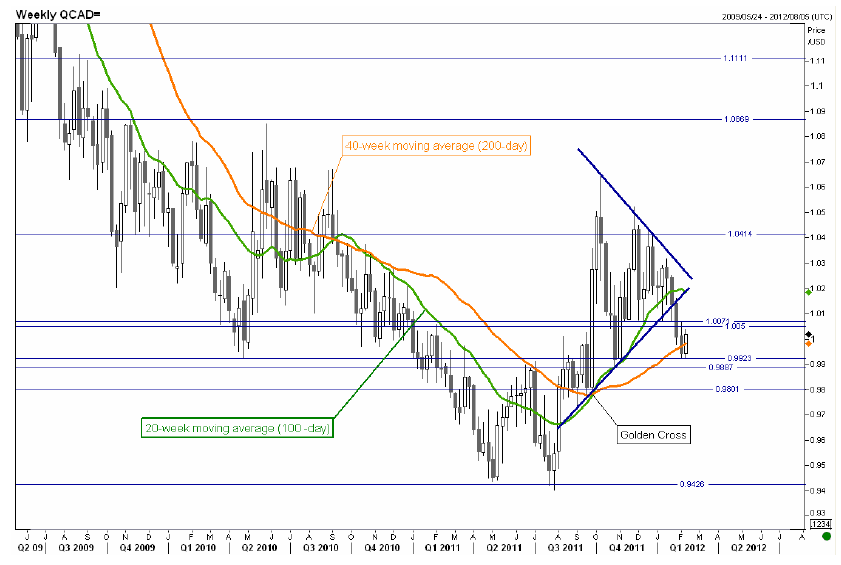

USD/CAD: (See weekly data graph)

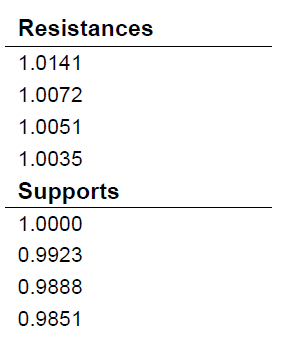

Dropping through the bottom of the triangle three weeks ago broke many levels: 1.0072-1.0052-1.0000. As expected, buyers appeared around the 200-day moving average (the orange line), with a new floor to watch at 0.9923. The strong rebound this week, closing just above 1.0013, produced a technical pattern called a bullish engulfing, in which the white candlestick completely engulfs the preceding week’s black candlestick. In such situations, buyers take control and a new upward correction should occur. However, but we know that it will be very difficult to break through the 1.0052-1.0072 zone. Below 0.9923, the next expected support level is 0.9990.

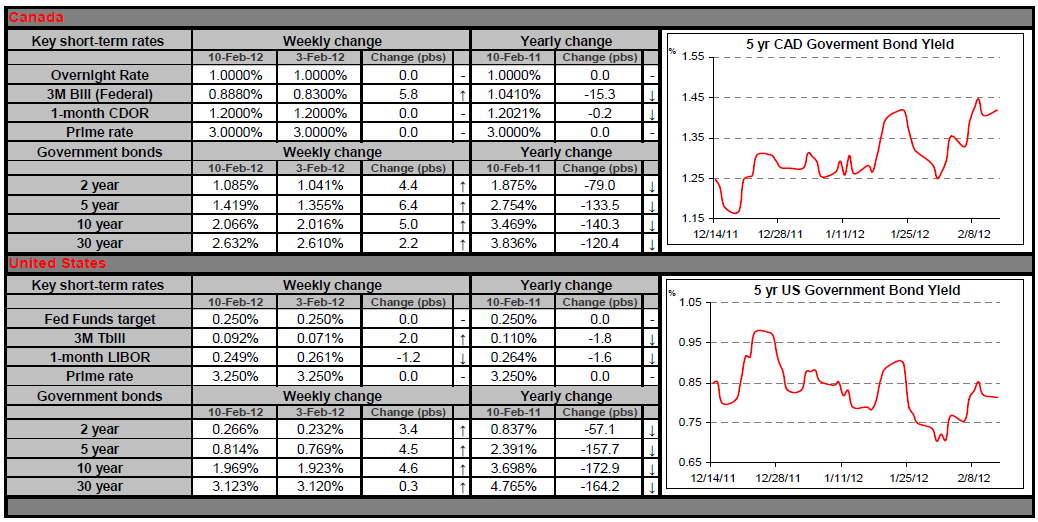

Fixed Income

Government bonds traded lower last week, with yields shifting higher for most maturities, as investors were encouraged by the strength of the latest corporate earnings and economic indicators.

