To the surprise of most market pundits, the 19th European Summit had a positive outcome, at least for the short-term, and helped calm global markets as well as Spain’s and Italy’s creditors. Essentially, for the first time since the European crisis began, Germany’s Chancellor Angela Merkel gave in to Italian and Spanish leaders and gave them what they wanted: measures that will allow them to seek financing in the bond markets at more “reasonable” interest rates. What was so positively perceived by the markets is Angela Merkel’s new “openness” to the use of various eurozone bailout funds and the conditions under which the indebted countries will be able to borrow.

The bailout funds may now be used to directly help Spanish banks (in the past, the funds were paid to the country, which then came to the assistance of the banks) without establishing any additional austerity measures. This is a step in the right direction, as it favours some growth while maintaining severe austerity measures. However, while a battle may have been won, the war is not over by any means. We still have a long way to go before this crisis will be settled once and for all!

Canada

The abbreviated week in Canada will be short on economic news. The only important news will be the release of employment data and the Ivey Purchasing Managers’ Index on Friday. Economists are expecting 5,000 jobs to have been created in June.

United States

The week will also be shortened in the U.S., which celebrates Independence Day tomorrow, but there will be much news nonetheless. Today, Factory Orders data for May will be released while, on Thursday, we will have the ADP employment figures. Analysts estimate that 100,000 new jobs were created in June, 33,000 less than in May. Naturally, the most important indicator will be nonfarm payrolls, expected on Friday. For the last three months, this figure has systematically come in below expectations and disappointed the markets. This time, economists are forecasting a small, 97,000 increase in the number of jobs, or 15,000 less than the last reading.

International

In international news, we will continue to monitor very closely the implications of the plan announced by eurozone members, as well as its aftermath. Today the Reserve Bank of Australia will announce its decision on its key interest rate. On Wednesday, the Purchasing Managers’ Indices for Italy, Germany and France will be revealed, followed by Retail Sales for May for the eurozone. On Thursday, the Chinese HSBC Services PMI will be released and the European Central Bank will announce its decision on its key interest rate. With the most recent political developments following the European summit, it will be interesting to see whether Mr. Draghi is also ready to take action. The week in international news will end with the confidence index for China.

The Loonie

« Don't walk behind me; I may not lead. Don't walk in front of me; I may not follow. Just walk beside me and be my friend. » - Albert Camus

So far, the month has been chock-full of news; whether it was the economic headlines, the release of GDP figures for Canada and the U.S., or twists and turns in financial markets, the USD/CAD pair had one of its most volatile days in the last 6 months. And this is not to mention Italy’s surprising defeat against Spain in euro 2012. But, at the risk of disappointing our soccer fans, we will not be focusing here on how teams have fared at the euro, but rather on developments that are just as captivating in North America’s two largest economies. Last week’s release of data on GDP growth gave us some very interesting new information on the health of the world’s two most integrated economies.

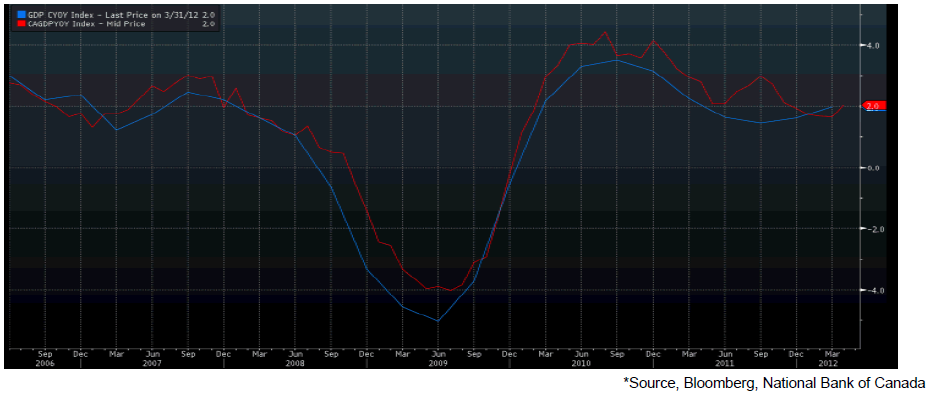

As we can see from the chart above, the fact that Canada and the United States are partners of prime importance for one another results in economic growth that appears to be remarkably similar. Canada (red line) seems to have been able to make the best out of a hard situation in recent years; it was less affected by the recession of 2008-09 and subsequently bounced back faster in 2010. This is also what the exchange markets are telling us, the Canadian dollar quickly regained its pre-crisis level and seems to be comfortably anchored against the greenback despite the European turmoil.

However, and this is what we learned last Thursday, the U.S. (blue line) has rebounded in the first quarter of 2012, posting an increase of 1.9% for the first three months of 2012 when compared to the same period last year. By doing so, our southern neighbour catches up to the Canadian performance that it was published Friday at growth of 2.0% in April from its level at the same time last year. In the medium-term, this could influence the appetite of foreign capital for the relative calms of Canada. This most probably means that the Canadian dollar would benefit from much less buying interest on international markets, affecting its position against the greenback.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

FX Snapshot: Summit Outcome Offers Short-Term Gains

Published 07/03/2012, 02:29 AM

Updated 05/14/2017, 06:45 AM

FX Snapshot: Summit Outcome Offers Short-Term Gains

Major News

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.