Most recent earnings’ releases surprised analysts, and stocks performed very well over the past few weeks, adding upward pressure on bond yields.

Still, investors were waiting for the Greek parliament to vote the austerity measures they promised, in order to secure the next bailout funds and avoid bankruptcy.

On the bright side, at home, Statistics Canada announced on Friday the country’s merchandise trade surplus widened to the largest level in more than three years. Canadian exports of aircrafts, oil, and food were in great demand abroad during the month of December of last year.

For the week ahead, we expect bond rates will be impacted by US retail sales on Tuesday, as well as fresh Canadian inflation data on Friday.

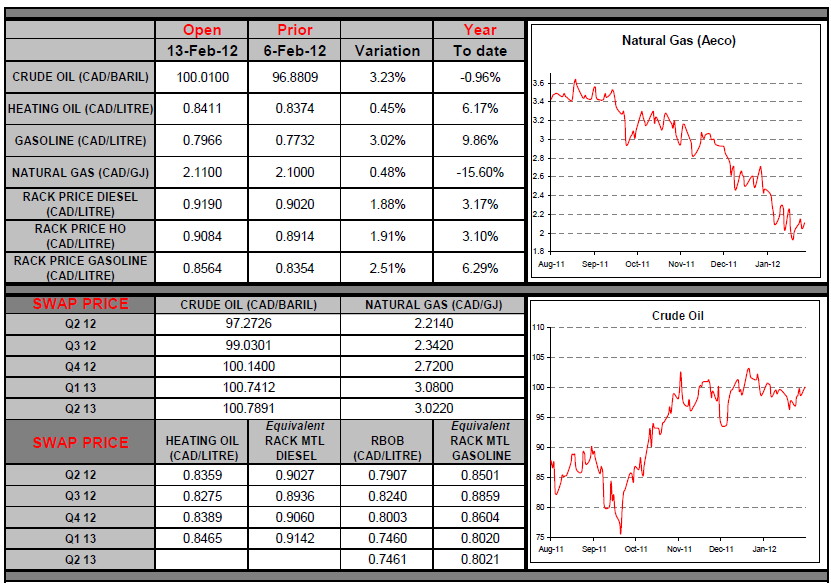

Commodities

February began on a positive note: fuel prices have been rising steadily for several days. The increases have been 4% and 3% for heating oil and gasoline, respectively, against NYMEX closing prices on January 31, 2012. At time of writing, the price of heating oil is CAD$0.8426/L and the average price since the beginning of February is CAD$0.8282/L. This is good news for companies that have traded with us over the last few months. The spread between Brent crude and WTI crude prices is also worth noting – it was close to $19/barrel as of last Friday. The record spread is $27.88/barrel, recorded on October 14, 2011. This widening spread explains the increased diesel prices in an environment where the price of WTI has remained under $100/barrel. Have a great week!

Last Week at a Glance

Canada – Housing starts edged down to 197.9K units in January from a downwardly revised 199.9K in December. That was nonetheless much better than consensus expectations. Urban single family starts decreased 5.5K, or 7.8%, to 64.9K while multiple starts edged up 0.5K, or 0.4%, to 111.7K. On a regional basis, starts declined markedly in Quebec (from 50.0K to 35.5K) and in Nova Scotia (from an unusually high 8.5K to 2.7K), and moderately in Alberta (from 28.3K to 25.4K) and in PEI (from 0.8K to 0.7K). Starts were up in the other six provinces. While we’re not expecting stellar numbers for residential construction in 2012, housing starts should get some support in the coming months if the strong building permit applications are any guide. The merchandise trade surplus soared in December to C$2.7 bn, more than triple consensus expectations. That was the highest surplus in three years. The prior month was revised up a bit to a surplus of C$1.2 bn. In December, exports rose 4.5% with broad-based gains, including the 9.2% increase in machinery and equipment. Imports rose only 0.8% as declines in energy imports (-7.5%) largely offset increases in other categories. In real terms exports rose 5.1% while imports fell 0.5%. With December's hot numbers, trade is set to be a contributor to GDP. With the increase in volumes, Canadian exports are tracking +7% annualized in the final quarter of year, after a 16.2% increase in Q3. The rise in real imports of machinery and equipment in December (+1.7%) allowed the quarter to end flat for that component, pointing to a stabilization in business investment in Q4, after a sharp contraction in the prior quarter. The Ivey PMI rose to 64.1 on a seasonallyadjusted basis in January, topping consensus expectations for a drop to 59.7. However, the purchasing managers were less upbeat than the prior month with regards to employment, inventories, deliveries and prices, with all of those PMI indices falling in the first month of 2012 (although all of the indices except the deliveries index, remained well above 50). The fact that the index remains well north of 50 (i.e. more respondents than not saying that their purchases were higher) is consistent with further expansion of GDP through the Q4-Q1 period. We expect growth to be soft over that period, at around 2% annualized. Alberta’s 2012-13 budget was presented last week and the target of a balanced budget by 2013-14 was confirmed. Fiscal discipline was evident in the budget with spending growth limited to just 3.3% next fiscal year and 3.0% on average for the following two years. And that despite forecasted revenue growth of 4.6% next year and 10% for the subsequent two years.

United States – Initial jobless claims fell to 358K in the past week, from an upwardly revised 373K. The 4-wk moving average fell 11K to 366.3K, the lowest in over three years. That’s further evidence that the US labour market is on an upswing. The trade deficit widened to $48.8 bn in December from an upwardly revised $47.1 bn. While in nominal terms, imports grew faster than exports (due to the larger amount of crude imports), in real terms, both exports and imports grew 1.4%.

Europe – The European Central Bank left its target interest rate unchanged at 1% stating that it saw “some tentative signs of a stabilisation in economic activity”. The ECB loosened the requirements for financing by banks by saying that it was accepting “additional performing credit claims as collateral”. The end-February LTRO should be well bid as a result. The Greek government presented its austerity plan that includes 300 million euros in government spending cuts, a 15,000 immediate reduction in government payrolls, and a 22% cut in the minimum wage. Markets rallied on the news on Thursday, but quickly reversed those gains as the plan was deemed unsatisfactory by European finance ministers who opted to delay releasing a bailout package to Greece. There continues to be uncertainty not just about whether Greece can increase the size and scope of its austerity plan, but whether any revised plan will be carried out after the April elections. Further impasse on those issues cannot last much longer if Greece is to receive bailout money to roll over maturing debt on March 20th. The worst case scenario is a disorderly default of Greek debt come March, something that would trigger credit default swaps, precipitate a Greek exit from the eurozone, and potentially trigger a global financial crisis.

German industrial production plummeted nearly 3% in December, causing Q4 IP to contract at an annualized pace of 7.4%, the worst quarterly drop since the 2009 recession. That makes a Q4 GDP contraction all the more likely for Germany. The handoff from December IP was so bad that the first quarter of 2012 is now tracking -7.7% annualized, assuming no change in industrial output through March. Clearly, for Germany to avoid a recession (i.e. negative growth in both Q4 and Q1), its IP will have to pick up significantly over the January-March period. The Bank of England left its target interest rate unchanged at 0.5%, but increased its QE program by £50 bn to a total of £325 bn.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Snapshot: USD Continues to Trade in Narrow Range

Published 02/14/2012, 02:12 AM

Updated 05/14/2017, 06:45 AM

FX Snapshot: USD Continues to Trade in Narrow Range

Major News this Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.